Home Depot’s marketing strategy has been instrumental in positioning the company as a leader in the retail space, particularly within the home improvement sector. In this article, we’ll break down the key components of Home Depot’s award-winning approach, exploring how the company successfully utilizes various tactics and methods to engage customers across all channels. With recent initiatives that have propelled the brand to new heights, understanding Home Depot’s marketing tactics can provide retail executives, eCommerce professionals, and marketers with valuable insights to apply in their strategies. Keep reading to uncover actionable insights from Home Depot’s successful marketing strategy that you can apply to elevate your brand’s performance and customer experience.

Key components of Home Depot’s business model

- Revenue Streams: The primary revenue stream comes from product sales, emphasizing home improvement products and construction materials available in-store and online. Installation services and the Pro Loyalty Program also contribute significantly.

- Value Propositions: Home Depot’s value propositions include product authority, seamless customer experiences, and strong partnerships with professional contractors. These elements help position Home Depot as a one-stop solution for both DIY customers and professionals.

- Channels: The company uses both in-store retail and online channels, along with educational content such as workshops, to engage and provide value to customers.

- Customer Segments: Home Depot serves DIY customers and professional contractors, offering tailored services and products to meet the needs of each segment.

- Key Activities: Core activities include inventory management, customer engagement through workshops and loyalty programs, and digital integration to ensure a consistent experience across all channels

Home Depot: The history of the DIY retailer

Founded in 1978 by Bernie Marcus, Arthur Blank, Ron Brill, Pat Farrah, and Ken Langone, Home Depot emerged to create a home improvement superstore that offered a vast selection of products at affordable prices. The first stores opened in Atlanta, Georgia in 1979, showcasing a revolutionary warehouse-style format that set Home Depot apart from competitors. This innovative approach, coupled with an emphasis on knowledgeable customer service, made the brand popular with DIY enthusiasts and professional contractors.

Home Depot’s expansion began in the early 1980s when the company went public in 1981. This fuelled its growth across the United States and eventually into Canada and Mexico. By the mid-1990s, Home Depot had become the largest home improvement retailer in the country, and its acquisition of Canadian hardware chain Aikenhead’s Hardware further strengthened its North American presence. The brand’s commitment to providing quality products and customer education through in-store workshops helped solidify its position as a leading DIY retailer.

In more recent years, Home Depot has focused on embracing eCommerce and investing in its digital infrastructure to enhance the customer experience. The brand’s omnichannel strategy successfully blends its physical stores with a seamless online experience, keeping it ahead of its competitors in the market. Today, Home Depot operates over 2,300 stores across North America, maintaining its mission to empower customers with the tools and confidence needed to take on any home improvement project.

Home Depot: The best videos every retail executive should watch

How Home Depot Became the World’s Largest Home-Improvement Retailer | WSJ

Home Depot Success Analysis – the World’s Largest Home Improvement Retailer | Fortune Reports

Inside Home Depot: Unveiling the Business Strategies & Success | How to Buy Money

The Home Depot-SRS Distribution deal plays right into the company’s strategy: D.A. Davidson’s Baker | CNBC Television

