As the sporting goods arena becomes increasingly competitive and digitally driven, Intersport stands out as a compelling example of how a global retail network can remain both agile and deeply rooted in local markets. The Intersport marketing strategy, business model, and digital ecosystem together form a powerful blueprint for modern retail, driving growth through innovation, local adaptation, and customer-centric experiences. With more than 5,000 stores across 42 countries, the brand’s 2024 performance underscores the strength of its approach, closing the year with record-breaking results of €14.0 billion in omnichannel sales. Behind these numbers lies a carefully orchestrated marketing strategy that blends data-driven decision-making with community-based brand engagement. In the sections that follow, we explore how the company’s digital initiatives and eCommerce strategy continue to strengthen its position, as new leadership and concept stores set the stage for the next chapter in its evolution. This approach reflects best practices in eCommerce marketing automation, where timely, data-driven messaging directly impacts engagement and revenue.

Intersport: The history

Founded in 1968 in Bern, Switzerland, Intersport began as an alliance of ten national sporting goods retailers who banded together to gain scale in purchasing and branding. The founding members spanned Western Europe, from France and Germany to Sweden and Italy, reflecting a cooperative DNA that still defines Intersport today. Over subsequent decades, more country organizations joined as Intersport expanded globally, and by 2014 the group had 5,490 stores in 42 countries.

This cooperative model allowed Intersport to combine global brand partnerships with local entrepreneurship. Each store is typically independently owned, enabling local sports expertise and community engagement, while benefiting from Intersport’s collective buying power and marketing support. Intersport also developed its own private-label brands (e.g. McKinley, Firefly, PRO TOUCH) from 1983 onward to offer exclusive products.

Throughout its history, Intersport has leveraged major sports events for growth, for example, serving as an official retailer at multiple Olympic Games. In 2012, it even acquired The Athlete’s Foot chain to expand in the athletic footwear segment, adding ~560 stores at the time, but those stores were later sold in 2021 to refocus on core business. After 50+ years, Intersport remains a unique retail federation: globally unified yet hyper-local at heart.

The best videos about Intersport every retail executive should watch

To truly understand the Intersport marketing strategy and culture, we recommend a few insightful videos for retail executives. These videos demonstrate Intersport’s marketing in action, from high-level brand storytelling to tactical execution, providing valuable lessons for retail professionals.

Webinar: How Intersport Gains & Grows Customers with Data

A conference talk by Intersport’s Global Data & Analytics Director (Gianpaolo Valenti) discussing how the Intersport marketing strategy incorporates customer data to drive loyalty and sales (available on YouTube). This reveals Intersport’s data-driven marketing and omnichannel approach in detail.

Intersport’s business performance: Key metrics (2015–2024)

Revenue growth and store expansion: Intersport’s sales grew steadily in the mid-2010s, then faced a pandemic dip and a robust rebound. In 2015, annual revenue surpassed €11 billion for the first time. By 2019, sales had reached €12.3 billion, reflecting a moderate growth of ~3%. The store count hovered around 5,400–5,500 locations in 40+ countries through these years.

Pandemic impact: 2020 hit hard and revenue fell 13.8% to €10.6 billion as lockdowns shuttered stores. Intersport closed 240 stores that year, ending 2020 with 5,186 stores. Notably, however, online sales “trebled” in many markets in 2020 as customers shifted to e-commerce.

Post-2020 recovery: In 2021, Intersport achieved a v-shaped recovery, with sales jumping +20.7% to €12.2 billion, actually 3% above 2019’s pre-COVID level. By 2022, momentum continued: revenue hit €13.7 billion (+13.4% YoY) across ~5,300 stores. Digital growth normalized somewhat in 2022 (web sales were “slightly down” as shoppers flocked back to stores post-COVID), but overall performance was strong.

