In 2023, Black Friday sales soared to approximately $9.8 billion—a significant 12.3% increase from the previous year. Notably, 75% of consumers chose to shop online, underscoring the shift toward digital engagement. This trend highlights a marked evolution from pre-pandemic years when in-store foot traffic dominated; today, omnichannel strategies and highly personalized digital campaigns are imperative to meet the new consumer expectations. Our Black Friday email marketing study analyzes strategies of eleven top-performing retailers, dissecting critical factors such as campaign timing, content personalization, and call-to-action effectiveness. By utilizing these insights, executives can refine their BFCM approach, fostering engagement and driving meaningful results during peak shopping seasons.

Disclaimer: This Black Friday email study does not analyze the performance of the email strategies employed by the retailers examined. Instead, it focuses on the strategic decisions made by leading retailers in deploying their email campaigns during November 2023. We hope that you will enjoy its findings as much as we did.

Methodology of the Black Friday email marketing study

Selection criteria

- Aldi: Leading discount grocery chain in the U.S. and Europe, operating more than 2,000 stores and generating over $100 billion globally last year.

- Appliances Direct: A prominent UK-based online appliance retailer known for competitive pricing and a strong e-commerce presence in the electronics sector.

- Argos: Major UK retailer with a diverse product catalog and over 800 locations, generating over $5 billion annually in revenue.

- Blacks: A leading outdoor retail specialist in the UK, recognized for its range of gear and apparel, with a growing online and in-store presence.

- BurnsPet: Established UK brand specializing in pet food and products, known for catering to pet owners’ needs with highly personalized offerings.

- Decathlon: Global sports retail giant, with over 1,600 stores in 60 countries, known for its extensive product range and annual sales exceeding $12 billion.

- John Lewis: Iconic British retailer with over 30 department stores, generating approximately $12 billion in annual revenue, with a focus on high-quality and premium products.

- Samuel H: Renowned luxury jeweler and watch retailer in the UK, known for high-end offerings and exclusive, personalized services.

- Sports Direct: One of the largest UK sports-goods retailers, with over 400 stores and a revenue exceeding $4 billion, catering to a broad range of sporting goods.

- Watches of Switzerland: A premier UK retailer specializing in luxury watches and jewelry, with annual revenue of around $1.5 billion, catering to an exclusive clientele.

- Wayfair: Leading online home goods retailer with a significant U.S. presence, generating over $12 billion in revenue through a vast product range and digital-first approach.

The rationale

These retailers represent a cross-section of market-leading brands, each with distinct BFCM email marketing strategies, from high-frequency discounting to luxury personalization. The selection showcases a range of tactics across diverse retail segments, offering actionable insights into best practices and emerging trends for retail executives.

Data collection process

- Timeframe of Email Collection: 1st Nov – 30th Nov, 2023

- Tools Used: This study was conducted by subscribing to the retailers’ newsletters to collect data. The analysis and visualization were carried out using Google Sheets for data organization and Power BI for advanced analytics and insights generation, ensuring a robust and professional evaluation process.

Analytical framework: 17 different metrics, and 141 email campaigns

Key metrics

- Number of Newsletter Campaigns

- Average Email Campaign Sending Time

- Most Preferred Time of the Day

- Average Character Count in Email Subject Lines

- Emojis Usage within Email Subject Lines

- Weekly Frequency

- Most Preferred Day

- Ratio of Titles with Emojis (%)

- Black Friday-Focused Email Campaigns (%)

- Email Campaigns Sent During Black Week (%)

- Email Campaign Sent on Black Friday?

- Incentive-Driven Subject Lines (%)

- Number of CTA Buttons within the BF newsletter

- GIFs Included within the Email Newsletters

- Email Body Content Sections

- Type of Black Friday Offers

- Personalization Features

Total metrics analyzed: 17 different criteria were analyzed during our Black Friday email marketing study.

Qualitative analysis: We evaluated 141 different BFCM email campaigns across 17 different metrics and dimensions, which occurred during November 2023.

