The Bulgarian retail landscape is undergoing a seismic transformation. As consumer expectations evolve and digital adoption accelerates, traditional powerhouses are being challenged by agile newcomers. It’s a market defined by contrasts, and by bold Bulgarian retail marketing strategies, where omnichannel veterans race to modernize, legacy brands fight for relevance, and digital-native disruptors redefine what value and convenience mean for the modern shopper.

In this high-stakes arena, three players stand out for their distinct Bulgarian retail marketing strategies and ambitions. Technopolis, the omnichannel electronics giant, leverages its vast store network and brand equity to maintain dominance. Zora, once a household name, is undergoing a digital transformation, pivoting from outdated legacy systems toward a more agile, customer-first model. On the other end of the spectrum is Flip.bg, a digital disruptor born from the circular economy movement, which is gaining traction by offering refurbished tech products with unbeatable value and a strong sustainability appeal.

This article takes a deep dive into these three contenders to uncover what’s driving their growth. We’ll dissect how each brand approaches digital marketing, what their eCommerce execution reveals about their strategic priorities, and which innovations are proving most effective in winning the modern Bulgarian consumer.

For retail leaders seeking to sharpen their competitive edge, this comparative breakdown provides more than theory; it delivers actionable insights into how established and emerging brands alike are navigating Bulgaria’s rapidly evolving retail landscape.

The Bulgarian eCommerce market at a glance

eCommerce has become a dominant force, and it accounts for 20.0% of the total market in Bulgaria. This shift underscores the importance of Bulgarian retail marketing strategies that prioritize omnichannel convenience, strong service guarantees, and mobile-first design. The Bulgarian consumer is increasingly value-conscious, seeking not only competitive pricing but also reliable service and product availability, which fuels the competition between large-format retailers, traditional brands, and new online disruptors.

