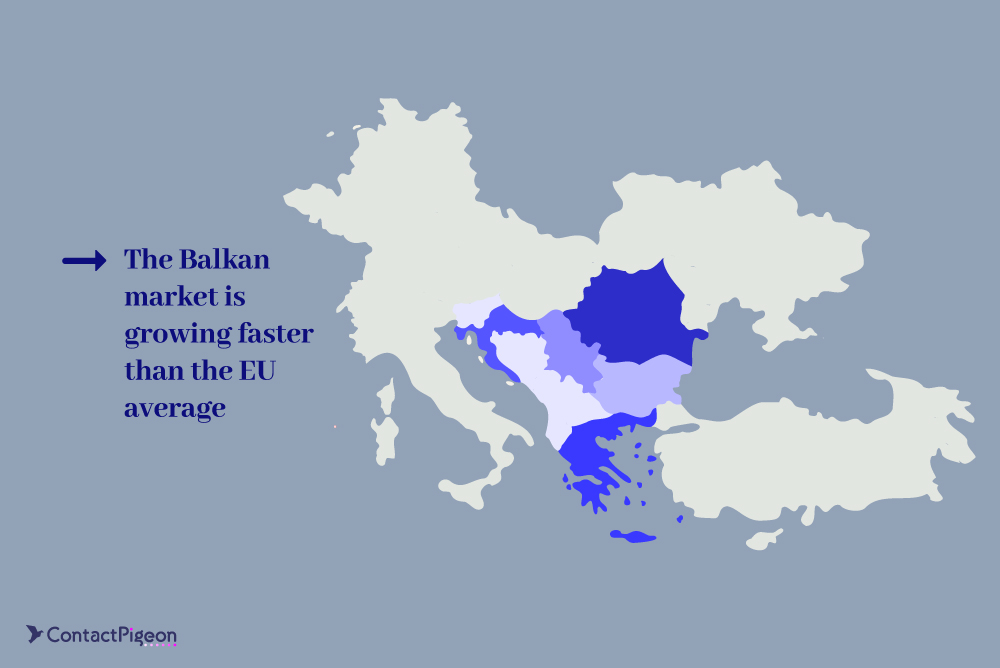

Retail in the Balkans is experiencing an unprecedented boom, with eCommerce growing at 20% year-over-year, more than double the EU average of 8%. But beneath these impressive numbers lies one of the most complex and fragmented retail landscapes in Europe. The Balkan region stretches across multiple countries, each with its own languages, regulations, and infrastructure. This creates a unique mix of opportunities and challenges for retailers, from fragmented logistics networks to consumers who are rapidly adopting digital channels while still expecting personalized, local shopping experiences. For retail executives navigating this dynamic terrain, operational excellence requires not only agility and innovation but also a deep understanding of the region’s nuances.

Retail in the Balkans: The most important stats for executives

The Balkan region is undergoing a period of accelerated digitalization, economic development, and retail transformation. For executives eyeing market entry or expansion, understanding the most critical statistics and market dynamics is essential for informed decision-making.

Key trends and opportunities

The following key trends outline the macro forces shaping the retail and e-commerce environment in the Balkans today:

- The region is experiencing a digital transformation, with steady increases in e-commerce adoption and digital public services. (Regional Cooperation Council)

- Challenges remain in logistics, delivery, and cross-border sales, but ongoing reforms and EU integration efforts are expected to further expand the market. (Regional Cooperation Council)

- The European Commission estimates that deeper economic integration within the Western Balkans, especially through the Common Regional Market, could add up to 10% to regional GDP over time. (European Commission)

General statistics

A snapshot of general economic, digital, and retail data highlights the current state of the Balkan markets and reveals gaps, especially in cross-border e-commerce penetration:

- The Western Balkans (Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, and Serbia) are projected to see combined economic growth of 3.2% in 2025, with a slight acceleration to 3.5% in 2026. (World Bank Group)

- In 2021, 21% of SMEs in the Western Balkans made online sales, compared to 18.5% in the EU. Serbia (26%), Montenegro (23%), and Kosovo (22%) led the region in SME online sales. (Regional Cooperation Council)

- Despite this progress, only 4% of SMEs reported sales to EU customers, indicating significant untapped cross-border potential. (Regional Cooperation Council)

- This growth is driven by lower inflation, rising wages, increased consumption, and public investment, but is tempered by global trade uncertainties and weaker external demand from the EU.

