Over the past decade, Macy’s, the renowned clothing retailer, has undergone a remarkable transformation and significant growth in its business operations. Despite the coronavirus hardships, Macy’s marketing strategy helped the company to overcome all challenges, reaching $24.4 billion in net sales for 2022. Showing a substantial increase in revenue and market presence, Macy’s has become the nation’s leading full-line department store chain, with 853 stores in 45 states, the District of Columbia, Guam, Puerto Rico, and Dubai.

To examine the astonishing feats of this retail leader, this article is dedicated to Macy’s growth strategy, unveiling the key factors that have fueled its expansion. For readers seeking insights into successful omnichannel retail strategies and marketing innovations, this exploration of Macy’s journey provides valuable lessons and inspiration in the industry’s evolution. Explore how Macy’s has harnessed the power of omnichannel customer engagement to thrive in a changing retail landscape.

Listen on the go!

The history of Macy’s retail chain

Initially known as R. H. Macy & Co., Macy’s history dates back to its founding in 1858 by Rowland Hussey Macy. In 1994, the iconic brand became a sibling to the Bloomingdale’s department store chain when it was acquired by the Cincinnati-based holding company Federated Department Stores. Notably, in 2007, the parent company adopted the name Macy’s, Inc., marking a pivotal moment in the company’s evolution. Operating under the brand names “Macy’s” and, to a lesser extent, “Bloomingdale’s, its iconic flagship store is located at Herald Square in Manhattan, New York City. The Macy’s Herald Square store is the largest department store in the world, covering an entire New York City block and 1.1 million square feet.

Early days

Rowland Hussey Macy’s early retail adventures, including the original Macy’s store in Haverhill, Massachusetts, came up short, and at first, it ultimately failed. In hindsight, he used these setbacks as valuable learning experiences as he made a groundbreaking move. In 1858, he moved to a less established retail area, relocating to New York City and establishing “R. H. Macy & Co.” on Sixth Avenue. Despite the humble beginnings, with sales of just $11.08 on the first day, Macy’s gradually expanded and introduced innovative retail tactics that drew customers. Some of these initiatives included a store Santa Claus, themed exhibits, and captivating window displays. Additionally, they offered a money-back guarantee and even produced custom clothing on-site.

In 1875, Macy partnered with his nephew Robert M. Valentine and Abiel T. La Forge. Unfortunately, Macy, La Forge, and Valentine passed away within a few years. Ownership of the company remained within the Macy family until 1895 when the Straus brothers, Isidor and Nathan, acquired the company, which was known as “R. H. Macy & Co.” by then. The Straus brothers had prior experience selling goods within the Macy’s store. Notably, in 1912, Isidor Straus tragically lost his life in the Titanic sinking along with his wife, Ida.

During the 1900s, Macy’s entered a new era by constructing the emblematic Herald Square flagship store. In 1902, Macy’s headquarters moved to Herald Square at 34th Street and Broadway, a location significantly further north than other major dry goods stores. To accommodate the distance, Macy’s offered a steam wagonette to transport customers from 14th Street to 34th Street. Although the Herald Square store initially occupied one building, the building expanded significantly, eventually taking up most of the block between Seventh Avenue on the west, Broadway on the east, 34th Street on the south, and 35th Street on the north. This historic building earned a place on the National Register of Historic Places as a National Historic Landmark in 1978.

Expansion and development

In the 1960s, Macy’s constructed a distinctive round-shaped store on Queens Boulevard in Elmhurst, a neighborhood in Queens, New York City. This store occupied most of the lot, with a small privately owned house on one corner. However, Macy’s no longer fully occupies this building; it has since been repurposed as the Queens Place Mall, with Macy’s Furniture Gallery as one of its tenants. Instead, Macy’s relocated its primary outlet to the nearby Queens Center. Additionally, Macy’s made several distant acquisitions over the years, including Lasalle & Koch (Toledo, 1924), Davison-Paxon-Stokes (Atlanta, 1929), L. Bamberger & Co. (Newark, 1929), O’Connor Moffat & Company (San Francisco, 1945), and John Taylor Dry Goods Co. (Kansas City, 1947). These acquisitions led to the renaming and consolidation of various stores, eventually forming the foundation for Macy’s Midwest and Macy’s California divisions.