Home Depot’s business performance: Metrics and charts

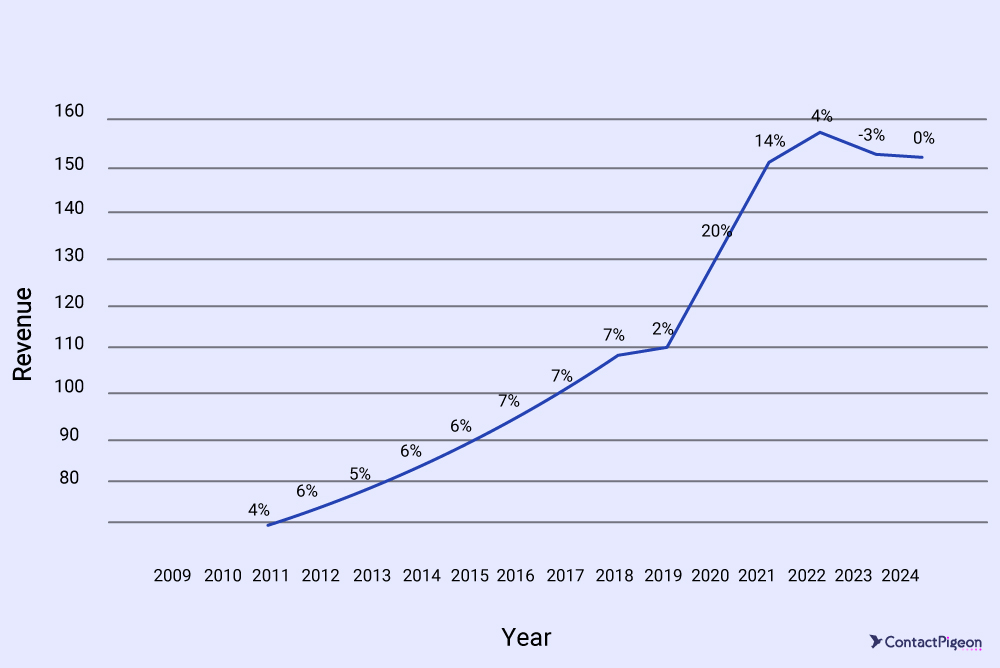

Revenue growth over time

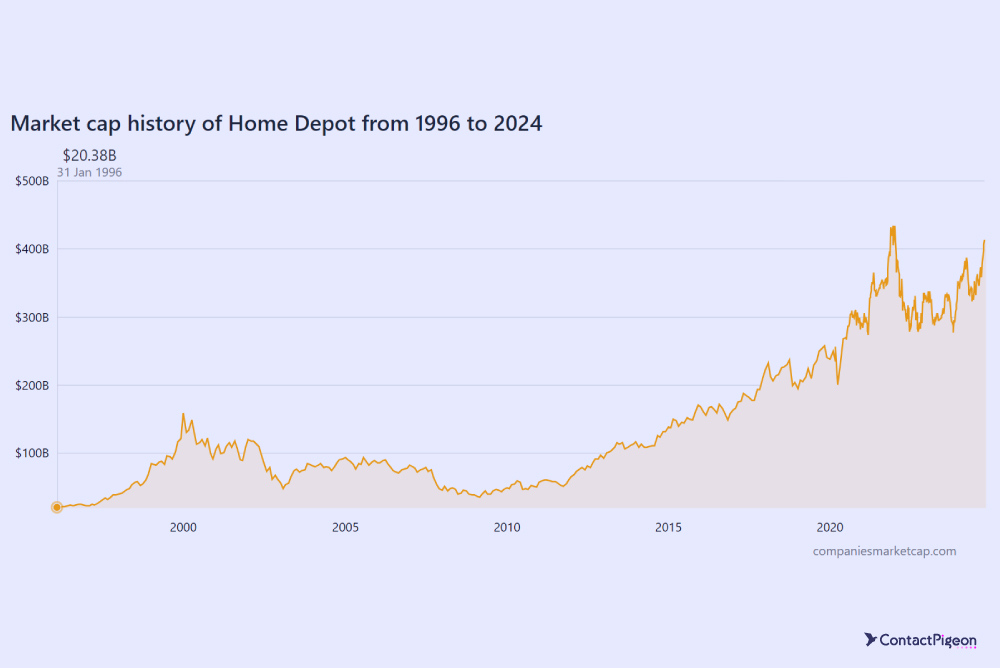

Market cap

Key takeaways from Home Depot’s revenue & performance (2015-2024):

- Significant Growth Pre-COVID: Home Depot experienced consistent revenue growth from 2015 to 2019, averaging around 6-7% annually. This indicates a strong performance driven by factors such as a booming housing market and increased consumer spending on home improvement projects.

- COVID-19 Boom: The COVID-19 pandemic in 2020 led to an unprecedented surge in Home Depot’s revenue, with a remarkable 20% increase. This was primarily attributed to lockdowns, remote work arrangements, and increased DIY activity as people invested more in their homes.