- Greece leads the Central and Eastern Europe region, with e-commerce contributing 7.87% to GDP in 2024. (Business Review)

Total Addressable Market (TAM)

The total addressable market for e-commerce in the Balkans is rapidly expanding, offering a clear signal for retailers and investors seeking long-term growth opportunities:

- The Balkan eCommerce Summit and market analysts frequently cite the region’s total addressable e-commerce market at over $9 billion, with Romania as a leading contributor. (Balkan E-commerce Summit)

- The TAM for the broader Western Balkans is growing rapidly, supported by increasing internet penetration, digital transformation, and consumer demand. (Regional Cooperation Council)

Leading countries in the e-commerce Balkan market

Several Balkan countries stand out as e-commerce frontrunners, each with unique market dynamics, consumer behaviors, and digital maturity levels:

Serbia

- Serbia leads the Western Balkans in e-commerce revenue, expected to reach €1.5 billion by 2029, followed by Bosnia and Herzegovina. (Statista)

- Market size & growth: Serbia’s e-commerce market was projected to reach $1 billion in revenue in 2024, with an expected annual growth rate of over 10% through 2029. (Balkan E-commerce Summit)

- Penetration rate: Serbia has an e-commerce penetration rate of nearly 34% in 2024, forecasted to reach over 41% by 2029. (Statista)

- Demographics & usage: High internet usage (85.4% used the internet in the last 3 months), strong social media engagement (82 %+), and younger generations (16–34) are the most active online shoppers. (Balkan E-commerce Summit)

Romania

- E-commerce penetration: Approximately 55% of Romanians aged 16–74 are expected to have shopped online in 2024. (Zelist Blog)

- Market growth: The e-commerce market is projected to reach $9.84 billion in revenue by 2029, representing a 70.81% increase from 2024. E-commerce penetration is expected to grow from 38.6% in 2025 to 46.1% by 2029. Balkan E-commerce Summit)

- Cross-border shopping: Romania is part of the broader Balkan market, where 70% of Europeans purchase from foreign websites, indicating strong cross-border e-commerce potential. (Zelist Blog)

Bulgaria

- Market growth: Bulgaria’s e-commerce market has doubled in size over the past 4 years, with a 20% year-on-year growth rate in the Balkans overall, where Bulgaria is a key contributor. (Balkan E-commerce Summit)

- Retail share: Online retail accounts for around 8% of total retail sales in Bulgaria, compared to 15% in some neighboring countries. (Balkan E-commerce Summit)

Τhe Do’s & the Don’ts for high performance retail in the Balkans

This guide breaks down 50 essential Do’s and Don’ts for achieving high-performance retail in the Balkans, organized into 5 strategic categories that cover every critical aspect of the journey.

1: Market Strategy: Related points to consider

Balkan markets are not one-size-fits-all. Success here demands country-specific strategy, regulatory nuance, and decentralized leadership.

✅ Do’s

- Use localized SWOT per country: Assess strengths, weaknesses, opportunities, and threats for each Balkan country independently to capture local nuances.

- Create regional KPIs: Set measurable KPIs that reflect both country-specific and regional goals to monitor true performance.

- Use JVs/franchising for entry: Leverage local joint ventures or franchising models to fast-track market entry with reduced risk.

- Consult country-specific advisors: Engage local legal, tax, and market advisors to navigate regulatory and cultural complexities effectively.

- Prioritize decentralization: Empower local teams with decision-making authority to stay agile and responsive to market shifts.

❌ Don’ts

- Don’t apply one-size-fits-all EU strategies: Avoid replicating EU-level strategies without tailoring them to Balkan realities and consumer behaviors.

- Avoid centralizing HQ decisions: Steer clear of rigid HQ-led decision-making that may slow down responsiveness to local market dynamics.

- Don’t skip regulatory nuance (EU vs non-EU): Understand the regulatory split between EU and non-EU Balkan countries to prevent costly missteps.

- Don’t ignore sustainability programs (EBRD-backed): Overlooking EBRD-supported sustainability programs can weaken your ESG positioning and funding access.

- Avoid outdated retail playbooks: Forget legacy retail models—Balkan consumers expect modern, digital-first experiences.

2: Customer experience: Strategic points for executives

With language diversity, cultural uniqueness, and rising digital expectations, personalization is your retail edge in the Balkans.

✅ Do’s

- Personalize loyalty programs per country: Tailor loyalty rewards, tiers, and communications to fit each country’s cultural and purchasing patterns.

- Offer multilingual onboarding: Ensure all digital and in-store touchpoints support local languages for frictionless customer onboarding.

- Use regional holidays in campaigns: Capitalize on local and regional holidays to craft timely, hyper-relevant marketing campaigns.

- Automate customer journeys with ContactPigeon or similar tools: Implement omnichannel automation platforms to deliver personalized, data-driven experiences at scale.

- Track NPS by segment: Monitor Net Promoter Score per country and key segments to fine-tune your CX strategies effectively.

See how AI is transforming retail customer engagement.

❌ Don’ts

- Don’t reuse EU loyalty templates:

Standardized loyalty schemes from other EU markets often fail to resonate with Balkan consumers. - Don’t assume one language works for all:

Relying on a single language risks alienating key demographics across the region’s multilingual landscape. - Avoid generic engagement campaigns:

Broad, non-personalized campaigns dilute impact and miss opportunities for local relevance. - Don’t overlook SMS for rural demographics:

Neglecting SMS channels ignores an essential touchpoint for rural and older audiences. - Don’t ignore churn triggers:

Failing to monitor early churn signals can erode long-term loyalty and revenue streams.

