The COVID-19 pandemic has turned out to be a genuine black swan turning the global economic patterns upside down. The retail industry and apparel segment, in particular, are not an exception. The lockdown has not only forced fashion retailers to put more effort into online channel development but has also changed consumer shopping behavior in a fundamental manner.

There are good reasons to say that the apparel industry will not be the same as we got used to it before the crisis. So, how can retailers stay effective while everyone around is now selling online? This entry is right about to give some useful tips on sustaining growth in eCommerce. But, first, let’s take a more thorough look at how exactly has the crisis changed apparel and footwear retail.

How COVID-19 changed apparel retail

To find out some truly effective means of dealing with the recent crisis, it is first necessary to evaluate the extent to which the segment was damaged. Let’s be honest: in most countries, apparel was among the industries hit by the pandemic in the most severe way. For example, in the UK, only during May 2020 (the first month of non-essential stores’ lockdown), the online clothing sales dropped by 24% compared to the previous year. And that’s when offline sales were halted completely.

There are several factors that have made the crisis impact so devastating for fashion retailers. First and most obvious, apparel and footwear do not belong to essential categories. That’s why, during the first spring months, when the spring-summer buying is usually setting in, the demand had dropped instead. Second, it was not only the B2C sales that were undermined by the outbreak but the entire supply chain process.

Here is an example: China is one of the world’s largest textile exporters. Subsequently, as the country was the first to face the pandemic outbreak in January 2020, many Chinese textile production facilities were shut down partly or completely. The setback was itself enough to undermine the apparel retail in other parts of the world even before the first cases of COVID-19 were localized there.

The third factor that has aggravated the negative impact of the coronavirus outbreak was a poorly developed online sales channel. Of course, some players did a great job in the past few years to make eCommerce a sustainable and self-sufficient sales channel. At the same time, a large number of retailers have put a stake on offline sales while the digital ones were unfairly disregarded. Eventually, the offline-only fashion retailers have suffered from the crisis the most.

Post-crisis apparel: online retail becomes a new normal

The recent crisis has accelerated some of the trends dominating in retail for the past few years. First and foremost, the statement refers to the increasing eCommerce share in total apparel sales. Before we lay out some numbers highlighting the post-crisis recovery of online apparel, it is necessary to make an important note concerning offline apparel retail.

Shopping in brick-and-mortar stores remains an important part of customer experience for a large group of buyers. Huge queues to apparel retail stores re-opened after a lockdown in the UK may serve as a good illustration to show that offline retail is not dead. The point is that the offline-only retail model becomes an unjustifiable risk for apparel and fashion sellers. Basically, in the post-COVID world, retailers can thrive with no brick-and-mortar stores but they cannot survive without selling online.

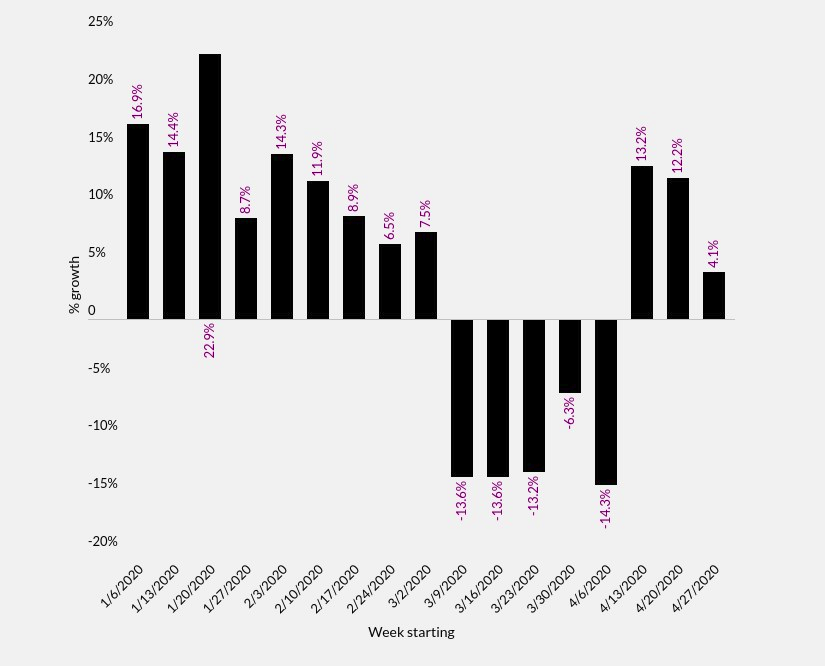

Here are some facts to prove the statement. According to the report by Rakuten Intelligence, online apparel sales have recently started to bounce back in the US while offline retail is still suffering. The table below shows the week-by-week apparel sales dynamics in 2020 compared to the previous year.