- Sustained Growth Post-COVID: Revenue continued to rise in 2021, albeit at a slower pace (14%), suggesting sustained demand for home improvement products even as lockdowns eased.

- Normalization and Challenges: In 2022 and 2023, revenue growth slowed down considerably (4% and -3%, respectively). Several factors likely contributed to this:

- Economic Uncertainty: Rising inflation, interest rate hikes, and fears of a recession impacted consumer spending and the housing market.

- Supply Chain Disruptions: The Russia-Ukraine war and ongoing global supply chain issues led to increased costs and potential product shortages.

- Normalization of Demand: As people returned to pre-pandemic routines, the exceptional demand for home improvement products seen during lockdowns subsided.

- Mixed Performance in 2024: The projected 0% change in revenue for 2024 suggests a continued challenging environment for Home Depot. While the company might be navigating economic headwinds effectively, it is likely still grappling with inflation, supply chain issues, and a more cautious consumer base.

- Resilience in the Face of Challenges: Despite the slowdown, Home Depot has demonstrated resilience compared to other retailers. Its focus on home improvement, a sector less susceptible to discretionary spending cuts, has helped it weather economic downturns better

- Energy Crisis Impact: While not explicitly marked on the chart, the energy crisis in recent years may have indirectly impacted Home Depot’s revenue. Higher energy costs could lead consumers to prioritize essential spending over discretionary home improvement projects. Additionally, rising costs for manufacturing and transportation could put pressure on Home Depot’s margins.

- Strategic Adaptation: To maintain growth in this challenging environment, Home Depot will likely need to continue adapting its strategies. This could include:

- Focus on Value: Offering competitive pricing and promotions to attract price-sensitive consumers.

- Expanding Pro Services: Catering to professional contractors and builders who are less impacted by economic fluctuations.

- Enhancing Online Presence: Investing in e-commerce capabilities to meet the growing demand for online shopping.

- Supply Chain Optimization: Diversifying suppliers and improving inventory management to mitigate disruptions.

The Home Depot business model

Home Depot’s business model is built on several core strategies that have driven its growth and market leadership. Below, we explore the key elements of Home Depot’s business model and the tactics that have contributed to its success.

Signature DIY workshops and customer education

Home Depot offers signature DIY workshops both in-store and online, aimed at empowering customers with the skills needed to complete home improvement projects. These workshops cater to all skill levels, providing practical, hands-on experience in a variety of topics ranging from gardening to complex renovation projects.

Pro loyalty program and targeting professional contractors

The Pro Loyalty Program is designed specifically for professional contractors, providing exclusive benefits such as bulk pricing, personalized services, and dedicated sales representatives. This program aims to foster loyalty and drive higher spending among professional customers, who represent a crucial customer segment for Home Depot.

Omnichannel integration and digital experience

The Home Depot marketing strategy has heavily invested in an omnichannel strategy, integrating its physical stores with an enhanced online presence. This approach allows customers to seamlessly shop across multiple platforms, whether in-store, online, or through their mobile app, ensuring a flexible and convenient shopping experience.

Impact: Customers using BOPIS spend over 20% more per transaction, with approximately 85% adding extra items to their shopping carts when they arrive for pickup.

Product authority and exclusive partnerships

Home Depot has focused on building product authority by offering exclusive product lines and forging strategic partnerships with well-known brands. These exclusive partnerships differentiate the Home Depot marketing strategy from its competitors by providing unique products that cannot be found elsewhere.

The Home Depot digital marketing strategy

To fully understand Home Depot’s digital marketing success, it’s important to break down the components of its strategy across various online platforms. From social media engagement to email marketing and paid ads, Home Depot has built a robust digital presence that resonates with both DIY consumers and professional contractors alike. Let’s explore how their social media efforts play a critical role in connecting with their diverse customer base.

Home Depot’s social media strategy

What we liked:

- Community Engagement and Storytelling: Home Depot showcases customer stories, employees, and DIY projects, tapping into community-based content. This humanizes the brand and fosters connection with both DIY enthusiasts and professional contractors.