In 1983, Macy’s New York expanded its presence beyond its traditional New York City and Long Island trade area. The company opened stores in locations such as Aventura, Florida, followed by several outlets in Plantation, Florida, Houston, New Orleans, and Dallas. The unification of Macy’s Midwest in Atlanta in early 1985 marked a significant move, but later that year, Macy’s sold off the former Midwest locations. Meanwhile, Bamberger’s, which had aggressively expanded across New Jersey and other regions, was rebranded as Macy’s New Jersey in 1986. These expansions and rebrandings reflected Macy’s commitment to growing its retail footprint in various states of the US.

Despite the obstacles throughout the years, Macy’s continued to evolve, making acquisitions such as Story in May 2018 and a minority investment in b8ta, a retail-as-a-service concept, in June 2018. In 2019, Macy’s announced its intention to ban the sale of fur products in its stores by the end of the 2020 fiscal year. These moves represented Macy’s response to shifts in consumer preferences and the retail industry. The company also altered its organizational structure, strengthened its headquarters, and explored new partnerships, like collaborating with Toys “R” Us to open toy shops within Macy’s stores. Furthermore, Macy’s aimed to improve employee compensation by raising the corporation’s base salary to $15 per hour. In February 2023, Macy’s announced a policy change to discontinue the sale of leather goods made from exotic skins, signaling a commitment to ethical and sustainable practices.

The key components of Macy’s marketing strategy

Macy’s journey reflects the ongoing transformation of a retail giant in a dynamic and ever-changing market. Macy’s marketing strategy revolves around customer-centricity, seamless omnichannel integration, digital engagement, and strategic collaborations. Take a look below to find out more.

Product strategy and target markets

Macy’s offers a rich product offering, including top-featured brands like Calvin Klein, Michael Kors, Levi’s, Ralph Lauren, Nike, and Adidas. The brand’s diverse range of products for shoppers of all ages includes various items from brands across multiple categories, like home essentials, bed and bath products, clothing, and accessories for women, men, and children. Macy’s high-quality products and services are a crucial factor in attracting and retaining customers.

Pricing and promotion strategies

Since Macy’s has a wide range of products and brands, it is fair to say that the retailer’s pricing strategy is equally divergent. Thus, the prices of products at Macy’s are generally affordable, with some slightly higher prices in developing markets due to shipping costs. Macy’s offers a variety of cost-saving opportunities for customers, both online and in retail stores. These include clearance sales, ongoing sales, daily deals, discounts, coupons, and special promotions.

With 853 stores across 45 states, the District of Columbia, Guam, and Puerto Rico, Macy’s distribution and promotional strategy includes both an online and offline reach. Besides print and traditional media, like magazines, television, and radio ads, Macy’s has a strong digital presence on social platforms. Moreover, to keep customers informed and updated, the brand offers store catalogs, both in the physical stores and online. Additionally, Macy’s provides store cards, and cardholders receive regular daily and weekly circulars with relevant information. Customers who make credit card purchases receive personalized email catalogs based on their purchase histories, which have proven to significantly boost sales.

Examining Macy’s growth strategy and USPs

Macy’s marketing strategy encompasses several vital components that have evolved to adapt to changing consumer behaviors and market dynamics. Making significant strides in its retail media network as part of its evolving digital marketing strategy, the retail leader always keeps up with the latest trends.