Part A: Key findings of the Black Friday email marketing study

Key Black Friday email trends & observations

Key Black Friday trend #1: % Discounts still reign supreme in Black Friday Promotions vs other types of promotions

Product discounts were the cornerstone of Black Friday email campaigns, employed by 73% of the retailers (8 out of 11). This strategy highlighted both general price reductions and product-specific offers, catering to a wide range of shoppers. Zero-interest payment options and free shipping followed as the second and third most popular strategies, respectively.

Key Black Friday trend #2: Incentive-driven subject lines dominate

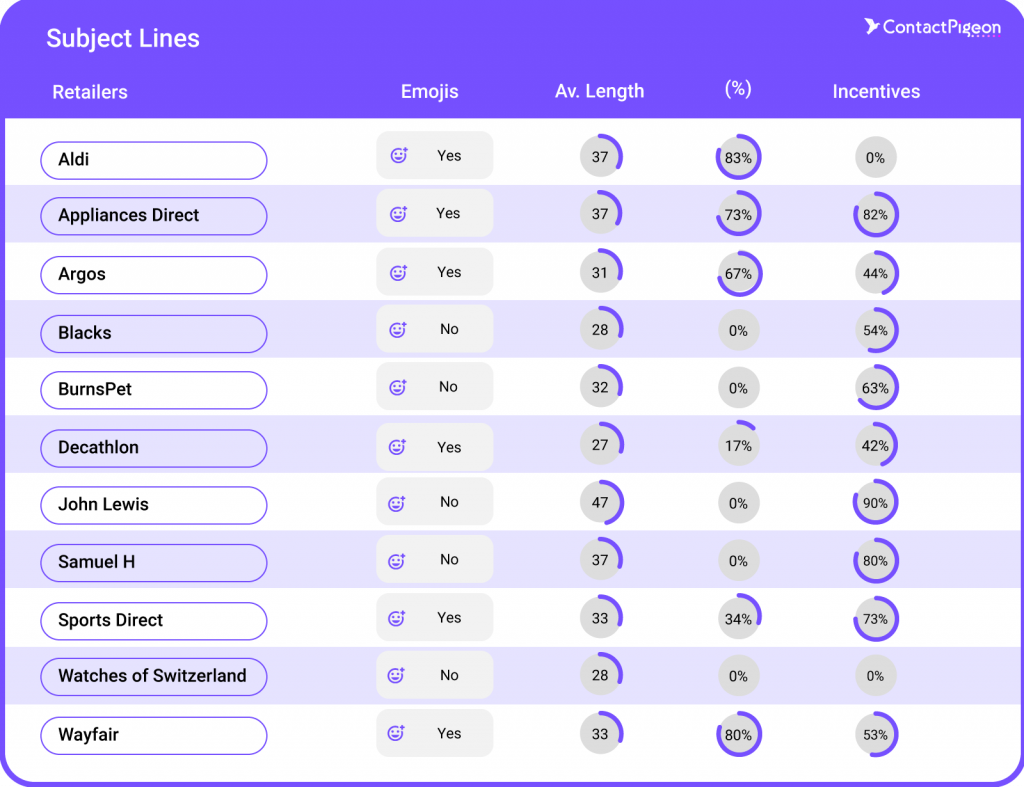

Incentive-driven subject lines were the defining feature of Black Friday email campaigns, with 81.8% of retailers prominently highlighting discounts, free shipping, and other promotional offers. These subject lines effectively captured shoppers’ attention by focusing on urgency and value. On average, subject lines contained 33 characters, striking a balance between brevity and impact to ensure visibility on mobile devices. Additionally, 54.5% of retailers incorporated emojis, using visuals to stand out in crowded inboxes. However, personalization and exclusivity were largely absent, revealing an opportunity for retailers to create more tailored and engaging customer experiences in future campaigns.

