Purpose & Scope

Top fashion retailers with advanced omnichannel and eCommerce operations are pursuing strategic growth on multiple fronts. In an industry defined by fast-changing consumer behavior and fierce competition, top performers blend digital and physical retail strengths. They excel in acquiring and retaining customers, optimizing inventory, integrating channels, leveraging data, and personalizing experiences. This report outlines key growth pillars, quantifiable performance benchmarks, and case studies of best-in-class retailers such as Macy’s, Marks & Spencer, GAP, Lululemon, New Look, SHEIN, Superdry, Tommy Hilfiger, Zara, Farfetch, and ASOS. It also compares digital vs. physical retail metrics and highlights how leading brands structure teams, invest in technology, and craft seamless customer journeys.

The goal of this study is to benchmark performance across key retail KPIs, such as conversion, average order value, turnover, and returns, to define what “best-in-class” truly means in 2025. It also aims to map each retailer against the framework’s core growth pillars, highlighting common strategies and execution patterns. Ultimately, the purpose is to extract actionable insights for decision-makers who are building future growth roadmaps grounded in evidence rather than trend-driven narratives.

Strategic growth pillars of modern fashion retail

Top fashion retailers don’t treat strategic capabilities as isolated initiatives. Instead, they build a self-reinforcing growth system where each pillar amplifies the others: data fuels agility, agility enables personalization, personalization strengthens loyalty, and loyalty boosts both revenue and the quality of customer insights. At the core of this system is AI, the connective layer that integrates these capabilities into a dynamic, customer-centric engine for sustainable growth. To explore how AI agents are transforming eCommerce performance for fashion brands, read our guide on the Best eCommerce AI Agents for Fashion Retailers. For practical examples of automated campaigns that boost engagement and revenue in fashion eCommerce, explore our guide on Fashion Ecommerce Marketing Automation Flows.

Benchmark performance landscape

Fashion retail success today is a blend of operational precision and experiential innovation and top fashion retailers focus on store productivity, digital natives push boundaries in personalization and AI analytics. Across markets, leading fashion retailers marketing strategies are redefining best-in-class performance by integrating data, experience, and operational agility. The metrics below define the upper quartile of industry performance across both physical and digital domains.

Key performance drivers in omnichannel retail

Modern fashion and apparel retailers operate across two primary environments, physical and digital, each governed by distinct performance dynamics. The following framework identifies the four core metrics that define omnichannel retail efficiency and the strategic principles underpinning them. For a deeper look at omnichannel execution and the challenges fashion brands face, explore our guide on Fashion Retailers: Omnichannel Marketing Ideas and Challenges.

Sales productivity

- Typical apparel retailers generate between $300–$600 per sq. ft. annually.

- Lululemon leads the global apparel sector at roughly $1,600 per sq. ft., outpacing even luxury peers, due to smaller stores, prime urban locations, and community events that boost in-store frequency.

- This underscores that brand intimacy and in-store experiences can outperform even high-volume fast fashion when optimized for loyalty and engagement.

Conversion rate

- Physical stores convert a far higher share of visitors into buyers, typically 20–40% vs ~1–3% online.

- Average online fashion conversion rates hover between 2.5–3%.

- Top-quartile brands achieve 4–6%, thanks to personalized recommendations, frictionless checkout, and AI-driven product matching.

- In contrast, physical retail conversion typically ranges 20–40%, showing how digital optimization still has massive headroom.

Inventory turnover

- Industry median: 4–6x per year

- Fast fashion leaders, like Zara, reach ~12x by leveraging AI-powered forecasting, social listening, and nearshoring production cycles.

- Rapid turns improve cash flow, reduce markdowns, and feed constant novelty, the core psychological engine of fast fashion.

AOV ranges by segment:

- Mid-market apparel: ~$100–$150 per order

- Fashion e-commerce overall (2023): ~$140

- Fashion e-commerce overall (late 2024): ~$196

- Luxury segment (e.g., jewelry): ~$436

Returns & fulfillment

- Overall eCommerce ~24.5%, versus 8.7% in-store

- Online apparel returns average 20–30%, versus 8–10% in-store.

- Best-in-class retailers manage this gap by introducing AI-driven fit prediction, virtual try-ons, and channel-flexible returns (e.g., online orders returned in-store).