- Visual Consistency and Branding: Their social platforms maintain a cohesive visual identity, using their signature orange and product-centric imagery. This builds brand recognition while making the content instantly identifiable.

- Timely and Relevant Content: Posts are tied to current events, seasonal sales, and home improvement trends (e.g., Halloween, hurricane relief). This keeps the content timely, leveraging moments that resonate with the audience.

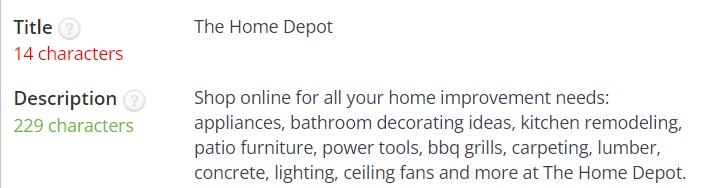

Home Depot’s SEO strategy

What we liked:

- Title Tag Optimization: The title tag, “The Home Depot,” is short but could be enhanced with keywords like “Home Improvement” or “DIY Supplies” to target more relevant search queries.

- Meta Description: While informative, the meta description is too long (229 characters), which could result in truncation on SERPs. A more concise, keyword-rich description would improve visibility.

- Content Relevance: The inclusion of a broad range of products in the meta description shows keyword targeting, but better categorization of key terms could improve ranking for specific queries.

Home Depot’s email marketing strategy

What we liked:

- Personalized Promotions: The Home Depot marketing strategy consists of emails that are heavily promotional, offering discounts on high-ticket items (appliances, home improvement) and incentivizing action with limited-time offers like “up to $2400 off.”

- Clear CTAs (Call-to-Actions): The CTAs are prominent and action-oriented, with phrases like “Shop Now” or “Get Coupon,” making it easy for subscribers to take immediate action.

- Visual Layout: The layout is image-heavy, with product images and bold, attention-grabbing text in colors like orange and black. This is visually engaging and aligns with the Home Depot marketing strategy and brand.

- Mobile Optimization: The design appears to be responsive, a crucial factor in email marketing best practices since many users check emails on mobile devices.

- Incentives and Urgency: The emails use urgency, such as countdowns for “Final Hours” sales, and incentives like a $5 discount for new customers, which encourages conversions.

- Segmentation and Personalization: The emails target different customer segments by offering a variety of products from appliances to seasonal gardening supplies, ensuring relevance for a wide audience.

- Cross-Selling: Product recommendations like “Today’s Selections for You” show effective cross-selling based on previous browsing or purchase behavior.

Home Depot’s paid ads strategy

- Product-Focused Ads: The majority of ads showcase individual products, such as tools, hardware, and home improvement items. Each ad contains a clear image, a short description, and price information.

- Variety in Ad Types: Both product carousel ads and search result ads are used, targeting different stages of the customer journey (awareness to consideration).

- Utility in Imagery: Ads emphasize utility, focusing on the practical use and specific details of each product, appealing to DIY enthusiasts and professionals alike.

- Geographical Targeting: Based on the display, the ads seem tailored to U.S. audiences, focusing on national availability.

Analysis of Home Depot’s eCommerce strategy

By analyzing key elements such as homepage design, category navigation, product presentation, and the checkout process, we can better understand how Home Depot delivers a superior online shopping experience and continues to lead in the retail space. Let’s start with an in-depth look at their homepage.