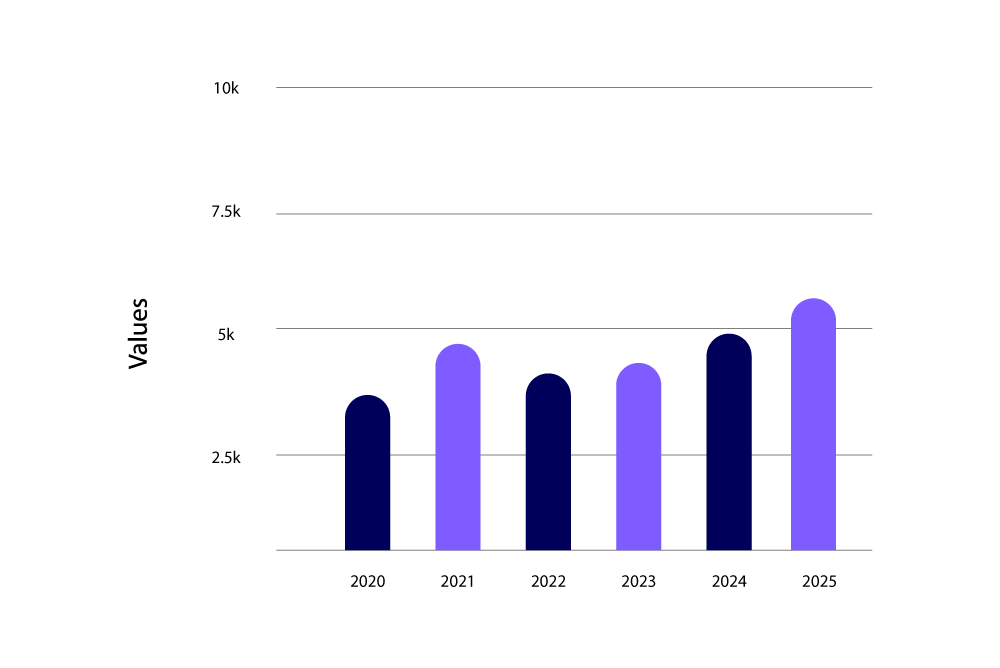

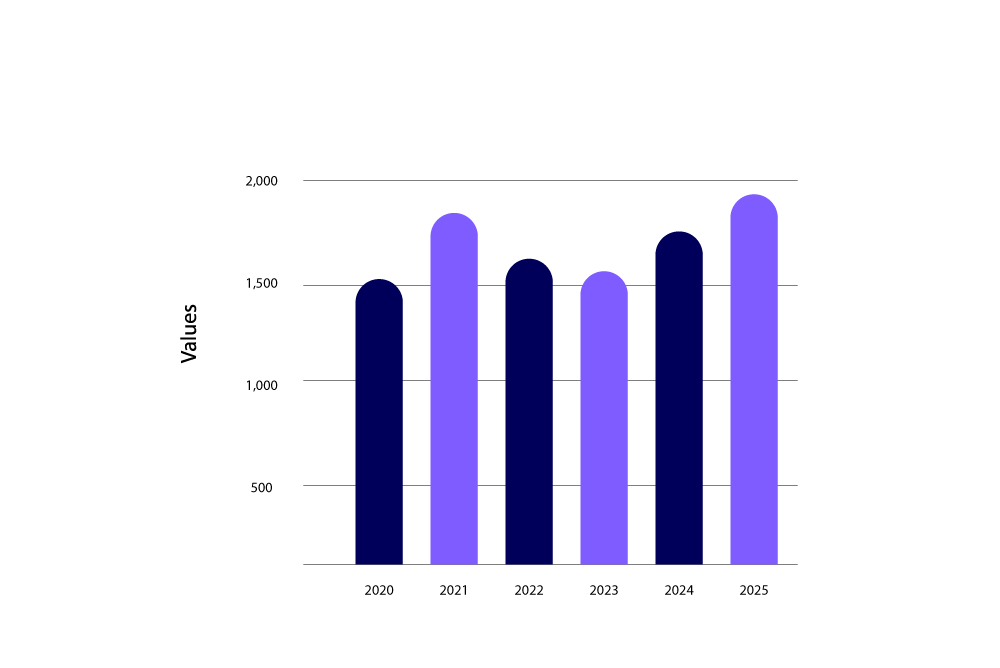

Bulgarian consumer electronics market revenue

The Bulgarian Electronics e-commerce market is predicted to reach US$283.1 million by 2025. The market is characterized by a high demand for communication devices, with the phones & wearables segment being the largest, and a steady shift towards online purchasing. As consumer demand grows, effective Bulgarian retail marketing strategies must focus on capturing online traffic, enhancing product discovery, and improving conversion flows.

Introduction of the brands

Technopolis.bg

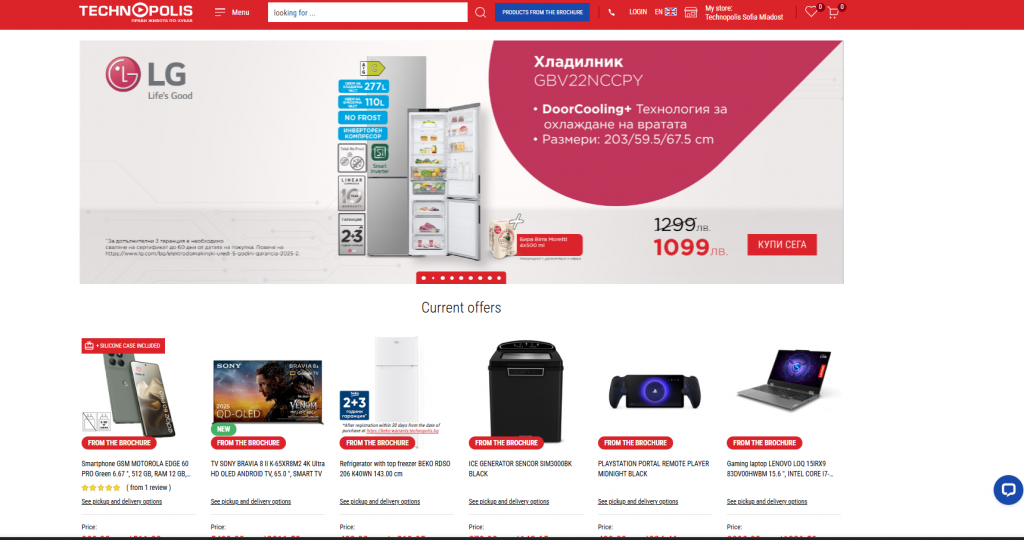

Technopolis is one of Bulgaria’s leading electronics and home appliance retailers, established in 2001. Operated by Videolux Holding, the brand has built a nationwide network of large-format stores. In addition to its strong offline presence, Technopolis offers a wide array of products, including consumer electronics, home appliances, IT equipment, and entertainment technology. Moreover, the company is recognized for its exceptional after-sales service, which fosters customer loyalty and trust. To complement its brick-and-mortar operations, Technopolis.bg features a robust eCommerce platform that ensures nationwide accessibility. Notably, the brand is widely recognized for its competitive pricing, seasonal promotions, and trusted partnerships with top global manufacturers, including Samsung, Bosch, and Apple.