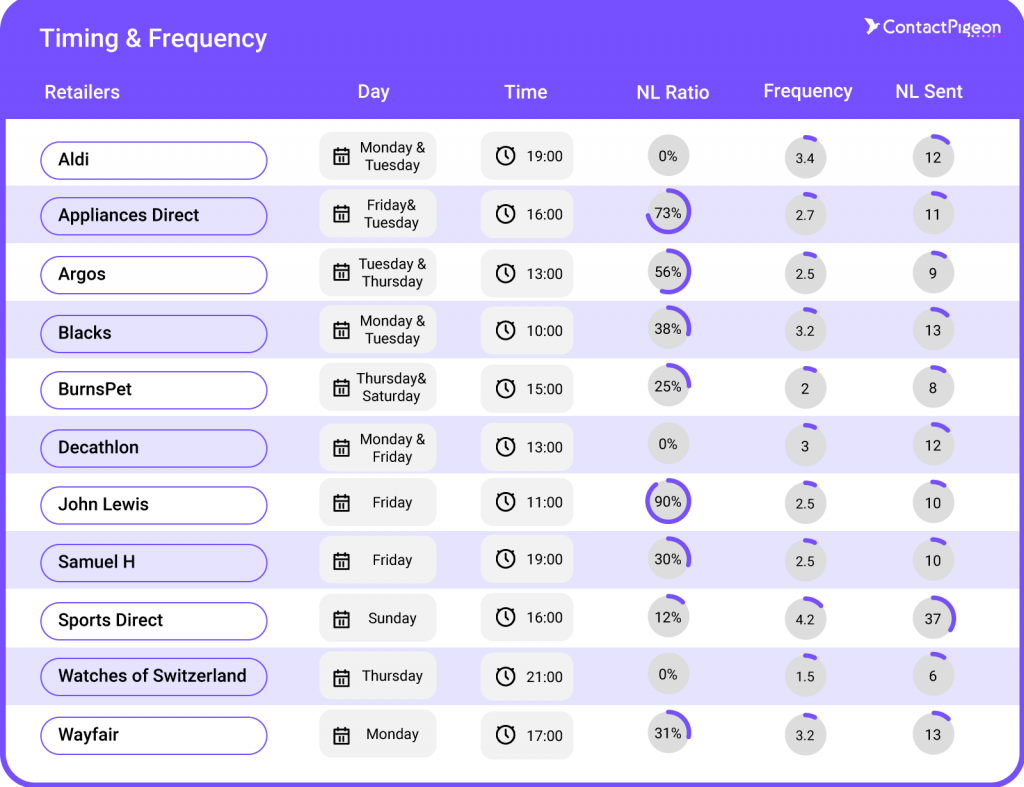

Key Black Friday trend #3: Concentrated send times and increased email frequency

Retailers strategically increased their email campaign frequency during November, averaging 12.8 newsletters per retailer to capitalize on the Black Friday period. Leading the charge, Sports Direct sent a remarkable 37 emails, with Wayfair and Blacks each sending 13 emails, exceeding the average and showcasing a more aggressive marketing approach.

Email sends were predominantly concentrated in the mornings between 10–11 AM and early afternoons from 2–3 PM, aligning with peak times when consumers are most likely to check their inboxes. This timing strategy aims to enhance open rates and capitalize on moments when shoppers are actively making purchasing decisions.

Notably, some retailers, such as Watches of Switzerland, experimented with evening sends to capture a different segment of the audience. Evening emails cater to consumers who engage with promotional content after work hours, potentially appealing to those considering luxury or high-value purchases that require more contemplation. This variation in send times underscores the importance of understanding customer behavior and suggests opportunities for further segmentation and A/B testing to optimize email marketing strategies.