Transition to omnichannel retailing

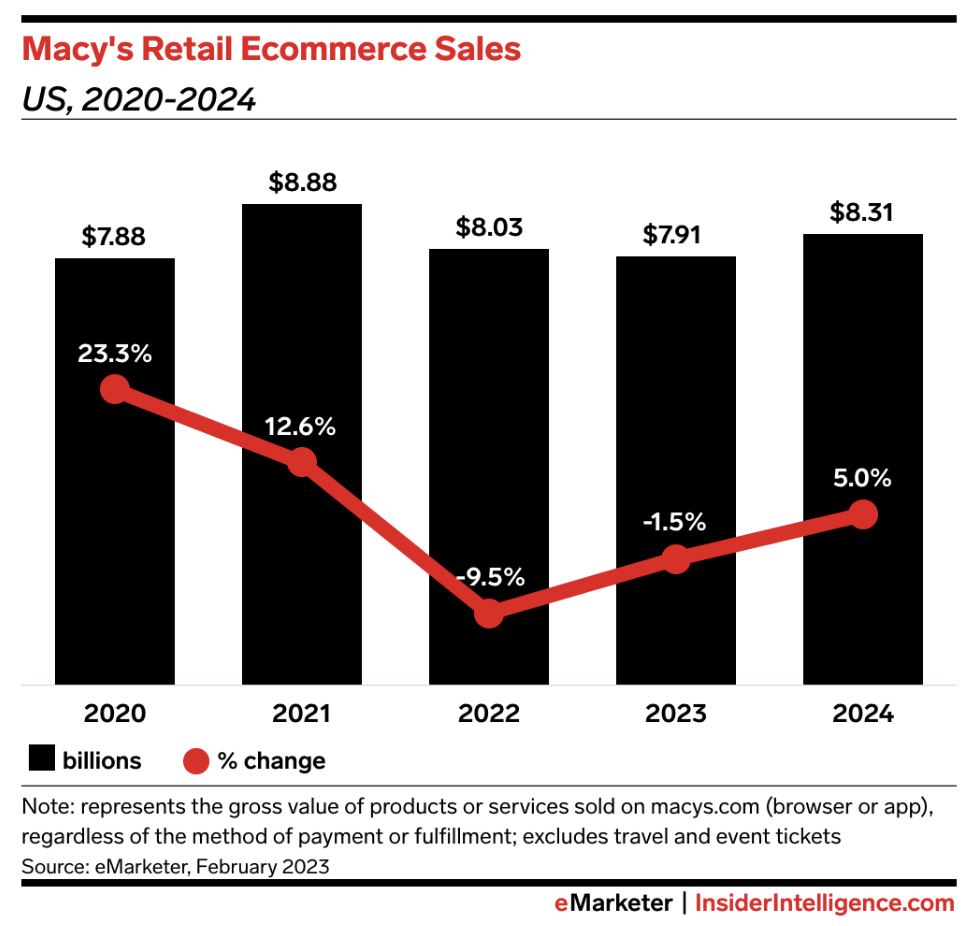

In 2010, Macy’s embarked on a digital transformation, focusing on a comprehensive omnichannel strategy aimed at creating a seamless customer experience that bridges both physical and digital retail channels. A key component of Macy’s omnichannel approach is the implementation of “ship from store” capabilities, utilizing its extensive network of 868 stores as distribution centers for online orders.

This strategy optimizes inventory management while enhancing the customer experience. Instead of maintaining separate inventories exclusively for eCommerce orders in warehouses, Macy’s leverages its stores to fulfill online orders based on the availability of requested items in nearby stores. This approach reduces overall inventory costs and minimizes the need for markdowns. Furthermore, customers benefit from faster delivery as items are shipped from local stores rather than distant national distribution centers.

Private label strategy

The company recently announced its plans to introduce four new private brands by the end of 2025. The first of these, named On 34th, is set to launch on August 17, with shoes from this brand becoming available in spring 2024. Macy’s intends to introduce multiple private brands in 2024, spanning various categories, including clothing and accessories.

Macy’s already boasts a substantial portfolio of over 25 private brands, such as I.N.C., Alfani, Charter Club, and Sun + Stone. Approximately 16% of Macy’s annual sales in fiscal 2022 originated from these private brands, a figure that was higher before the pandemic, hovering at around 20%. Macy’s aims to raise this percentage back to around 20% in the long term, targeting a 25% contribution from private brands to its sales by 2025, as stated by CEO Jeff Gennette in 2020.

This move is part of Macy’s strategy to enhance its private-brand offerings to attract more customers. Investing in private brands allows big-box or mall retailers like Macy’s to regain losses by exerting more control over production and distribution, ultimately retaining a larger share of profits.

Social, retail media strategy and digital marketing

In 2020, Macy’s introduced the Macy’s Media Network, functioning as an agency collaborating directly with brands that align with its stores, facilitating ad placements on Macy’s and Bloomingdale’s websites, apps, and physical retail locations.

Macy’s has now expanded its retail media strategy by offering a self-serve option for advertisers via The Trade Desk, driven by the retailer’s proprietary shopper data. This strategic move aligns with multiple business objectives, including establishing new agency relationships and enhancing off-site digital ad channels such as programmatic display, video, and audio. Importantly, it enables Macy’s to enter the realm of connected TV (CTV). According to Melanie Zimmermann, the vice president of Macy’s Media Network, CTV represents a promising growth area, attracting non-endemic brands, and Macy’s anticipates substantial expansion in categories like travel, insurance, and auto.