2023–2024 plateau and highlights: Fiscal 2023 was relatively stable at €13.7 billion, and 2024 saw a modest uptick to €14 billion (+2.1%), a record high. The store network also grew to 5,464 locations by the end of 2024. Intersport cited especially positive 2024 results in France, Italy, and Switzerland, and strong sales in categories like sport-fashion (“Sportstyle”), football, and running. Notably, Q3 2024 had the biggest jump vs 2023 as Intersport capitalized on major sports events (e.g. Olympic Games in Paris, Euro football in Germany) to drive sales.

Key takeaways (2015–2024):

Overall, Intersport’s financial trend (2015–2024) showcases steady growth, a sharp but temporary pandemic drop, and a return to record performance by 2024. The company’s focus on omnichannel transformation and local-market strength has underpinned this trajectory.

- Long-term growth: Intersport’s revenue grew roughly 33% from ~€10.5B in 2014 to €14.0B in 2024, despite a pandemic downturn. Its omnichannel model and quick pandemic recovery underscore resilience.

- Store network: Store count remained >5,000 throughout, reflecting continued expansion (especially via franchisees) in existing and new markets. Even as digital grows, Intersport emphasizes physical presence, adding 83 stores in 2024 alone.

- Pandemic pivot: Online investments paid off as e-commerce surged in 2020 (3x in some markets) and continued growing in 2021 (+25% online sales), helping offset store closures. Intersport’s ability to serve customers across channels cushioned the COVID impact.

- Regional strength: France has become a powerhouse for Intersport (revenue there hit €3.88B in 2024, +6.3%), aided by Intersport France’s acquisition of rival Go Sport in 2023. Germany and Austria are also top markets contributing significantly.

Decrypting Intersport’s business model: Key elements

The Intersport marketing strategy demonstrates how the brand combines global scale with local entrepreneurship. Its cooperative structure delivers efficiency and consistency while keeping every store agile, authentic, and rooted in community sport.

Collective scale, local reach: Intersport operates under a “glocal” cooperative model. Its Swiss-based headquarters, Intersport International Corporation (IIC), handles buying, branding, and strategy, while over 5,000 locally owned stores run as independent entrepreneurs. This gives each store access to global resources but the freedom to stay deeply connected to its community.

Purchasing power and brand consistency: IIC negotiates with major suppliers like Nike and Adidas and develops private-label lines. This ensures consistent product quality and global campaigns, even though stores are independently managed.

Hyper-local strategy: Local owners know their markets best. They adapt product assortments and marketing to local sports interests, supporting community teams and events. This “Heart of Sport” positioning builds trust and authenticity across markets.

Marketing cohesion with local flexibility: A unified global brand strategy ensures consistency, while local teams tailor campaigns and community events to reflect regional culture and needs.

Innovative store formats: Intersport is expanding beyond traditional retail with immersive concept stores. In 2025, it opened the first “Intersport Football” store in Athens, featuring an indoor field, interactive walls, and gaming zones. Similar specialty stores will follow across Europe to strengthen its community-driven identity.

Omnichannel integration: Even as independent entities, Intersport stores collaborate digitally. Unified e-commerce platforms allow ship-from-store and click-and-collect services, ensuring customers can always find what they need. Features like “send sale” let one store fulfill another’s order, boosting sales and customer satisfaction. This structure exemplifies how omnichannel retail connects online and offline touchpoints into a single, frictionless customer journey

Behind Intersport’s digital marketing strategies

Intersport has actively modernized its marketing in recent years, integrating digital channels to complement its in-store experience. Below we break down Intersport’s digital marketing playbook across key areas:

Social media strategy

Intersport’s social media approach centers on authenticity and local engagement. Following the 2019 eCommerce launch in Switzerland, the brand prioritized storytelling over promotions, using user-generated content, contests, and community highlights. Campaigns like #TheHeartOfSport and Wherever You Take Sport showcased local athletes and grassroots clubs, strengthening brand loyalty.

Key takeaway: Authentic, community-driven content transforms social followers into engaged sports enthusiasts.