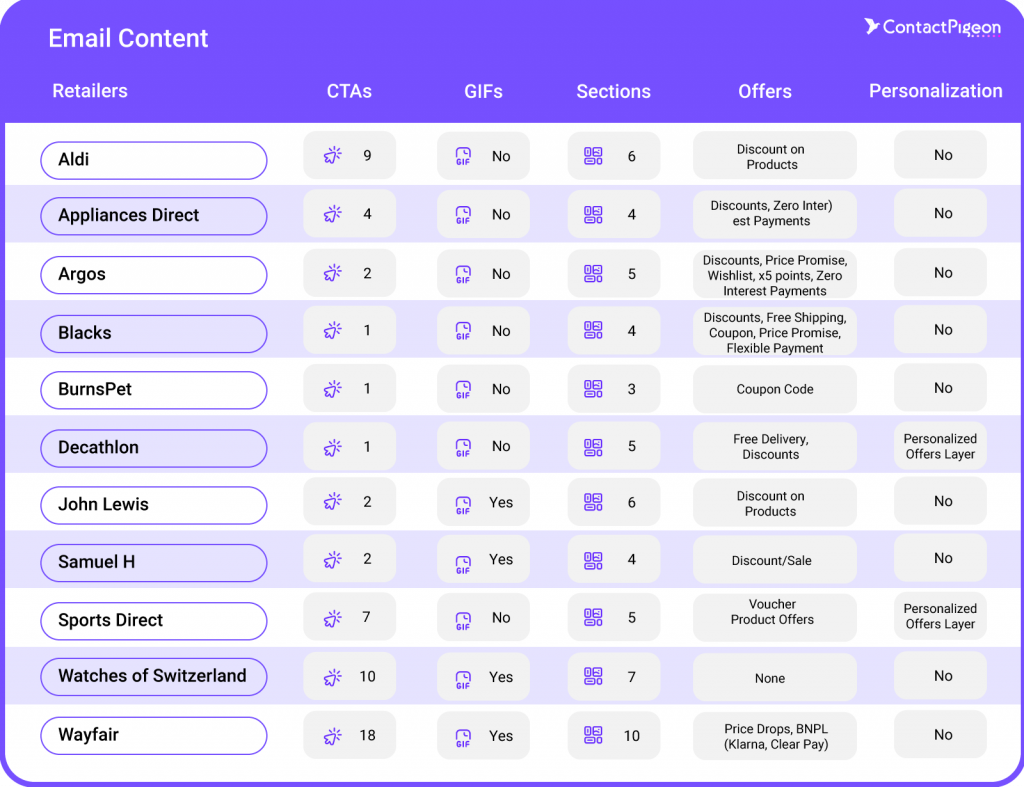

Key Black Friday trend #4: Minimal interactive and underutilized personalization

Interactive visuals, such as GIFs, were notably underutilized in Black Friday email campaigns, with only 36.4% of retailers (4 out of 11) incorporating them. These dynamic elements, including countdown timers, have the potential to drive urgency and engagement but were largely overlooked. This lack of interactive content represented a missed opportunity to captivate audiences and create a more compelling email experience.

Personalization was also significantly underused, with only 18.2% (2 out of 11) of retailers implementing personalized offers, such as tailored product recommendations or name-based greetings. This limited use of personalization reduced the relevance of campaigns, leaving untapped potential to forge deeper customer connections. Retailers missed an opportunity to enhance their email marketing strategies by aligning content more closely with individual preferences and behaviors.

Key Black Friday trend #5: Retailers favor long-format emails to drive engagement

Most retailers leaned toward long-format emails during Black Friday campaigns, with the average email containing 5.4 content sections. Retailers such as Wayfair, which averaged 10 content sections, and Watches of Switzerland (7 sections), demonstrated a clear preference for detailed emails. These formats allowed them to highlight multiple offers, categories, and value propositions, catering to consumers seeking comprehensive information.

However, a minority chose shorter emails with fewer than four sections, prioritizing simplicity and directness. For instance, BurnsPet, averaging 3 content sections, opted for a minimalist approach, focusing on concise, high-impact messaging. Overall, while long-format emails dominated, the divergence in strategies underscores how retailers tailor their communication styles to different consumer behaviors and campaign goals.