Community engagement and CSR

In 2022, Macy’s introduced a social purpose initiative called “Mission Every One” aimed at building on its commitment to corporate citizenship and driving positive societal change. This platform centers around three key pillars: people, communities, and the planet, directing $5 billion of the company’s spending toward partners, products, programs, and individuals that contribute to a more equitable and sustainable future by 2025.

Under the “people” pillar, Macy’s is taking steps to boost diversity and inclusivity. This includes increasing investment in underrepresented designers, brands, and business partners across the company. They’ll continue supporting The Workshop at Macy’s, which has fostered over 175 diverse and women-owned businesses since 2011. Moreover, Macy’s will expand its digital assortment with a focus on sustainability and circular solutions by adding 5,000 product pages to macys.com’s sustainability site.

Strong partnerships

Macy’s is elevating its omnichannel strategy even more by introducing a digital marketplace on its website, macys.com. This marketplace will present shoppers with a carefully curated selection of new brands, merchandise categories, and products offered by third-party merchants and brand partners. With over 20 product categories and 400 new brands, the macys.com marketplace will seamlessly integrate with the existing product lineup on the website.

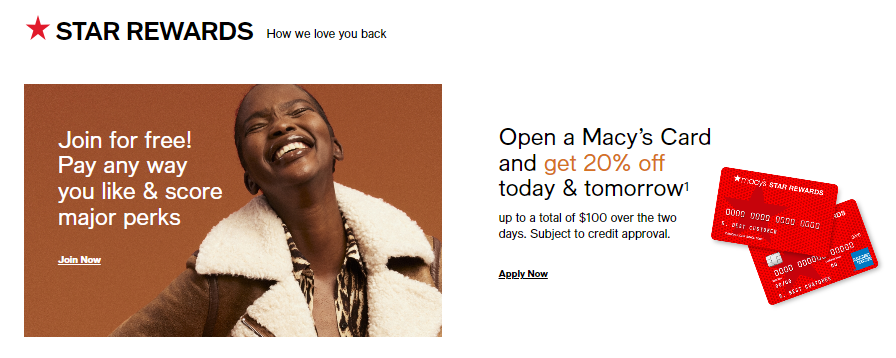

Personal stylist and loyalty club

Macy’s personal stylist service and loyalty program are key components of its marketing strategy, aimed at providing personalized experiences and building strong relationships with customers. With a personal stylist service, both in-store and online, Macy’s provides expert guidance to help customers discover the ideal clothing or home decor items that align with their unique preferences and requirements.

Additionally, the company operates the Star Rewards loyalty program, featuring four tiers and offering incentives such as discounts, free shipping, and exclusive event access. Remarkably, in 2021, more than 70% of all transactions were associated with the loyalty program, whether customers were existing members or joined during their transactions. This underscores the pivotal role of the loyalty program in enhancing customer engagement and driving sales.

Analyzing Macy’s eCommerce website

In this section, we’ve analyzed four-page templates of Macy’s website to identify eCommerce best practices and mistakes you should avoid.