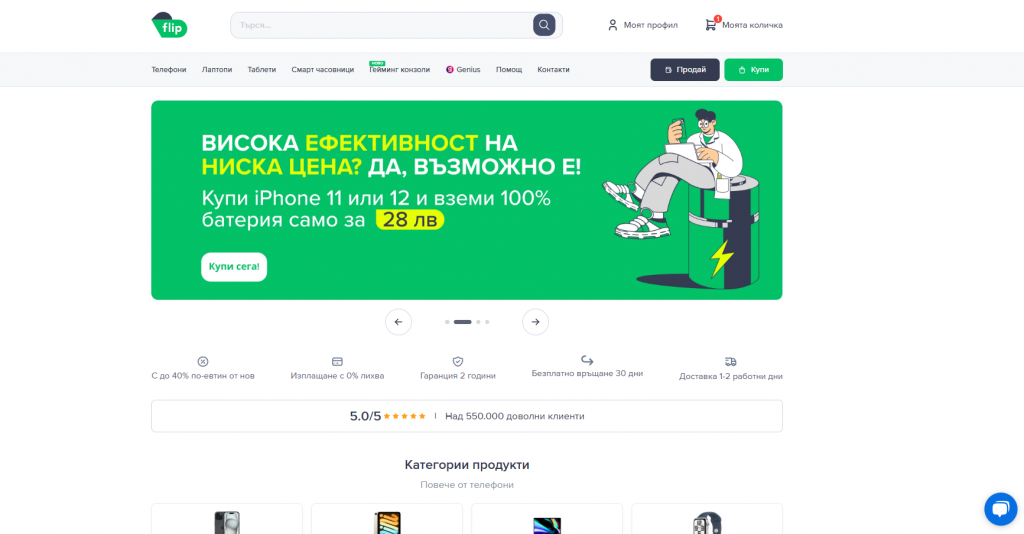

Flip.bg

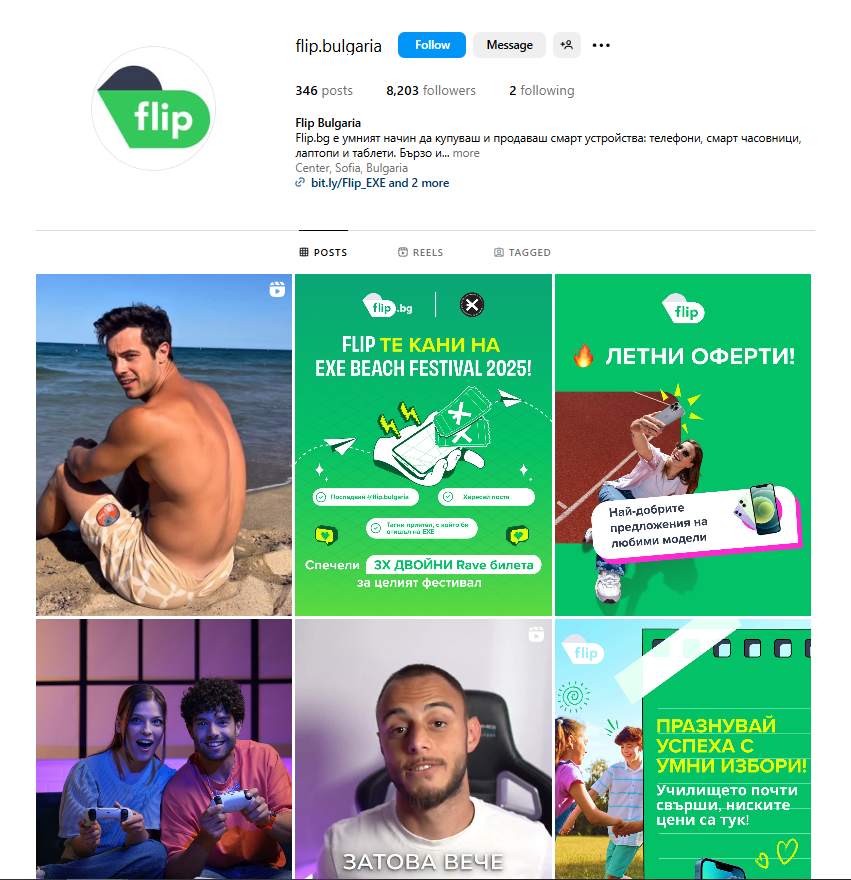

Flip is the Bulgarian arm of the Romanian-founded recommerce platform Flip.ro, which specializes in buying and selling refurbished smartphones and electronics. Entering the Bulgarian market in 2022, Flip.bg quickly gained traction by offering a sustainable, affordable, and quality-assured alternative to buying new tech devices. Every product listed on Flip.bg undergoes a strict technical inspection and comes with a warranty, making the brand a trusted choice for consumers looking to balance cost with environmental consciousness. Flip is part of the growing circular economy trend in Eastern Europe, catering to tech-savvy, budget-conscious, and eco-aware consumers.

Zora.bg

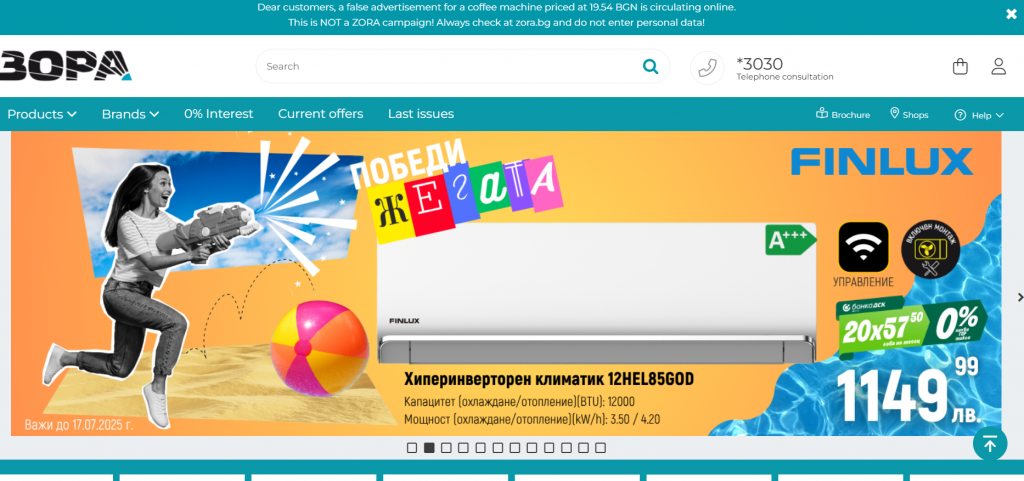

Zora is one of the most established retail chains in Bulgaria, with roots dating back to the early 1990s. Over the decades, Zora has evolved from a regional appliance store into a nationally recognized brand known for its customer-centric approach and broad product portfolio that spans white goods, audio-video equipment, air conditioning systems, and personal electronics. Zora.bg serves as the brand’s digital storefront, offering users a seamless shopping experience, detailed product information, and regular promotions. The brand is synonymous with reliability and tradition in Bulgarian retail, often competing head-to-head with newer market players thanks to its loyal customer base and long-standing reputation.

Decrypting the business models

The differences in each retailer’s approach reflect how Bulgarian retail marketing strategies are evolving based on business model maturity and customer expectations.

Flip.bg

Flip operates a digital-first, circular economy model centered on refurbished smartphones and smart devices. With no physical stores, its entire value chain is online—from product sourcing to checkout—offering discounted, eco-conscious tech bundled with services like extended warranties, fast shipping, and its “Genius” loyalty plan. Flip’s revenue comes from certified device sales and service upsells, targeting younger, budget-conscious consumers who value trust, sustainability, and flexibility.

Technopolis.bg

Technopolis follows a hybrid omnichannel retail model, combining its national chain of hypermarkets with a robust e-commerce platform. It generates revenue through direct sales of electronics and appliances, often financed via 0% installment plans and seasonal in-store promotions. The homepage reflects its offline dominance, integrating brochures, localized store selection, and mobile app promotion. Its model prioritizes household tech shoppers who value installment options and in-person support, while digital serves as an expanding but secondary channel.