The displayed figures highlight a general trend while the recovery dynamics may vary across different segments in apparel retail. For example, demand and sales in the luxury segment are usually recovering sooner compared to the other segments. The question is: what can help apparel retailers of all types to get back on track as soon as possible? And here is the answer.

Tip 1: Strengthen your online positions

It’s pretty obvious that those apparel retailers that have not yet started selling online should start doing it right now. However, it is not so simple as it might appear. Being an effective online retailer takes more than just launching a website filled with the offerings identical to ones in an offline store.

Now, in a time when everyone is moving online while customers are also recovering from the crisis, fashion retailers selling online should always keep in mind the concept of price transparency. What it means practically is that customers can compare prices offered by different sellers with little if any efforts. And here are the three things that can help the business to craft an optimal value offering.

First, find which products are the key-value items (KVIs) in your portfolio (spoiler: most likely, they are not what you think). Subsequently, it is necessary to make sure that your prices for KVIs are better than the ones offered by competitors. By means of AI-driven market data analysis, pricing software can help with both identifying the roles of the products in your portfolio and smart price monitoring.

There is no point in identifying KVIs if you don’t know your real competitors. Here’s a fact: only 3 out of 10 competitors selling the same SKU might have a real impact on your sales. And that’s the second advice: know who your real competitors are. Once again, the pricing software is here to help with the question “How?”. And the last thing: use effective promo campaigns as a means of strengthening your eCommerce profile. Start with ranging the products based on their sensitivity to promo.

Tip 2: Optimize markdown campaigns

Due to the COVID-19 pandemic, fashion and apparel retailers became more vulnerable to the factor of seasonality than usual. In particular, seasonality is likely to have a negative impact on the industry even in case the demand for clothes will stabilize soon. As the entire sales cycle was undermined by the coronavirus outbreak, retailers have to seek ways to sell a large number of stocked items from winter and spring collections.

Comprehensive markdown campaigns become inevitable and those players that will manage to hit their stock target at the maximum possible margin rate will be the winners. What it means is that old-school markdowns with ‘blanket’ discounts, diluted margin, and no predictability on hitting the target work no longer.

Smart elasticity-based markdown campaigns with predictable and controllable results are something apparel retailers would really need this year. The last-gen software enables the businesses to operate markdowns with discount depth differentiated at SKU-level so the margin is maximized and the targets are secured.

An example of a renowned Eastern European omnichannel retailer Intertop saving 200 b.p. of profit margin along with 10% of gross profit by means of implementing advanced tech may serve as a perfect illustration of what smart markdown campaigns mean in practice.

Tip 3: Automate pricing and other business processes

Sustaining one’s market positions and recovering after the crisis is not only about knowing what to do but is also about the time taken for decision-making and initiatives’ implementation. The speed of bringing to life the anti-crisis initiatives is, in the end, the crucial factor that defines winners and losers of the post-COVID world.

And that’s why apparel and fashion retailers have to automate and digitalize pricing and other business processes. Obviously, the use of a dynamic pricing algorithm alone can bring business to the next level of shopping experience personalization.

And here’s why. Automation by means of dynamic pricing algorithms brings apparel retailers flexibility enabling them to target various groups of shoppers with less time and more accuracy as market trends, demand fluctuations, and consumer behavior patterns are considered by the software.

Here are only a few examples showing how exactly can automation of pricing help retailers to sustain their position during and after the crises:

- Gain the maximum possible revenue from selling new entries and products for which the demand function is unknown. ML-based pricing engines can recreate a demand function for such SKUs relying on the historical performance of similar products.

- Avoid providing an inconsistent shopping experience. Automated pricing algorithms are the most reliable means of hitting the targeted service level rate.

- Minimize a cannibalization effect within the portfolio. Advanced pricing software brings coherency which means retailers can secure the sales of particular product groups, e.g. KVIs.

There are dozens of other goals that the automation of the pricing process helps to gain. But most importantly, it helps managers to make the right, sustainable, and timely decisions.

Conclusion

COVID-19 outbreak has dramatically changed conventional business models used by apparel and fashion retailers for years. In the post-crisis world, relying on offline stores alone becomes too risky. But simply going online is not enough also.

What retailers should do is to focus on strengthening their digital market positions by identifying the roles of products in a portfolio, finding their real competitors, and implementing smart promo practices. To become truly sustainable, apparel retailers should also automate the pricing process and run regular tech-driven markdown campaigns.

About the author:

Yulia Beregova is a top pricing expert with more than 10 years of professional experience in Marketing Research and Analytics. Currently, Yulia is focused on helping businesses to thrive by means of implementing top-notch pricing solutions.