Comparative analysis of each retailer’s BFCM email marketing strategy

Part B: Detailed findings of the Black Friday email marketing strategy

1. Newsletters sent & Black Friday newsletter ratio analysis

- Retailers like Aldi and Blacks send a high volume of newsletters (12 and 13 respectively), but their Black Friday newsletter ratio is low (0% and 38.5%). This suggests they don’t focus heavily on Black Friday promotions compared to retailers like Appliances Direct (72.7%).

- Retailers with a higher focus on Black Friday newsletters (e.g., Appliances Direct, 72.7%) might benefit from this tailored approach to capitalize on seasonal shopping trends.

Actionable insight: Retailers could consider increasing their Black Friday focus in November to capture holiday traffic more effectively.

2. Email frequency and timing analysis

- The average frequency of newsletters varies significantly:

- High-frequency senders: Aldi (3.36/week) and Blacks (3.25/week).

- Low-frequency senders: Burns Pet Food (2.0/week).

- Most Preferred Days: This varies by retailer, with Monday and Thursday being popular for Aldi and Friday and Tuesday dominating for Appliances Direct.

- Preferred Times of Day: Morning to mid-afternoon times are common (e.g., Aldi at 19:00, Argos at 13:00, Blacks at 10:00).

Actionable insight: Tailor email send times to align with customer engagement data. For instance, if opening rates peak in the evening for a retailer like Aldi, they should stick with 7 PM sends.

3. Email subject lines analysis

- Average length: The length of subject lines varies, with shorter ones seen in Blacks (28 characters) and longer in Aldi (37 characters).

- Emoji usage:

- High usage: Appliances Direct (73%).

- Low or no usage: Blacks and Burns Pet Food (0%).

- Incentive-driven subject lines: 81.8%

Actionable insight: Shorter subject lines (28–32 characters) might perform better for engagement due to readability. Emojis can be used selectively for retailers targeting younger audiences or for lighthearted offers.

4. Email content structure analysis

- CTA Buttons: Aldi leads with an average of 9 buttons per email, whereas others like Burns Pet Food use fewer (1).

- GIFs:

- Content sections: Aldi’s emails are more structured (6 sections), whereas simpler emails like Burns Pet Food (3 sections) might be more concise.

Actionable insight: Retailers can experiment with adding interactive elements like GIFs or optimizing the number of CTA buttons. Emails with too many buttons may overwhelm the reader, while too few might miss out on engagement opportunities.

5. Black Friday offers analysis

The types of Black Friday offers varied significantly across retailers, reflecting diverse strategies to attract consumers during this peak shopping period. Here is a detailed analysis enriched with statistics:

- Aldi: Focused solely on discounts on products, sending 12 emails in November but with 0% dedicated to Black Friday. This strategy appeals to cost-conscious consumers while maintaining simplicity. Aldi’s campaign lacked personalization and additional incentives.

- Appliances Direct: Combined discounts with value-driven offers like zero-interest payments, using a 72.7% Black Friday newsletter ratio in their 11 emails. This approach effectively attracted shoppers interested in financing larger purchases while still promoting savings.

- Argos: Highlighted discounts, price promises, and wishlisting features, with 56% of their emails dedicated to Black Friday out of a total of 9 emails. These features were designed to appeal to planners and deal-seekers, encouraging engagement through exclusive deals and loyalty incentives.

- Blacks: Promoted a diverse mix of offers, including free shipping, coupons, and price promises, with a 38.5% Black Friday email ratio among their 13 emails. This balanced approach aimed to capture a broad audience, combining short-term incentives like free shipping with value-driven commitments such as price guarantees.

- Burns Pet Food: Focused exclusively on coupon codes, delivering a minimalist strategy. They sent 8 emails, with a 25% Black Friday email ratio, targeting pet owners seeking straightforward savings.

- Decathlon: Featured free delivery and discounts, sending 12 emails in November, none specifically focused on Black Friday (0% Black Friday ratio). Their campaigns emphasized value but missed opportunities for event-specific engagement.