- These efforts not only lower costs but also reinforce customer trust, a critical soft metric tied to retention.

Takeaway: “Great” fashion retailers are not simply faster or bigger, but systemically integrated. Their operational data, AI analytics, and brand experiences operate as one self-learning organism.

Brand spotlights: Strategic profiles

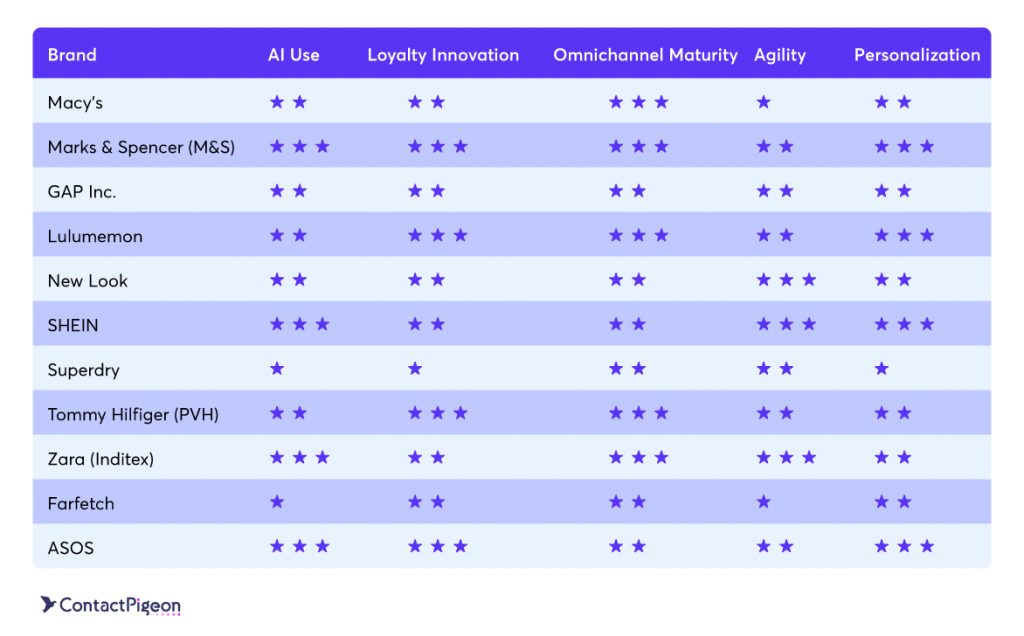

Macy’s

Macy’s is actively transforming through its 2024 “A Bold New Chapter” strategy. The retailer is closing 150 underperforming stores and focusing on high-potential locations, while expanding Bloomingdale’s and Bluemercury. The approach includes tighter omnichannel integration, investment in digital loyalty, and fulfillment innovations that make its physical assets digitally scalable. Macy’s continues to lean on first-party data via Star Rewards and Macy’s Media Network to personalize marketing and boost customer retention.

Read the detailed growth study of Macy’s here.

Marks & Spencer (M&S)

M&S has deepened its digital maturity with AI-powered personalization, a robust enterprise data platform, and the expansion of its Sparks loyalty program. It launched an AI stylist tool and enhanced its supply chain through automation and real-time inventory visibility. Its physical stores now serve as hybrid service centers in a tightly integrated customer journey that exemplifies data-led omnichannel commerce.

Read the detailed growth study of M&S here.

GAP

With a new CEO at the helm, GAP has pivoted toward profitability and brand relevance. Strategic initiatives include a partnership with Google Cloud to implement AI across product design, demand planning, and marketing personalization. GAP is refocusing on omnichannel effectiveness and streamlining its portfolio, positioning itself for renewed relevance in a competitive retail landscape.

Read the detailed growth study of GAP here.

Lululemon

Lululemon remains anchored in its “Power of Three x2” strategy: product innovation, guest experience, and global expansion. With 28 million loyalty members, the brand continues to drive community engagement and experiential retail. It shifted its digital fitness approach by partnering with Peloton, reaffirming its focus on core strengths in apparel, community, and premium lifestyle branding.

Read the detailed growth study of Lululemon here.

New Look

New Look has emerged from restructuring with £30M in new investment to accelerate data and AI adoption. The brand relaunched its Club New Look loyalty program and overhauled its digital and physical experiences. Enhanced mobile UX, store tech upgrades, and trend-responsive merchandising now define a more agile and customer-centric retailer.