Zora.bg

Zora operates a price-focused, traditional retail model rooted in nationwide brick-and-mortar operations. While its digital presence supports product discovery and comparisons, the brand’s core strength lies in bundling electronics with value-added services such as delivery and installation. As a result, revenue is primarily driven by competitive pricing, local store traffic, and attractive value-for-money appliance packages. Although the e-shop is functional and supports online browsing, the overall model remains offline-centric, with minimal emphasis on personalization or loyalty-building mechanics. Therefore, Zora continues to focus on volume sales through physical locations rather than digital-first innovation.

Website performance review: A comparative analysis

The Bulgarian retail landscape is undergoing a seismic transformation. As consumer expectations evolve and digital adoption accelerates, traditional powerhouses are being challenged by agile newcomers. It’s a market defined by contrasts, and by bold Bulgarian retail marketing strategies, where omnichannel veterans race to modernize, legacy brands fight for relevance, and digital-native disruptors redefine what value and convenience mean for the modern shopper. In this context, Bulgarian retail marketing strategies must also align with evolving digital behaviors, from seamless UX to SEO visibility, to stay competitive.

User experience (UX)

The table below outlines how each retailer performs across critical UX elements, including homepage clarity, trust signals, mobile optimization, and navigational flow. These factors directly impact bounce rates, engagement, and ultimately conversion.

| UX Element | Flip.bg | Technopolis.bg | Zora.bg |

|---|---|---|---|

| Homepage Clarity (UVP) | Strong value prop above the fold | Overloaded with competing banners | Slogan-led without product clarity |

| Navigation Design | Clean top nav, search bar, and visible categories | Full-feature header and store selector, though crowded | Functional menu with logical categories, but older UI |

| Product Discovery Speed | 1–2 scrolls to find hero offers, upsells, and CTAs | Deep scrolls and competing banners delay product visibility | Products shown early, but CTAs and visuals lack clarity |

| Mobile Optimization (UI/UX) | Streamlined, mobile-first design likely performs well | Likely struggles due to visual noise and multiple columns | Text/image density may create friction on mobile devices |

| Trust Signals (Homepage) | Excellent — warranty, sustainability, CO₂ impact, inspection details | Includes financing, store selector, and app promos | Clear pricing, delivery, financing info; missing visual trust enhancers |

eCommerce functionality & features

This comparison evaluates each brand’s digital merchandising practices, product presentation, cart features, and innovative conversion tools — all key drivers of higher average order value (AOV) and purchase completion rates.

| eCommerce Element | Flip.bg | Technopolis.bg | Zora.bg |

|---|---|---|---|

| Product Cards & Info Depth | Compact, upsell-rich, well-labeled with prices and services | Full product details, reviews, financing — but UI is dense | Transparent pricing and financing; some inconsistency in product tiles |

| Cart & Upsell Experience | Dynamic recommendation engine (add-ons, accessories, extended warranty) | No upsells or cart customization visible | Standard “Add to cart” — no smart bundling or product guidance |

| Promotional Features | Targeted campaigns, Genius membership, eco messaging | Brochures, banners, 0% interest campaigns aligned with store circulars | Seasonal offers, package deals, urgency via date tags |

| Checkout Conversion Elements | Minimalist path to cart with enhanced AOV tools | Clutter may cause drop-offs if not streamlined in later steps | Limited visibility into checkout experience; unclear if optimized |

| Innovative Tools / Offers | CO₂ calculator, Genius plan, 67-point device inspection | Mobile app with QR code, offline + online sync | No unique tools or digital CX features beyond pricing bundles |

SEO & metadata optimization

Finally, we dissect the SEO health and on-page optimization performance of each homepage, with a focus on metadata, keyword alignment, and structured content discoverability — all critical for visibility in search engine results.

| SEO Element | Flip.bg | Technopolis.bg | Zora.bg |

|---|---|---|---|

| Homepage Metadata & <title> | Not visible in screenshots, but likely tied to promo offers | Misses keyword-driven <title>; brand name only via logo | No evidence of strategic use of metadata for product keywords |

| Keyword Usage (Headings / Body) | H1s tied to offers and product lines (e.g. iPhone 11, battery deals) | Product categories underemphasized in headings | Overuse of slogans; minimal keyword targeting visible |

| URL Structure (Navigation SEO) | Clean URL slugs by category (/telefoni, /laptopi) | Structured but complex (e.g., brochure-heavy pages dilute crawl depth) | Flat architecture helps, but lacking category-level description content |

| Structured Data / Schema (Inferred) | Unclear from screenshots; likely product schema used | Product details suggest use, but no evidence of FAQ or Review schema | No visible enhanced search results or schema-supported snippets |

| Multilingual / Hreflang Support | No visible language toggle (could limit regional SEO) | Language selector (EN/BG) present, aiding international visibility | No switcher observed; risks missed organic traffic from multi-lingual users |

Digital marketing deep dive: Social media and community engagement

Social media shows what each brand stands for. Some push promos, others build real connections and the difference is clear.