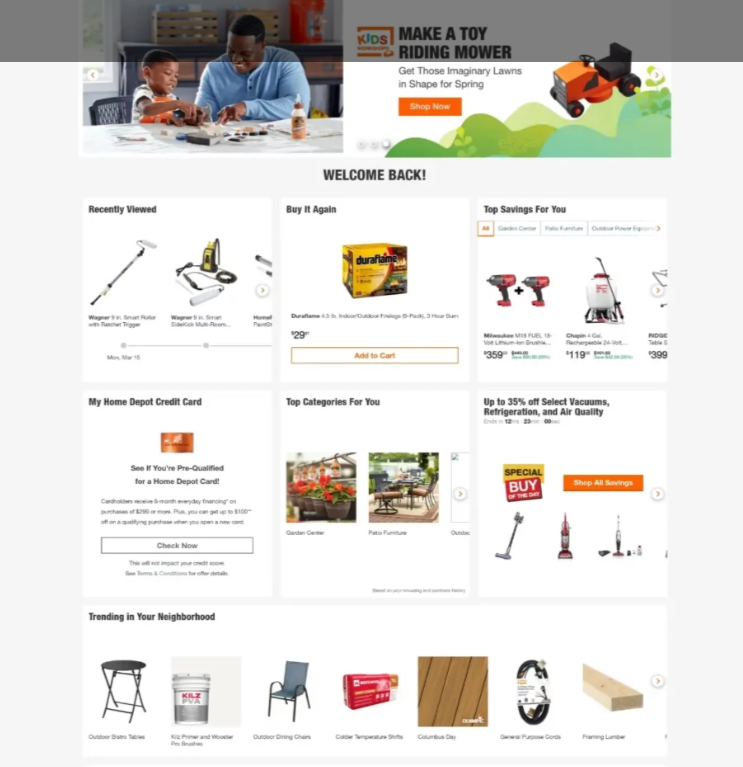

Home page analysis

Things we liked:

- Personalization and Recommendations: The homepage highlights “Recently Viewed” and “Buy it Again,” improving customer retention and encouraging repeat purchases—a well-proven tactic for increasing customer lifetime value.

- Visual Hierarchy and Product Categories: Clear and intuitive navigation with top product categories and DIY project guides allows customers to quickly find what they need.

- Cross-Channel Integration: Features like “Free In-Store Pickup” and “Curbside Pickup” provide flexibility and convenience, meeting modern consumer demand for omnichannel options.

Things we didn’t:

- Overwhelming Visuals: While comprehensive, the homepage feels cluttered with too many product images and text elements, which could hinder the customer’s shopping experience. Simplifying the layout would enhance usability.

- Missing Urgency Elements: While sales are highlighted, there’s a lack of urgency-focused tactics such as countdown timers or limited stock warnings, which are known to drive impulse buys.

- Limited Social Proof: The ratings are not prominently displayed on the homepage. Featuring this social proof could increase buyer confidence.

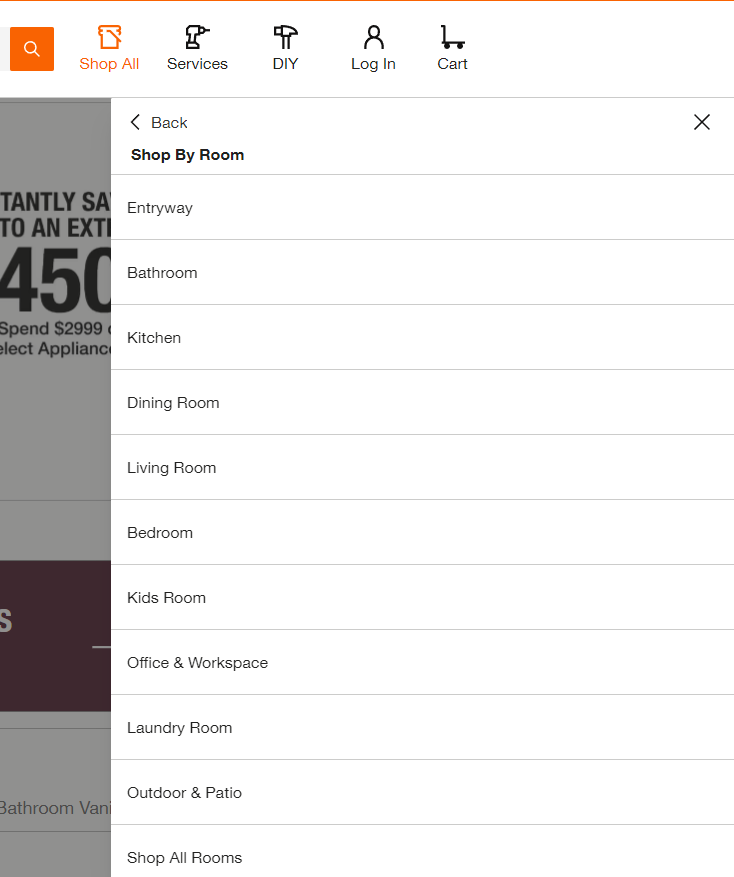

Category page analysis

Things we liked:

- Filtering Options: The ability to sort by features like “In Stock” and “Sensor Activation” is efficient for narrowing down options, saving customers time.