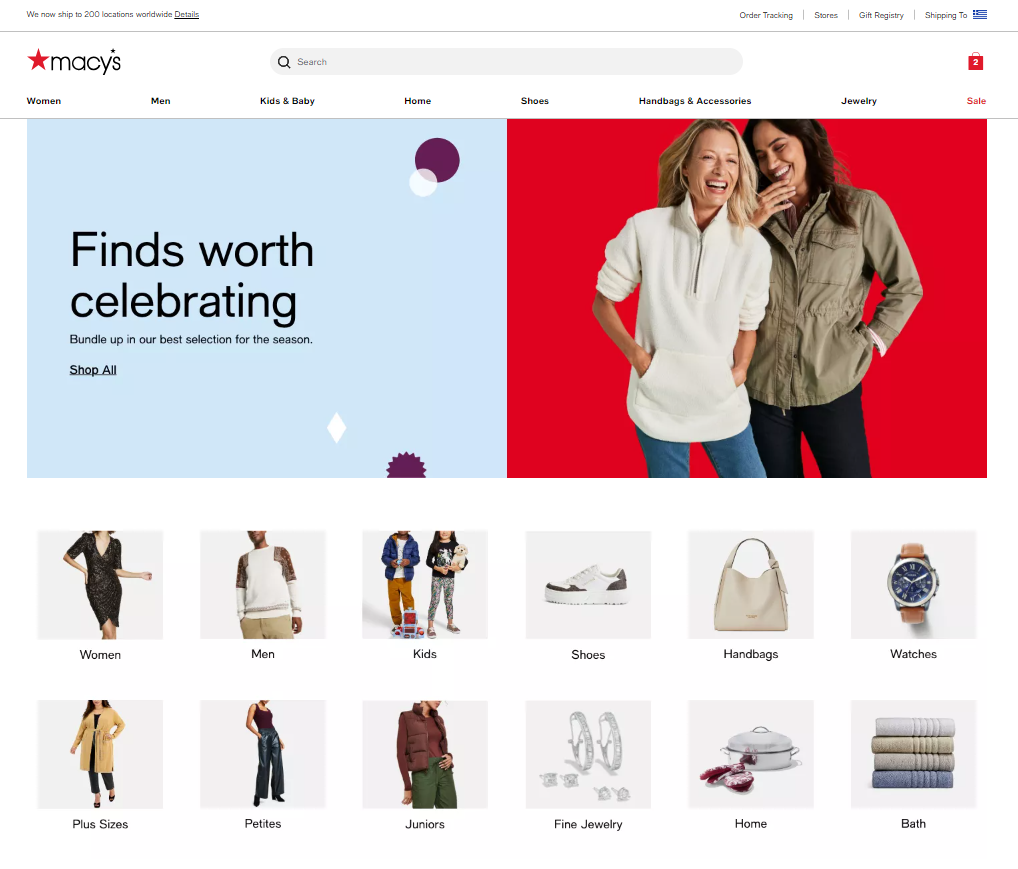

A. Analyzing Macy’s homepage

What we liked:

- Informative localized pop-up, notifying users of the shipping options that apply to their country.

- Minimal and sleek design that doesn’t confuse the visitors

- Drop-down, detailed menu with clear categorization

- Order tracking on the header

- Prominent search bar above the fold

What we didn’t:

- No sticky-cart functionality

- The “Sale” button could be highlighted more

- The “Black Friday Early Access Specials” and any other promotional offers are hidden in the drop-down menu