Paid ads strategy

Intersport runs a full-funnel digital advertising program spanning search, shopping, social, and programmatic display. Data-driven automation and lookalike targeting have delivered strong results, including a rise in conversion rates and increase in online sales. Localized social ads also drive in-store visits, connecting digital discovery with physical retail.

Key takeaway: Advanced targeting and automation maximize ROAS by blending acquisition, retargeting, and local reach.

Email marketing strategy

Email remains a cornerstone of the Intersport marketing strategy and its omnichannel ecosystem. After GDPR reduced its contact base, the company rebuilt it through on-site prompts and in-store QR signups, boosting acquisition. Using behavioral data, Intersport personalizes emails based on location and weather (e.g., promoting rain jackets during local storms). Automated campaigns and AI-driven segmentation increased engagement and average order value, proving email’s value in driving repeat purchases.

Key takeaway: Personalized, automated email programs turn shoppers into loyal, cross-channel customers.

SEO strategy

Intersport’s SEO improvements followed major platform migrations that enhanced speed, mobile usability, and content flexibility. The company’s content strategy focuses on expert guides and inspirational stories, while local SEO ensures every store ranks prominently in nearby searches.

Key takeaway: Technical upgrades and localized content strengthen both visibility and customer experience.

Analysis of Intersport’s eCommerce strategy

The Intersport marketing strategy extends the brand’s in-store strengths into the digital space through an eCommerce model that emphasizes omnichannel convenience and a consistent, user-friendly shopping experience. Below is an overview of how the retailer performs across key website touchpoints.

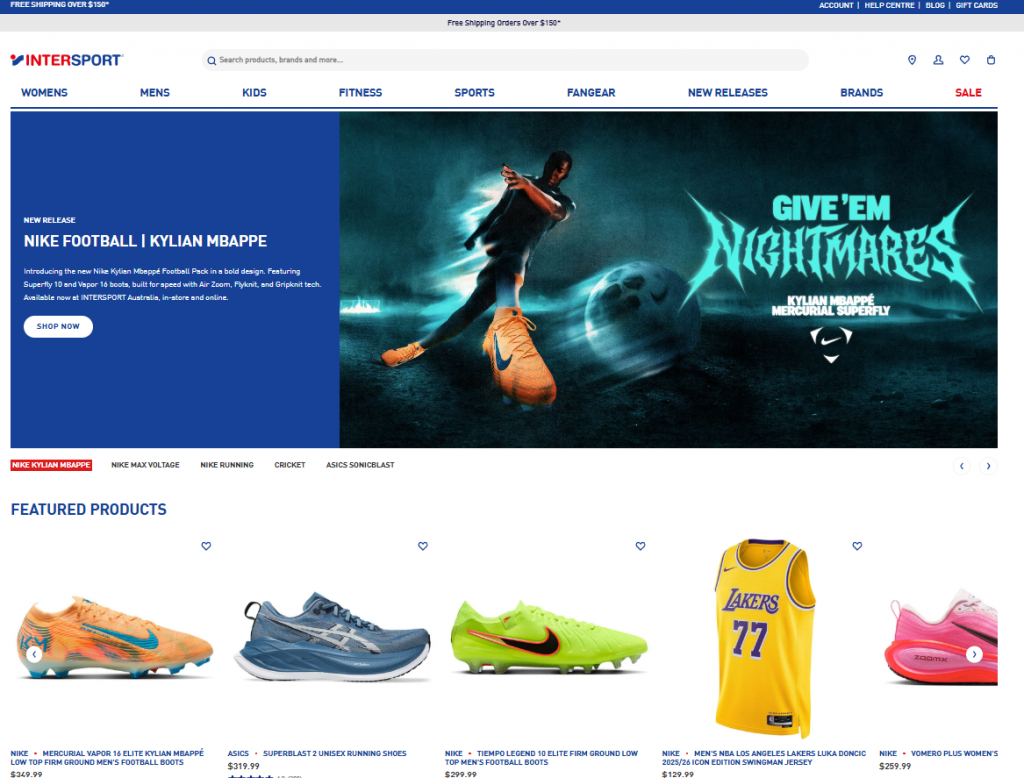

Home page

What we liked:

- Strong Visual Identity: The red–blue–white color scheme instantly signals the Intersport brand.

