As we flip over the most recent Black Friday Cyber Monday chapter of the retail year, it’s time to dive into data to call out a few key eCommerce trends from this year’s biggest shopping event. This is our second Black Friday Report since 2017 where we analyzed millions of transactional records across ContactPigeon’s eCommerce 250+ clients across North America and Europe.

Consumer enthusiasm drove online sales to new heights this Black Friday 2018 weekend at $18B in turnovers just in the United States. This trend reflects globally as well, as more retailers across Europe and Asia adopt the occasion to promote sales.

Here are the 8 key Black Friday eCommerce trends observed:

- Black Friday events continue to grow

- The rise of Black Friday Week

- Apparels, Beauty, and Electronics are top-selling Black Friday categories

- Peak shopping hours

- Top channel contributions to sales

- Marketing automation, the up and coming sales driver

- The mobile state of online shopping

- US vs Europe on Black Friday

- Latest Black Friday 2018 data

Black Friday eCommerce sales grew by 23%

Comparing the same 24-hour period last year, Black Friday 2018 saw another 23% increase in total sales across online retailers. This continues the trend we have observed on the healthy year over year sales growth in the eCommerce retail sector since a decade ago.

What’s more surprising this year, however, is the 9% increase in average order value for Black Friday deals comparing to Black Friday 2017. This may be driven by growing consumer willingness to purchase more and higher value deal items this season – with popular items such as fashion and electronics.

The rise of the Black Friday “Week”

Although sales culminate on Black Friday, the traditional day when holiday shopping season kick-starts, we observed retailers began Black Friday promotions much earlier in the week compared to previous years.

Sales begin to escalate as early as Monday, November 19th this year. eCommerce retailers launched pre-sales, sneak peeks, and special access for VIPs to drive up shopper enthusiasm way in advance of Black Friday (and beat competition a step ahead). Orders dip just the day prior, on Thanksgiving, as consumers wait in anticipation for special deals released during wee hours of Black Friday.

This is a new Black Friday trend that we expect to repeat next year. The implication? Spreading out over a longer period of time can alleviate the bottleneck of heavy online traffic to a single day. This brings relief to your IT teams and prevents disappointing your customers with any site down notifications, not to mention other logistical nightmare associated with a single day sale. On the flip side, this also means that eCommerce marketers will need to start preparing promotional campaigns much earlier to ensure the stores are ready for an extended sales season.

Apparels, Beauty, and Electronics are top-selling Black Friday categories

This year, fashion apparel & accessories sellers lead the way in terms of total orders made during Black Friday day. On a basis of order volume, apparels made up 25% of total orders captured by ContactPigeon. It is closely followed by Beauty & Personal Care and Electronics vendors, comprising 21% and 20

It seems that fashion, beauty, and electronics takes up the most popular purchases for holiday gifting in 2018.

Peak shopping hours based on Black Friday eCommerce stats

This pattern mirrors the trend we’ve observed last year. For shoppers who are at work or taking a break from the morning shopping in brick & mortar stores, the online orders peak during the lunch hour of noon as shoppers take advantage of the break to find attractive online deals. The same is true for a second peak at 8PM as the day winds down for consumers to find leisure in grabbing Black Friday deals at the comfort of their homes.

Given that many retailers started Black Friday sales earlier this year, the surge in orders during the midnight hours of Black Friday morning is no longer as significant as the one observed last year. The first two hours of Black Friday morning makes up merely 5% of the total order transactions. Say hello to beauty sleep and shopping in style!