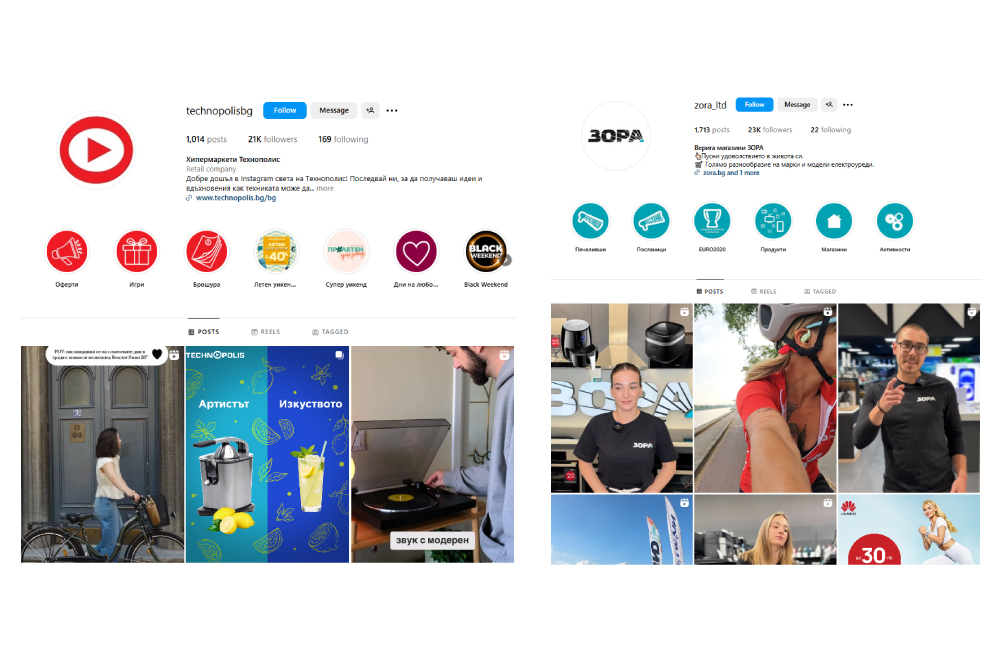

Technopolis & Zora: The promotional megaphone

- Both brands consistently use bold product visuals, clean design overlays, and short-form videos to showcase products and promote sales.

- Recurring visual elements: sale tags (e.g., „до -30%”), giveaway posts, tech/lifestyle integrations (e.g., summer drinks with a juicer, vlogging equipment, stylish headphones).

- Technopolis leans into seasonal context (e.g., “лятно кино у дома,” “на плажа”) to create a slight lifestyle appeal, but these remain product-first posts.

- ZORA incorporates more staff involvement and in-store content (e.g., POV-style videos of shopping), giving it a slightly more human feel than Technopolis, but still centered around the sales funnel.

Strategic takeaway:

- Their social media operates like a digital catalog. Polished visuals and branded campaigns drive traffic for specific SKUs or limited-time promotions.

- There’s limited storytelling and minimal two-way engagement.

- Result: This fosters a transactional relationship – users follow to hunt for deals, not necessarily to connect with the brand.

Flip.bg: The community builder.

- The Flip Instagram feed stands out immediately with its bright green branding and people-first content.

- Posts feature real people, user testimonials, comedic skits, educational explainers (e.g., “Digitalni nomadi?”), and memes.

- Strong use of text overlays, conversational language, and relatable storytelling (e.g., “ЗАТОВА ВЕЧЕ…” or playful skits with old phones).

Strategic takeaway:

- Flip.bg uses content to build trust and identity, not just push a product. They address pain points (old phones, digital lifestyle) and position themselves as a smart, eco-conscious choice.

- By using UGC, behind-the-scenes, and humor, they’ve created a community that resonates with younger, value-driven shoppers.

- The tone is casual, witty, and inclusive, aligning perfectly with modern expectations around authenticity and social responsibility.