- No CTA to log in or sign up for the Macy’s loyalty program

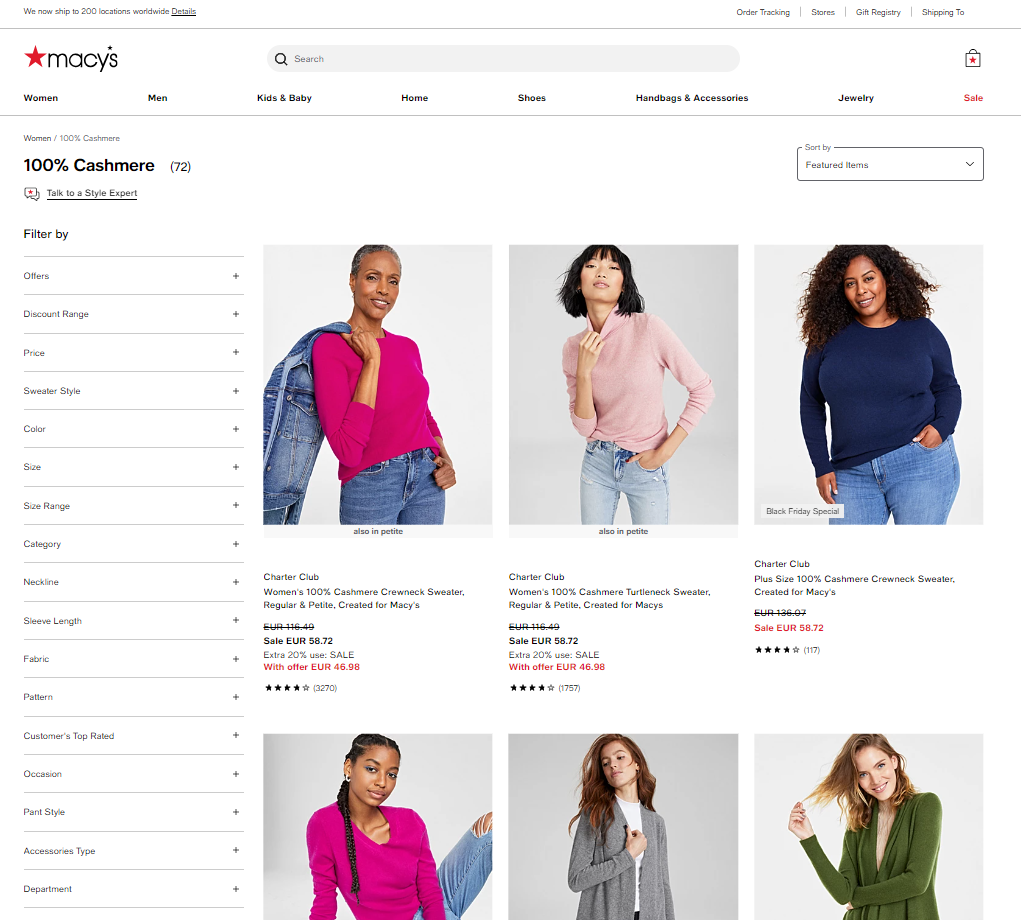

B. Analyzing Macy’s category page

What we liked:

- Subcategories under the mother category

- Sticky filtering

- A star-rating system under the listed products

- Additional offers with hovering functionality

- Localized pricing according to the country of the visitor

- Sorting filter on the right side

- Customizable display of the products based on the category

- Easy-access CTAs for flash sales and specials

- “Talk to a style expert” CTA

What we didn’t:

- No quick-add-to-cart and no wishlist functions

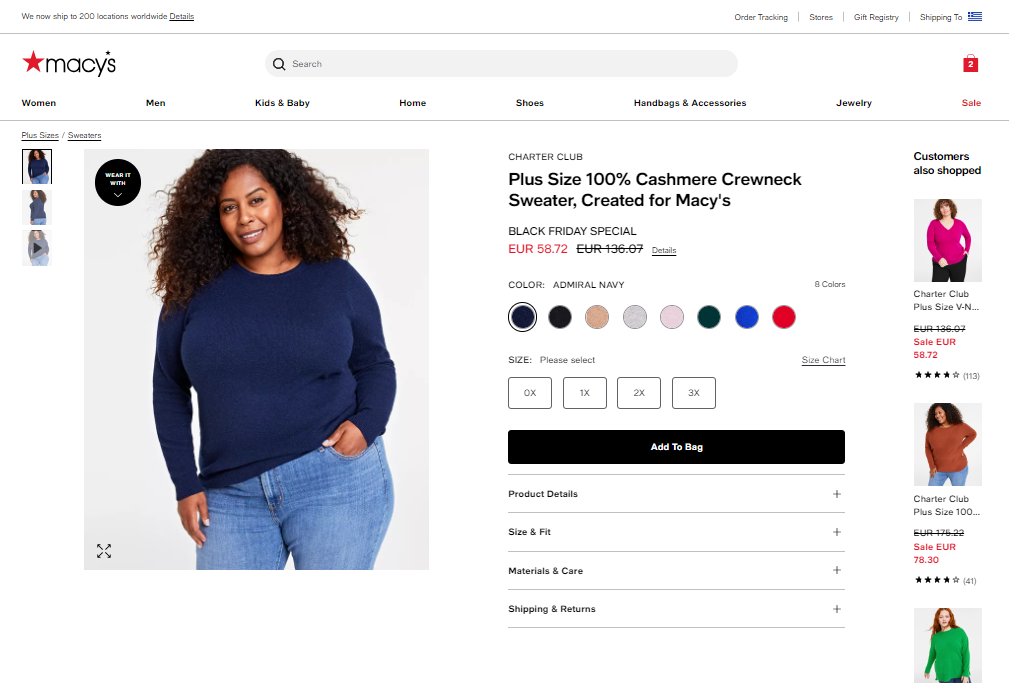

C. Analyzing Macy’s product page

What we liked:

- Size chart for the clothing items

- Visible promo codes

- Ratings and reviews section

- Availability or low stock notification

- Visible important information included like care instructions, or shipping and returns

- Relevant recommendations based on

What we didn’t:

- Not enough pictures of the products

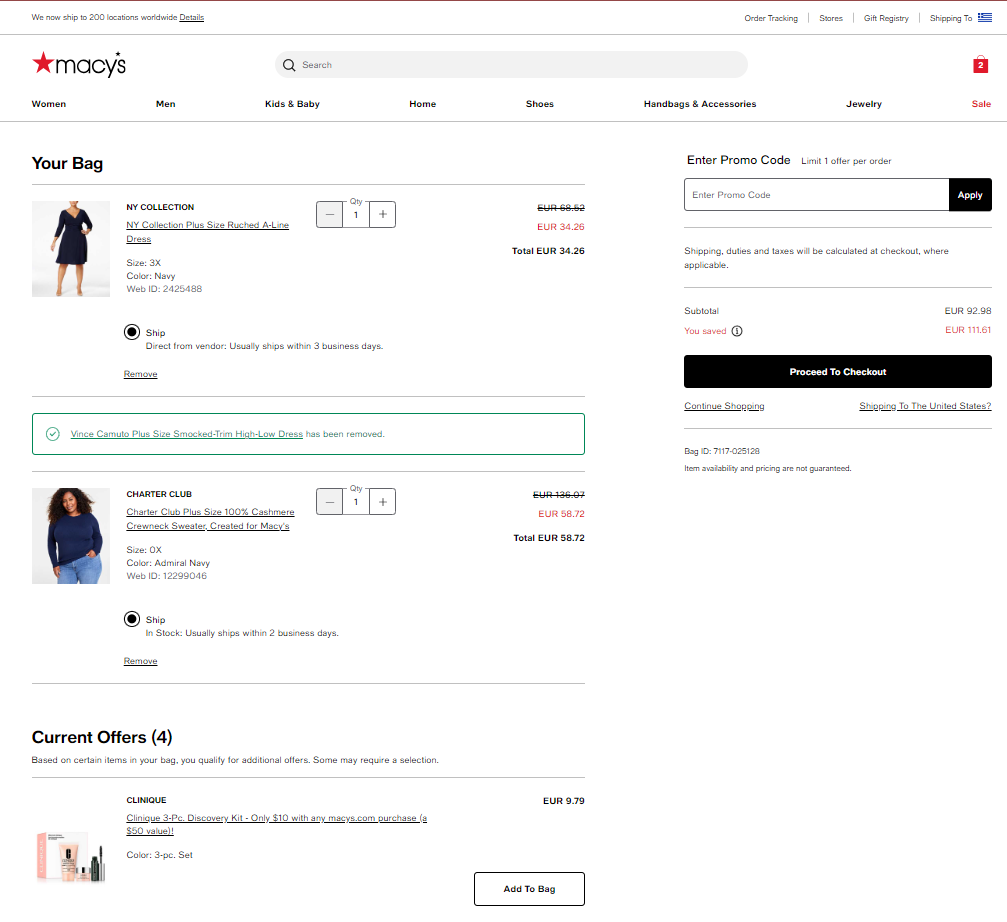

D. Analyzing Macy’s checkout process

What we liked:

- Additional costs like shipping and taxes, included at the beginning of the checkout process

What we didn’t:

- No guest checkout

- No alternative payment options, only PayPal

The biggest challenges Macy’s management team ever faced

Throughout the years, Macy’s encountered various financial and logistical challenges that shaped its strategies and operations. Despite the issues Macy’s had to navigate, the brand managed to overcome them and stay ahead of the curve.

Financial challenges

Starting in 2015, Macy’s initiated a series of strategic moves, which significantly impacted its operations and store footprint. The company began by announcing the closure of 14 stores in January 2015, a decision that affected 830 employees across Macy’s and Bloomingdale’s locations. Additionally, in July of the same year, Macy’s sold the former Kaufmann’s flagship store in Downtown Pittsburgh after 128 years, marking a significant shift in its real estate portfolio.

Throughout 2015 and into 2016, Macy’s faced challenges, including declining sales during the holiday season and announcing layoffs of up to 4,800 employees in January 2016. The store closures aimed to achieve cost savings of $400 million, reducing Macy’s store count to 770 by that time. In August 2016, Macy’s revealed plans to close 100 more stores in early 2017, part of a cost-saving strategy expected to cut over 10,000 jobs. Macy’s committed to investing $250 million in digital business and growth strategies for its remaining stores. In September 2016, Macy’s sought to adapt to the changing retail landscape by opening an Apple Store within its flagship location, becoming the first department store to do so.

Logistical and technological challenges

In 2013, Macy’s faced a significant challenge regarding inventory accuracy. The flow of products within their warehouses was difficult to control, leading to a monthly inventory degradation rate of 2-3%, potentially resulting in a 24% loss by year-end. This lapse in judgment caused a problem for the brand’s omnichannel sales, especially when stores reported having only one or two units of a particular product, as it was risky to make decisions based on unreliable data.