- Consistent Branding and Navigation: Clear, easy-to-access navigation, with a clean design that follows the user journey from home improvement to checkout, ensures seamless usability.

- Product Variety: The wide selection and detailed product images keep users engaged, making the page visually rich and informative for shoppers.

Things we didn’t:

- Overwhelming Product Display: The sheer number of items displayed can overwhelm users. Implementing infinite scroll or pagination could enhance the shopping experience.

- Missing Quick Product Comparisons: A comparison tool could help customers choose between similar products faster, improving decision-making.

- Lack of Urgency: No urgency indicators like “limited stock” or “fast-selling items” are visible. Adding this could drive more immediate purchases.

Product page analysis

Things we liked:

- Detailed Product Information: The product page provides comprehensive information, including dimensions, features, and product comparisons, which assists customers in making informed decisions.

- Frequently Bought Together: This is a smart upselling tactic that encourages higher basket values by bundling related items.

- Multiple Checkout Options: Options like “Add to Cart” and “Your Fastest Checkout” cater to different user preferences, improving the overall user experience.

Things we didn’t:

- Visual Overload: The large number of images, specs, and features can overwhelm users. Simplifying or categorizing the content more effectively could enhance usability.

- Lack of Interactive Features: Interactive 360-degree product views or videos demonstrating the product in use would add significant value.

- Limited Urgency Drivers: There is no visible urgency (e.g., stock levels or time-limited offers) to encourage immediate purchasing decisions.

Checkout page analysis

Things we liked:

- Minimalist Layout: The checkout page is clean, with essential fields easily accessible. It keeps distractions to a minimum, which helps users focus on completing the purchase.

- Multiple Payment Options: Including standard payments, PayPal, and store credit card options provides flexibility for users, increasing conversion potential.

- In-Store Pickup Integration: The “Pickup Nearby” option adds convenience for customers looking for immediate product availability.

Things we didn’t:

- Lack of Progress Indicator: A checkout progress bar is missing, which could help users understand how many steps remain.

- No Guest Checkout Highlight: While guest checkout is available, it could be highlighted more prominently to reduce friction for new customers.

How ContactPigeon’s retail CDP could assist Home Depot’s growth

Here are tailored proposals on how ContactPigeon’s Customer Data Platform (CDP) could assist the Home Depot marketing strategy and growth:

- Tailored Omnichannel Promotions Across Platforms: Make use of unified customer data to deliver personalized DIY offers via email, SMS, and web push notifications, driving seamless engagement both in-store and online.

- Dynamic Product Recommendations with Real-Time Behavioral Insights: Capitalize on Real-time customer behavior to automatically trigger personalized product recommendations, boosting upselling and cross-selling opportunities based on browsing or purchase history.

- Seamless Integration of In-Store and Online Customer Journeys: Utilize the CDP to synchronize customer data across physical and digital channels, offering region-specific promotions that reflect localized shopping trends.

- Demand Forecasting and Inventory Optimization with Predictive Analytics: Use advanced predictive analytics to anticipate customer demand, streamline inventory management, and reduce out-of-stock situations for high-demand items.

- Advanced Customer Segmentation for Precision Marketing: Segment Home Depot’s audience by DIY expertise, shopping habits, or project interests, enabling highly targeted marketing strategies for hobbyists, professionals, and seasonal customers.

These tailored strategies would drive both customer engagement and operational efficiency, supporting Home Depot’s long-term growth. Learn more about ContactPigeon’s powerful retail Customer Data Platform here.

Lessons learned from the Home Depot marketing strategy for retail executives

These insights demonstrate Home Depot’s strategic approach to blending traditional retail strengths with innovative digital practices to stay ahead of competitors.