- Lifestyle Imagery: High-quality visuals create energy and relevance for active consumers.

- Clear Navigation: The top menu (Women, Men, Kids, Fitness, Sports, etc.) simplifies product discovery.

- Category Teasers: Scrollable “Shop by Category” sections encourage exploration and increase dwell time.

- Promotional Focus: Hero banners effectively highlight major campaigns and seasonal offers.

What could be improved:

- Above-the-Fold Optimization: Hero banners dominate screen space; featuring products higher could boost engagement.

- Page Load Time: Heavy imagery can slow mobile performance, affecting bounce rate.

- CTA Consistency: Some “Shop Now” buttons blend into the background, stronger contrast would improve click-through.

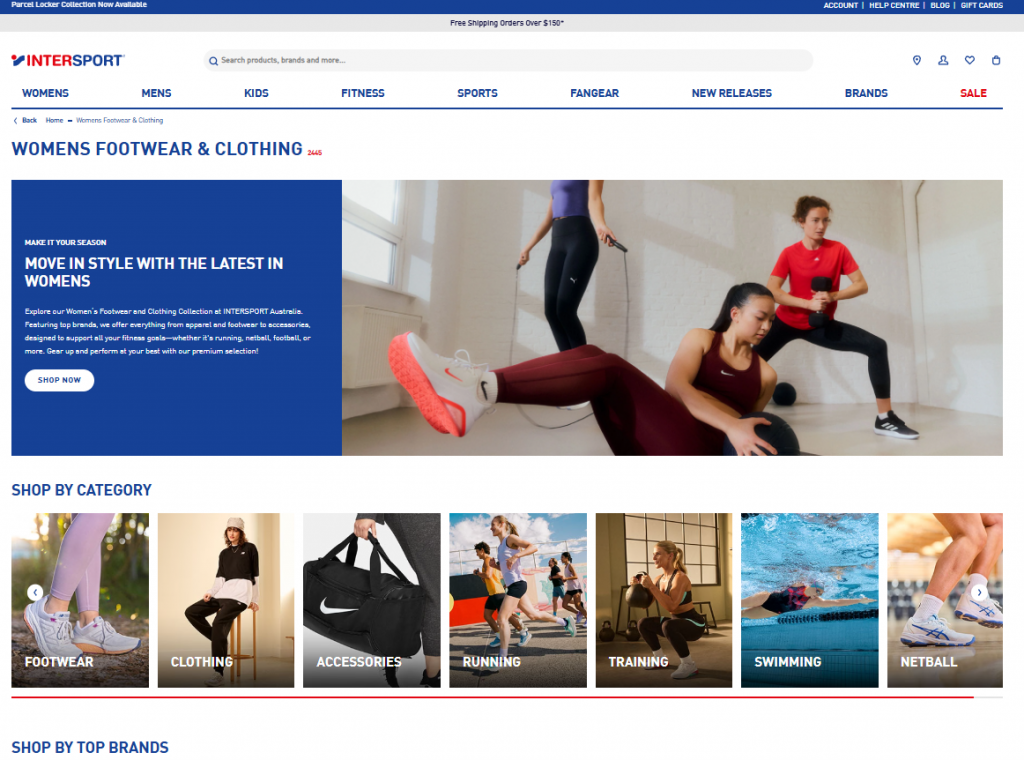

Category page

What we liked:

- Organized Layout: Product grids are clean, visually balanced, and easy to scan.

- Visual Filtering: Filters by category, size, and price improve user navigation.

- Lifestyle Integration: Banner images and short category intros add context and emotion.

- Omnichannel Integration: Options like “Find in Store” link online browsing with physical locations.