Read the detailed growth study of New Look here.

SHEIN

SHEIN continues to scale its ultra-fast fashion model with AI-driven design and marketplace expansion. Strategic additions include offline pilots, a Forever 21 partnership, and its new resale and sustainability initiatives. The brand’s gamified loyalty ecosystem and deep personalization cement its position as the dominant player in data-powered, trend-reactive retail.

Read the detailed growth study of SHEIN here.

Superdry

Superdry has retrenched to focus on operational efficiency and profitability. It implemented AI-based store management systems and upgraded its e-commerce infrastructure, while scaling back sustainability investments in the short term. The strategy now prioritizes leaner product assortments, cost controls, and survival-led agility over creative expansion.

Read the detailed growth study of Superdry here.

Tommy Hilfiger (PVH)

Tommy Hilfiger remains committed to digital innovation, with the PVH+ strategy focusing on omnichannel direct-to-consumer growth and AI-enhanced product design. The brand continues to leverage high-impact collaborations, experiential marketing, and sustainability programs like Tommy for Life to deepen engagement and cultural relevance.

Read the detailed growth study of Tommy Hilfiger here.

Zara (Inditex)

Zara has enhanced its retail model with AI-driven forecasting, RFID-enabled inventory, and its Zara Pre-Owned resale platform. It refined its store fleet to prioritize flagship stores as fulfillment nodes, reinforcing its omnichannel edge. Sustainability and circularity are increasingly integral, making Zara a model of agile and responsible fashion retail.

Read the detailed growth study of Zara here.

Farfetch

Farfetch underwent a major shift in 2024 after being acquired by Coupang. It exited its B2B platform services to focus on its core luxury marketplace. The company is consolidating operations, retaining its Access loyalty program, and streamlining toward profitability. The former vision of a full-service tech platform for luxury brands has been shelved in favor of marketplace efficiency.

Read the detailed growth study of Farfetch here.

ASOS

ASOS has transitioned from rapid growth to sustainable profitability. Key moves include cutting low-margin SKUs, adding paid return policies, and launching the ASOS.World loyalty program. With new AI-powered stylists and upgraded personalization engines, ASOS now emphasizes customer lifetime value and experience over volume.

Read the detailed growth study of ASOS here.

Tactic adoption matrix: What’s working in fashion retail now

This matrix summarizes which high-impact tactics are being adopted across top-performing fashion retailers, with estimates of strategic benefit and rollout complexity. It offers a practical lens for prioritizing digital initiatives.

Digital maturity heatmap

This heatmap evaluates 11 leading fashion retailers across five critical digital capabilities based on their most recent strategic moves and investments from 2024 to 2025.

Pillar-to-brand matrix

The matrix below maps each retailer against the strategic growth pillars they exemplify, offering a clear view of how today’s leaders activate omnichannel, data, personalization, brand experience, and supply agility as competitive levers.

What the evidence reveals

AI, agility, omnichannel orchestration, and brand experience now form fashion’s new strategic equilibrium. Top fashion retailers that connect these levers holistically, rather than sequentially, will define the next retail decade.

Next steps

Translating these insights into action requires a structured roadmap. The following recommendations outline how retail executives can operationalize the secrets of top fashion retailers, turning strategic awareness into measurable performance gains.

- Conduct an AI maturity audit: assess predictive analytics, personalization, and supply forecasting readiness.

- Design a customer-journey P&L, shifting KPIs from channel-centric to journey-centric metrics.

- Implement “test-and-learn” merchandising cycles mirroring Zara/SHEIN’s data cadence.

- Build omnichannel KPIs (cross-channel conversion, pickup/return ratios, CLV) into executive dashboards.

- Treat community initiatives as retention infrastructure, not marketing campaigns.

Conclusion

The success stories of top fashion retailers reveal a clear pattern: data-driven agility, omnichannel orchestration, and AI-powered personalization now define sustainable growth in the fashion industry. As digital and physical commerce continue to merge, retailers that integrate these capabilities holistically will shape the next era of customer experience. To achieve similar results, book a demo to explore how ContactPigeon’s omnichannel platform and Menura AI, our conversational commerce assistant, empower brands to personalize interactions, boost engagement, and convert insight into measurable performance.