3: Logistics: Critical priorities for retail leadership

Efficient logistics in the Balkans means balancing urban scale with rural accessibility, while staying agile across borders and infrastructure gaps.

✅ Do’s

- Build micro-fulfillment hubs: Establish local micro-fulfillment centers to cut delivery times and optimize last-mile costs.

- Partner with local 3PLs: Collaborate with local third-party logistics providers for agile, territory-specific delivery models.

- Support cash-on-delivery where needed: Offer cash-on-delivery in markets where digital payments remain underpenetrated.

- Map delivery routes around terrain/infrastructure: Design routes that factor in regional infrastructure limitations and complex terrains.

- Use ContactPigeon data to forecast fulfillment: Leverage real-time data to predict demand and optimize inventory allocation per region.

❌ Don’ts

- Don’t assume EU-level infrastructure: Expecting EU-standard logistics can cause costly delays in less developed Balkan markets.

- Avoid consolidated warehouses in distant locations: Over-reliance on centralized hubs far from key markets increases delivery times and costs.

- Don’t ignore sustainability in delivery: Failing to integrate green logistics practices can damage your brand and miss EBRD-aligned funding opportunities.

- Don’t offer same-day delivery promises blindly: Overpromising without assessing local infrastructure risks disappointing customers.

- Avoid weak post-purchase visibility: Lack of clear post-purchase tracking undermines trust and increases customer support costs.

4: Technology & automation: Key considerations for retail executives

Retailers who automate now will outpace those who hesitate, especially in a region where digital acceleration meets fragmented operations.

✅ Do’s

- Implement GDPR-compliant automation flows: Ensure every automated customer journey aligns with local data privacy laws and GDPR standards.

- Automate browse/cart recovery: Recover lost sales by setting up automated browse and cart abandonment flows across channels.

- Integrate POS + CRM + eComm: Unify your sales, CRM, and eCommerce platforms to create a seamless, data-driven retail ecosystem.

- Use AI-driven segmentation: Leverage AI-powered segmentation to tailor campaigns by behavior, demographics, and country-specific trends.

- Train teams on automation tools: Upskill local teams to manage, optimize, and innovate with your retail tech stack effectively.

[Here’s the guide to retail customer journey builder and how to build customer journeys that convert]

❌ Don’ts

- Don’t silo your customer data: Fragmented data across systems prevents you from delivering cohesive, personalized experiences.

- Avoid mobile-unfriendly flows: Poorly optimized mobile journeys can alienate the region’s growing base of mobile-first shoppers.

- Don’t rely on manual segmentation: Manual customer segmentation limits agility and accuracy in a fast-evolving retail environment.

- Don’t delay tech stack upgrades: Postponing technology investments can leave your operations lagging behind competitors.

- Don’t skip regional compliance steps: Ignoring country-specific compliance requirements risks fines and reputational damage.

5: Promotions & CX: Opportunities for driving customer value

In Balkan markets where 90% of sales are promotion-influenced, your campaigns must be precise, contextual, and omnichannel-aware to avoid margin erosion.

✅ Do’s

- A/B test offers by country: Test and refine promotions per market to identify what drives conversion without margin leakage.

- Personalize offers based on behavior: Use behavioral data to trigger offers that match each customer’s preferences and lifecycle stage.

- Sync offers across email, web, SMS: Ensure promotions are seamlessly aligned across all touchpoints for a consistent customer journey.

- Use ContactPigeon for pop-ups and targeting: Deploy dynamic popups and personalized targeting to boost conversion rates and reduce abandonment.

- Align timing with Orthodox holidays: Plan campaigns around local Orthodox holidays to maximize relevance and impact.

❌ Don’ts

- Don’t copy-paste promotions across all regions: Replicating the same offer across diverse countries ignores local sensitivities and price expectations.

- Avoid “discounting without purpose”: Frequent, untargeted discounting can erode brand value and train customers to wait for sales.

- Don’t separate CX from promo strategy: Treating customer experience and promotions as separate efforts weakens engagement and loyalty.

- Avoid broad, generic web overlays: Overly generic popups harm user experience and miss the chance for contextual upsell or retention.

- Don’t neglect offline insights for digital CX: Failing to integrate in-store data leaves critical gaps in your omnichannel customer understanding.

Own retail in the Balkans: From vision to results

The Balkan retail landscape offers a rare combination of rapid growth and high complexity, presenting both a lucrative opportunity and a strategic challenge for ambitious retailers. With eCommerce expanding at more than double the EU average, the region demands precision, localization, and omnichannel excellence to capture its full potential.

ContactPigeon empowers retail executives to navigate this terrain with confidence. From automating customer journeys and personalizing offers across channels, to unifying data for actionable insights, our platform is built to turn complexity into clarity—and strategy into measurable results. By applying the 50 Do’s and Don’ts outlined in this guide, leaders can sidestep common pitfalls and accelerate growth with a framework proven to drive engagement, loyalty, and sales in the Balkans.

Ready to transform your vision into Balkan retail success? [Book your demo with ContactPigeon’s experts now.]