- John Lewis: Concentrated on discounts on products, with 90% of their 10 emails targeting Black Friday. Their approach was one of the most focused, highlighting significant event-specific efforts to capture seasonal shoppers.

- Samuel H: Focused on discounts and sales across their 10 emails, with 30% dedicated to Black Friday promotions. Their campaigns blended traditional discounts with limited engagement in event-specific offers, balancing simplicity and appeal.

- Sports Direct: Adopted an aggressive approach with 37 emails, of which 12% targeted Black Friday. Promotions included exclusive product offers, vouchers (e.g., $X off per $Y spent), and general discounts, catering to deal-seekers with varied incentives.

- Watches of Switzerland: Delivered a premium experience, with no explicit Black Friday offers in their 6 emails. Instead, their campaigns focused on showcasing luxury products, appealing to a high-value audience without significant discounting.

- Wayfair: Promoted price drops and buy-now-pay-later (BNPL) options like Klarna and ClearPay, sending 13 emails with 31% focused on Black Friday. This dual strategy combined financial flexibility with targeted promotions to encourage purchases of larger items.

Actionable insight: Diversify offer types to appeal to different customer segments. Pairing discounts with loyalty programs or adding value through free shipping can boost engagement.

6. Email personalization analysis

- Limited use: Only 18.2% (2 out of 11) of retailers incorporated personalization, such as tailored product recommendations (e.g., Decathlon and Sports Direct).

- Majority opted out: 81.8% relied on generic messaging, missing opportunities for customer-specific engagement.

- Luxury vs. opportunity: While some, like Watches of Switzerland, avoid personalization to maintain a premium image, most retailers could improve campaign relevance with personalized content.

Actionable insight: Adding personalization—like dynamic product recommendations, customer names, or location-based offers—can improve open rates and conversions.

Part C: Analysis per retailer

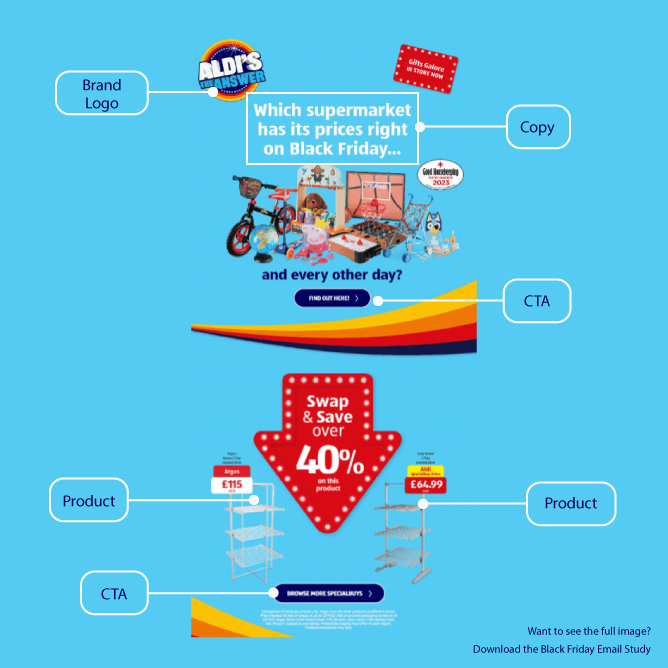

#1. Aldi’s Black Friday email marketing strategy

Aldi’s Black Friday newsletter campaign

Key insights about Aldi

- High email frequency (3.36/week) but 0% included “Black Friday” within their email titles.

- Strong use of CTAs (9 per email) and structured content (6 sections).

- Minimal emoji usage (16.6%) and lack of personalization features.

Positioning & observations

- Aldi’s approach relies on maintaining a high volume of newsletters but misses the mark by not tailoring content to Black Friday shoppers.

- Its reliance on structured content and numerous CTAs suggests a broad-targeting strategy but risks overwhelming readers.