- Omnichannel Excellence: Home Depot blends physical stores and digital channels seamlessly, increasing customer engagement with options like BOPIS (Buy Online, Pick Up In-Store), which drives higher spending per visit.

- Data-Driven Personalization: Leveraging customer data, Home Depot tailors promotions and product recommendations, boosting customer lifetime value and retention.

- Pro Loyalty Program: Targeting contractors with tailored services and bulk pricing captures a significant portion of the market (45% of sales).

- Localized Marketing: Hyper-local promotions tied to regional customer data enable Home Depot to cater to diverse markets effectively.

- Digital Investments: Significant eCommerce investments make Home Depot a leader in online shopping, delivering a frictionless user experience across all devices.

- Exclusive Partnerships: Offering exclusive products through strategic brand partnerships differentiates Home Depot from competitors and drives traffic.

- Educational Content: DIY workshops, both online and in-store, build customer trust and encourage repeat business, positioning Home Depot as an authority in home improvement.

- Resilience Through Economic Cycles: Home Depot’s business model, focused on home improvement and essential services, shows resilience in downturns, even during economic challenges post-COVID.

- Supply Chain Adaptation: Constant optimization of supply chain operations, coupled with predictive analytics, helps the company mitigate disruptions and control inventory.

- Customer Engagement on Social Media: By integrating customer stories and seasonal trends into its social media, Home Depot builds brand loyalty and keeps content relevant.

Turn Project Intent Into Revenue With ContactPigeon and Menura AI

Home Depot wins by converting project intent into repeat spend across channels. Choose a growth lever to see how ContactPigeon and Menura AI activate DIY and Pro journeys using real-time behavior, inventory signals, and omnichannel fulfillment.

Latest news about Home Depot

- The Home Depot Activates Emergency Command Center In Response To Hurricane Milton (Corporate Home Depot)

- Orange Apron Media Announces New Comprehensive Self-Service Ad Platform – Orange Access (Corporate Home Depot)

- The Home Depot Earns 2024 Partner of the Year Awards from the EPA (Corporate Home Depot)

- The Home Depot Foundation commits up to $2 million for Hurricane Helene relief (Corporate Home Depot)

- Unlocking New Trades Opportunities for the Next Generation with Path to Pro (Corporate Home Depot)

Interesting statistics about Home Depot

- Revenue: $157.4 billion in fiscal year 2023 (Source: Home Depot 2023 Annual Report)

- Net Earnings: $17.1 billion in fiscal year 2023 (Source: Home Depot 2023 Annual Report)

- Market Capitalization: Approximately $413.27 billion as of October 2024 (Source: Companies Market Cap)

- Number of Stores: 2,322 stores in North America as of July 2023 (Source: Home Depot 2023 Q2 Earnings Release)

- Employees: Over 500,000 associates worldwide (Source: Home Depot Corporate Website)

- Customer Transactions: Over 1.6 billion customer transactions in fiscal year 2023 (Source: Statista)

- Website Traffic: Over 213 million visits per month as of August 2024 (Source: Semrush)

- Brand Value: 52.8 billion U.S. dollars (Source: Statista)

- Most Trusted Brand: Ranked #1 most trusted brand in home improvement retail (Source: Lifestory Research)

- Market Share: 12.28% market share in the U.S. home improvement retail market (Source: CSI Market)

- E-commerce Sales: Home Depot's online sales accounted for approximately 14.8% in 2023 (Source: Statista)

Discover additional must-read reports about Home Depot

- Deloitte's Global Powers of Retailing 2023 - Deloitte United States

- Home Depot SWOT and PESTLE Analysis - Quaintel Research

Interested in replicating Home Depot’s strategy? Let's talk.

Discover how ContactPigeon’s powerful retail Customer Data Platform (CDP) can help you drive omnichannel engagement, improve customer segmentation, and boost sales with personalized marketing campaigns. Book a demo today and see how our tailored solutions can elevate your business growth just like Home Depot's!

Let's Help You Scale Up