How ContactPigeon’s retail CDP could assist Bulgarian retailers

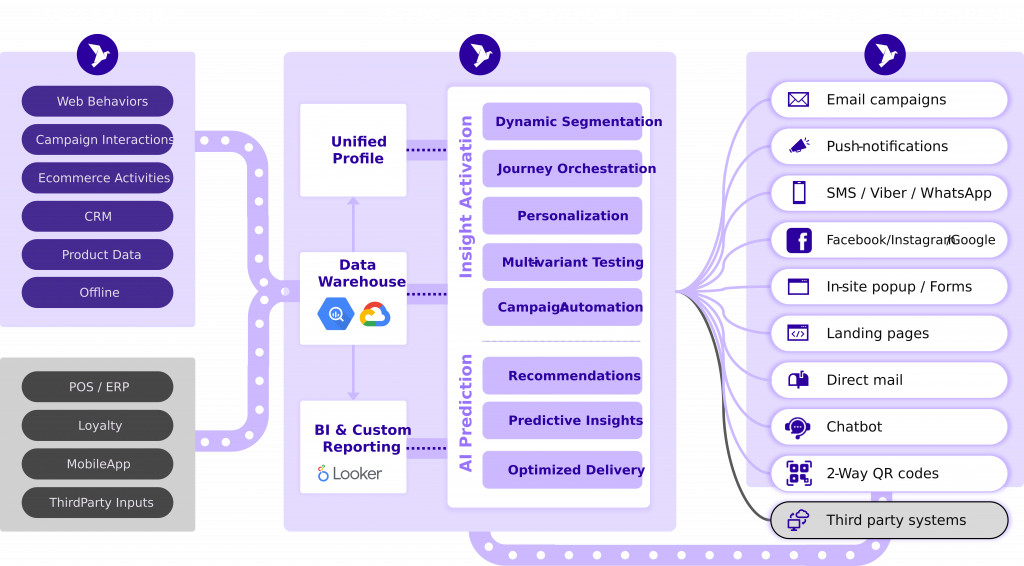

ContactPigeon’s Retail Customer Data Platform (CDP) can empower Bulgarian retailers like Technopolis, Zora, and Flip.bg to compete more effectively by:

- Unifying customer data from both online and offline channels to create actionable 360° profiles, vital for omnichannel retailers like Technopolis and Zora.

- Triggering hyper-personalized campaigns based on behavior, browsing history, and predicted intent, closing the gap between legacy systems and modern CX.

- Optimizing email marketing and cart recovery to reduce bounce rates and abandoned carts, a clear opportunity for Zora and Technopolis given their under-leveraged upselling.

- Powering predictive analytics that help Flip.bg and others anticipate customer needs, automate loyalty offers (e.g., Genius plan alternatives), and maximize LTV.

- Real-time segmentation and campaign automation, making social promotions, seasonal offers, and personalized touchpoints more effective across all channels.

Operationalize Bulgarian Retail Marketing Strategies With ContactPigeon

Turn insights into action across omnichannel identity, digital conversion, and loyalty growth. Select a focus to see how Menura AI and ContactPigeon activate it.

Lessons learned from the Bulgarian retail

Across the board, strong Bulgarian retail marketing strategies hinge on personalization, agile tech stacks, and a deep understanding of modern consumer behaviors.

- Digital agility wins loyalty: Flip.bg proves that trust, UX, and content matter more than price tags alone.

- Omnichannel ≠ digital maturity: Technopolis shows that simply having eCommerce isn't enough without frictionless design and optimized flows.

- Legacy brands must prioritize personalization: Zora’s solid foundation is weakened by static UX and underdeveloped SEO and loyalty strategies.

- User-generated content builds credibility: Flip’s memes, testimonials, and behind-the-scenes humanize the brand and foster real engagement.

- SEO and metadata hygiene remain underutilized: All three brands miss out on valuable traffic by neglecting keyword strategy, structured data, and hreflang.

From insights to action: Build your growth strategy

Bulgaria’s electronics retail market is at a digital crossroads. While Technopolis is holding its ground and Zora is catching up, meanwhile, Flip.bg is redefining the race entirely. To succeed in this €283M+ market, eCommerce UX, mobile performance, and customer-centric innovation are no longer optional; they’re expected. Therefore, retailers that act now to close gaps in personalization, loyalty, and digital engagement will be best positioned to lead.

Whether you're a legacy giant or a rising disruptor, the battlefield has shifted, and it’s now powered by data, agility, and authentic customer relationships.