What could be improved:

- Filter Experience: Some filters reload the page instead of updating dynamically, disrupting flow.

- Pagination: Infinite scroll or load-more functionality could enhance usability.

- Promotion Overload: Occasional branded promo slots interrupt product flow.

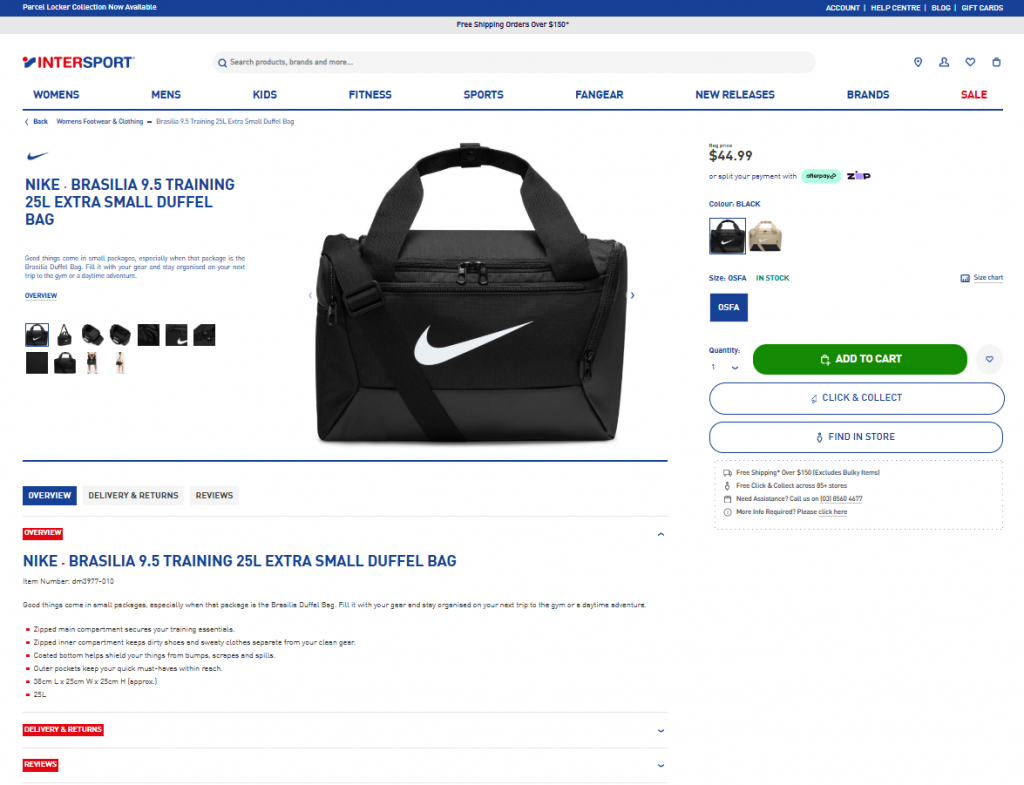

Product page

What we liked:

- Comprehensive Product Info: Multiple images, videos, specs, and detailed descriptions enhance trust and clarity.

- Prominent Add-to-Cart & Click & Collect: Encourages conversion and omnichannel convenience.

- Cross-Selling: “You may also like” suggestions drive AOV.

- Transparency: Stock availability and pricing are clear and easy to understand.

What could be improved:

- Mobile UX: Scrolling could be optimized; long descriptions push CTAs too far down.

- Visual Uniformity: Some product pages vary in layout or photography style, reducing consistency.

- Real-Time Inventory: Occasional mismatch between displayed stock and actual availability.