Macy’s had been prioritizing sales and customer service while neglecting inventory management, resulting in issues related to merchandise movement, administrative errors, and system updates that hindered the fulfillment process. With thousands of product categories and a vast customer base across their 800 stores, Macy’s recognized the need to focus on providing a localized merchandise offering to ensure a seamless shopping experience.

Intriguing tech Macy is presently applying

Using the buildwith tool, we scanned Macy’s website and highlighted the most impressive technologies spotted.

- Omniture SiteCatalyst: Digital analytics tool that helps businesses track and analyze user interactions and behaviors on their websites.

- Coremetrics: A digital marketing analytics platform for tracking and analyzing online customer behavior.

- Dynatrace: Dynatrace is an application performance management and monitoring platform for optimizing software and web applications.

- TVSquared: TVSquared is a TV attribution and measurement platform that helps advertisers analyze the impact of television advertising on business outcomes.

- Salesforce Audience Studio: Salesforce Audience Studio is a data management platform for collecting, managing, and activating customer data to enhance marketing and advertising efforts.

- Akamai mPulse: A real user monitoring (RUM) and web performance monitoring solution, designed to help businesses analyze and optimize the performance of their web applications and websites from the perspective of end-users.

Remarkable Macy’s statistics and facts every retail executive should know

- In 2021, macys.com ranked as the second highest-grossing online fashion store in the United States. (Statista)

- In 2022, Macy’s emerged as the world’s largest department store company by retail sales, outpacing its U.S. rival, Kohl’s. (Statista)

- In 2021, Macy’s achieved global net sales of approximately 24.5 billion U.S. dollars, marking a significant increase of 43 percent compared to the previous year when it recorded around 17.35 billion dollars in sales. (Statista)

- In 2020, Macy’s collaborated with CEO Action for Racial Equity to promote the development of scalable and enduring public policies focused on racial equity. (macysinc.com)

- Macy’s has issued credit cards for 14 million accounts, resulting in additional cost savings. (studocu.com)

- As of 2023, the company has approximately 95,000 employees. (Statista)

Macy’s latest big news

- Macy’s will open up to 30 stores, as department store looks to strip malls as a key part of its future. (CNBC)

- Macy’s aims to add nearly 40,000 workers in seasonal roles. (Fox Business)

- Macy’s CEO Jeff Gennette is to retire next year. (Fox Business)

- The World-Famous Macy’s Thanksgiving Day Parade® Kicks Off the Holiday Season. (Yahoo! Finance)

- Macy’s, Inc. to Report Third Quarter 2023 Results on November 16, 2023. (macysinc.com)

- Macy’s Celebrates the Holiday Season With Big Brothers Big Sisters. (macysinc.com)

Resources about other renowned fashion retailers

- How ZARA Dominates the Ecommerce Fashion Industry

- Why ASOS is the Absolute UK Ecommerce Success Story

- New Look: The Marketing Strategy Behind the UK Fast-Fashion Retailer

- Farfetch Case Study: Analyzing The Strategy of the UK Fashion Unicorn

- The Marks and Spencer eCommerce Case Study: 3 Growth Lessons for Retailers

- SUPERDRY Case Study: The Marketing Strategy Behind One of the Top UK Clothing Retailers

- John Lewis Omnichannel Strategy: How the UK’s top homeware retailer has reached the top

Make Macy’s case study your catalyst for expansion

Macy’s exceptional success is a testament to its long-standing legacy and a meticulously crafted strategy that has been artfully adapted for the digital age. This iconic department store, which includes brands like Bloomingdale’s and Bluemercury, has undergone a significant transformation in recent years. Macy’s remarkable achievements aren’t merely a product of chance; they derive from a brilliant and passionately executed strategy, which they have seamlessly replicated in the online realm. Macy’s dedication to building strong relationships with its customers and providing a unified shopping experience positions them as a prominent force in the retail landscape.

Before embarking on your journey to enhance customer engagement, we urge you to conduct thorough market research. For personalized guidance and insights tailored to your business, schedule a free consultation with ContactPigeon. We’re proud to be recognized as the world’s easiest-to-use marketing automation platform by G2, and we’re here to help you thrive.

Let’s Help You Scale Up