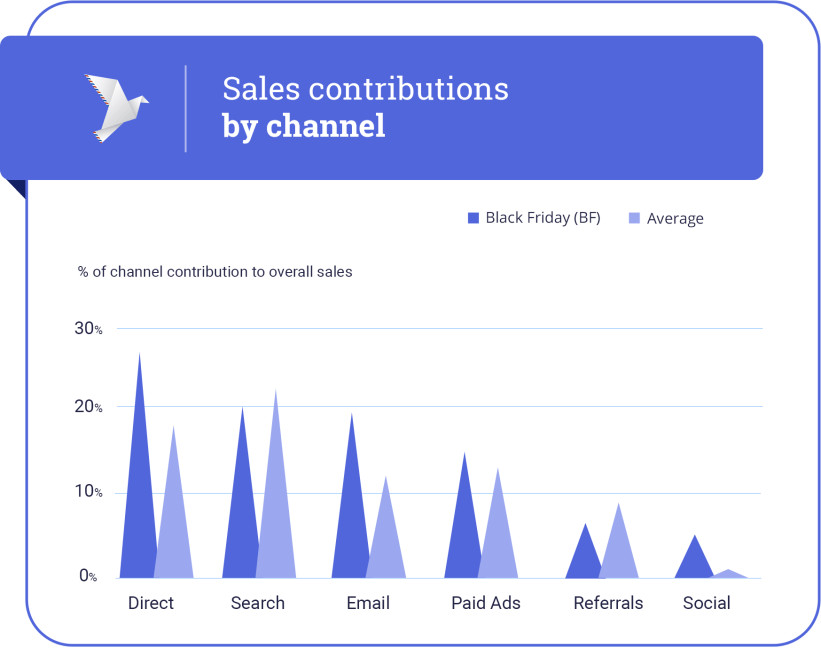

Top digital marketing channels for sales

26% of the traffic who made a purchase visited the website directly. By Black Friday, consumers have already made plans to visit the particular retailers they know and trusts, some may even have bookmarked specific deals they’ve been eyeing for in advance. This means that building up brand awareness from previous interactions and marketing in advance is a key to a successful Black Friday promotion.

Email remains strong as a key referral source for Black Friday sales. Particularly for existing subscribers and customers you already have a connection with, Black Friday email marketing provides the most direct means of communicating deals and offers. During Black Friday 2018, email alone generated nearly 20% of the sales.

[bctt tweet=”Email marketing alone contributed to nearly 20% of eCommerce sales this Black Friday 2018.” username=”contactpigeon”]Marketing automation, the up and coming sales driver

A long-term passion of ours is understanding the effect of marketing automation on sales and productivity. We looked at how various automation tactics are impacting sales in this Black Friday report. Compared to the same 24-hour period last year, we noticed that there’s an uptick in the adoption of automated campaigns when it comes to Black Friday promotions. After all, when you’re busy fielding incoming customer calls and inventory updates on Black Friday, you can offload a lot of the marketing interactions to automation.

During this Black Friday period, automation triggered on-site messages, push notifications and automated emails contributed to overall 7% of the gross online sales. While that number may not sound like a significant impact compared to the overall eCommerce volume, marketing automation tools still make quite a dent in impact.

Particularly when you consider the effectiveness metrics, triggered emails such as abandoned cart reminders and price drop automation gets 3 times more open, clicks and subsequent conversions than standard emails outcomes.

We believe the adoption of Black Friday marketing automation will further increase next year, as technology makes these messages more real-time and personal to the recipients.

The mobile state of online shopping

Online purchases on mobile devices showed an increase compared to the previous year. While we noticed the trend of rising mobile usage in 2017, this trend has become more prominent in 2018.

Compared to 47% of the orders made via mobile devices (smartphone & tablet) last year, Black Friday 2018 saw that rate increases to 50%. The total dollar-spend via mobile accounts for 42% of all sales, up from 39% in 2017. On email tributed sales, however, that percentage rises to 58% of total dollar spend.

This suggests that while mobile is becoming more widespread for online shopping, consumers still prefer to make higher value purchase from a desktop. Mobile, on the other hand, offers the satisfaction of instant gratification of direct purchase after seeing an attractive offer from the vendor.

We expect the mobile shopping trend to continue to grow. This underscores how critical it is for retailers to deliver a stellar mobile shopping experience, and being able to tie that experience directly within a marketing campaign.

Black Friday: USA vs Europe

The Black Friday momentum is growing across Europe. Yet there are minor differences in the way regions adopt Black Friday sales. Here are some interesting differences we are seeing:

- Cyber Monday hasn’t yet caught on in Europe. While in the states, Cyber Monday 2018 just reached it’s highest sales ever at $7.9B, a 19.3% increase year over year according to Adobe Analytics.