#2. Appliances Direct’s Black Friday email marketing strategy

Appliances Direct’s Black Friday newsletter campaign

Key insights about Appliances Direct:

- High Black Friday focus (72.7%) and moderate email frequency (2.75/week).

- Heavy use of emojis (73%) and balanced CTAs (4 per email).

- Offers clear incentives like discounts and zero-interest payments.

Positioning & observations:

- Appliances Direct capitalizes on Black Friday effectively, with an aggressive incentive-driven approach.

- Its use of emojis adds a playful, engaging touch but may not resonate with all demographics.

#3. Argos’ Black Friday email marketing strategy

Argos’ Black Friday newsletter campaign

Key insights about Argos:

- Moderate Black Friday focus (56%) with low email frequency (2.25/week).

- Balanced approach with fewer CTAs (2 per email) and strong mid-day timing (13:00).

- Incentives include price promises and wishlist features.

Positioning & observations:

- Argos takes a measured approach, balancing incentives with quality offers like price guarantees.

- The mid-day send time is effective, but could be optimized further by analyzing open rates.

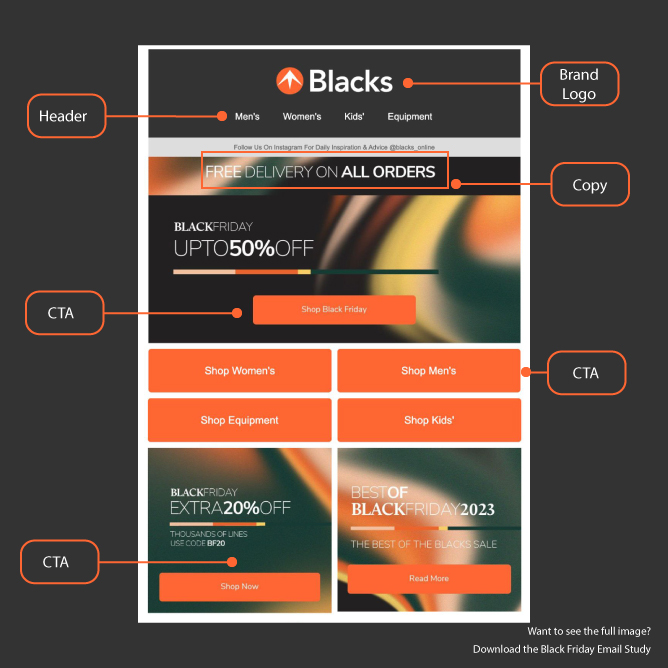

#4. Blacks’ Black Friday email marketing strategy

Black’s Black Friday newsletter campaign

Key insights about Blacks:

- High email volume (3.25/week) with a low Black Friday focus (38.5%).

- Minimalist approach with only 1 CTA per email and no emoji usage.

- Offers include diverse incentives (free shipping, coupons, price promises).

Positioning & observations:

- Blacks may struggle with engagement due to its low Black Friday focus and sparse email content.

- The lack of visual or engaging elements (e.g., emojis, and GIFs) reduces its appeal to younger demographics.

#5. Burns Pet Food’s Black Friday email marketing strategy

Burns’s Black Friday newsletter campaign

Key insights about Burns Pet Food:

- Low email frequency (2.0/week) and limited Black Friday focus (25%).

- Simple email structure with only 1 CTA and 3 content sections.

- Focuses on coupons as the primary incentive.

Positioning & observations:

- BurnsPet appears to prioritize a straightforward, minimalist email strategy.

- This approach may work for highly loyal customers, but risks being overlooked by casual shoppers.

Download the full Black Friday email marketing study by ContactPigeon

Unlock the detailed analysis of our Black Friday email marketing study, including brands like John Lewis & Partners, H.Samuel, Sports Direct, Watches of Switzerland & Wayfair.

You can gladly download and/or republish our Black Friday study’s key findings with your company or audience.

(Brand Mentions and links to the original source are kindly requested)

Interested in increasing your Black Friday revenue?

Request a free customer engagement consultation session with ContactPigeon’s omnichannel retail experts.