- In Europe, promotional sales begin much earlier compared to the US where consumptions begin to pick up just a couple days prior to Black Friday.

Lastly, we had taken a look at the search terms over the Black Friday period and summarized some of the winners across various markets.

Black Friday Report Infographic

Share this infographic on your site.

Key takeaways for your Black Friday eCommerce strategies next year?

The days where Black Friday remains an American past-time for post Thanksgiving shopping trips as a family is long gone. Today it has become a global shopping phenomenon that eCommerce marketer can no longer afford to ignore. Black Friday 2018 exhibited a number of notable milestones and interesting new trends, some of which we believe will likely remain for the years to come.

- Year after year record of eCommerce sales shifts consumption from brick-and-mortar shopping experience to a digital one. Just as a physical retailer prepares for the incoming foot traffic, eCommerce owners need to ensure that online infrastructure, operations teams, and promotional schedule are prepared to handle the surge in volume.

- Advance marketing and brand building are key for Black Friday success. Rely on email marketing to promote intra-day offers for higher conversions at the lowest channel costs.

- Plan and promote early. Vary your promotional schemes for Black Friday week to create a unique and interesting offer experience.

- Adopt marketing automation and triggered messages to generate scalable promotions and offers personalized to each recipient.

If you have a BFCM insight to share, we’d love hearing about them. Share your lessons learned in the comments below.

Interested in getting the full 2018 Holiday Season eCommerce report? Similar to last year, we are working on a detailed analysis of the key trends of the Holiday sales season for 2018. Sign up below to get it delivered when it’s out. Check out last year’s Black Friday report here.

Latest Black Friday 2018 data

The Black Friday report of Black-Friday.global had some really interesting data about last year’s shopping behavior that retailers shouldn’t ignore for this year’s Black Friday marketing strategy:

The average global interest in Black Friday deals was 117% in 2018

EU and Asia had impressive growth rates concerning the total interest in Black Friday deals in 2018. More specifically the average growth of interest of consumers in EU’s 4 biggest economies, was 1591%. This trend shows the potential of the eastern market vs the maturity US market shows in the Black Friday sales phenomenon. The biggest growth according to this Black Friday report came from South Africa where consumers’ interest grew by +9900%.

Black Friday VS ordinary Friday sales

The global average difference in Black Friday vs ordinary Friday online transactions was +624%. 21 countries had at least x10 times bigger number on Black Friday than rest Fridays of the year, including the US, UK, and Germany among them.

The methodology of the Black Friday Report 2018

Black Friday Report for eCommerce data was based on online transactions captured by more than 250+ businesses on ContactPigeon platform across the Americas and Europe. Data from research and top institutions are used for validation and supplements within the Black Friday report, to provide maximum value to our readers. The last paragraph of the article provides some data coming from 3rd party Black Friday reports in order to deliver higher value to each reader.

Other useful Black Friday resources for eCommerce

- 7 Creative Black Friday Strategies for retailers

- 9 Email Marketing Ideas for Black Friday 2020

- Black Friday Email Subject Lines

- Top 5 Black Friday Marketing Automation Scenarios for Holiday Success

- 9 Black Friday Ecommerce Hacks to Skyrocket Your Sales

- How to Prepare for Black Friday 2021: A Retailer’s Guide

- The 12 best Black Friday campaigns of all time

[…] Black Friday Report for Ecommerce 2018 [Infographic] […]

[…] below, mobile shopping is on the rise. You can check out the other holiday shopping trends in the thorough report from […]

[…] email-driven sales on Black Friday in 2017, this year’s post-Thanksgiving spending spree saw 58% of email-driven sales start on mobile. Mobile accounted for half of overall orders that day, up a few percentage points from the previous […]

[…] Source: ContactPigeon’s Black Friday report […]

[…] Friday online sales were $18B in the United States in 2018, whereas customers spend over $50B in retail sales. However, the […]