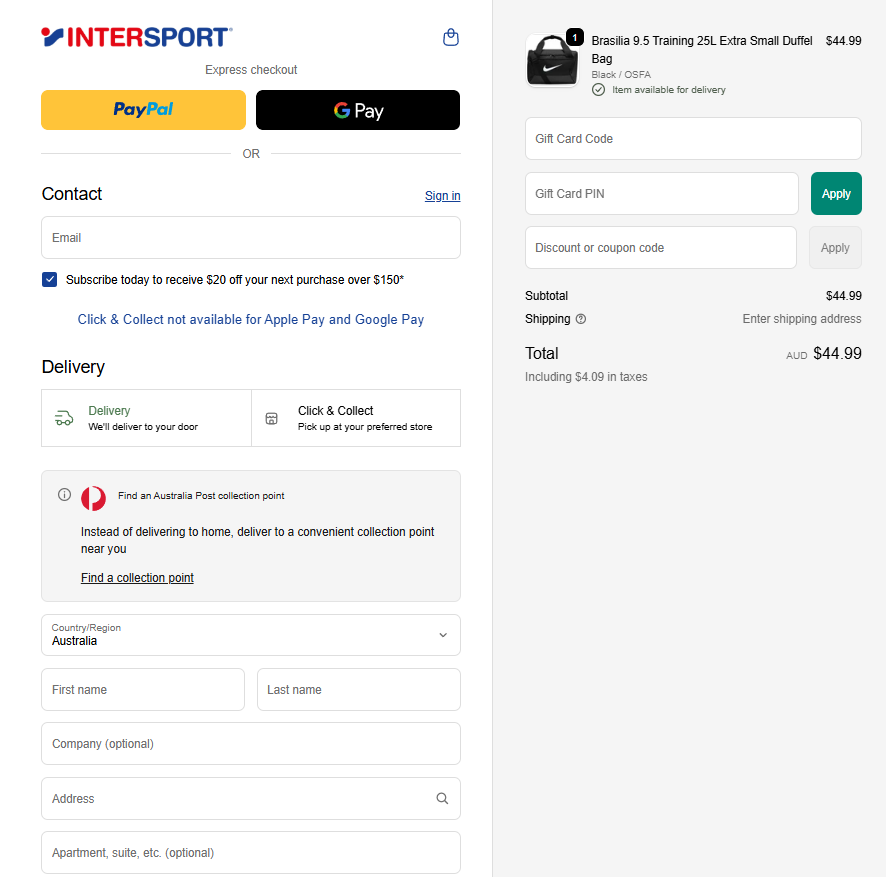

Checkout page

What we liked:

- Express Payments: PayPal and Google Pay reduce checkout friction.

- Guest Checkout Option: Supports faster purchases for first-time customers.

- Shipping Clarity: Multiple delivery and Click & Collect options improve flexibility.

- Trust Elements: Order summary, tax breakdown, and visible security icons reinforce confidence.

What could be improved:

- Brand Continuity: The checkout design feels disconnected from the rest of the site (minimal Intersport branding).

- Form Simplicity: Consolidating steps above-the-fold to avoid excessive scrolling could reduce abandonment.

- Mobile Layout: Field spacing and button size could be more touch-friendly.

Overall Takeaway

Intersport delivers a robust and omnichannel-aligned online experience, blending inspiration with functionality. Its biggest opportunities lie in design consistency, faster performance, and deeper integration of customer data across regions. Continuous investment in data-driven insights and campaign management positioning Intersport for stronger digital growth ahead. Complementing these efforts, AI-powered assistants built on proven chatbot best practices can further reduce friction in support and post-purchase journeys.

Lessons learned from the Intersport marketing strategy

The Intersport marketing strategy offers valuable insights for retail marketers and executives aiming to balance global brand power with local authenticity. By combining data-driven personalization with brand purpose, Intersport continues to lead as a modern, customer-centric retailer.

1. “Glocal” branding drives relevance: Intersport proves that a unified global identity can thrive when paired with local autonomy. Each store engages its own community while sharing one brand voice and mission: “The Heart of Sport.”

Lesson: Empower local teams to create community impact under a strong central brand story. Local trust fuels global strength.

2. Leverage events and strategic partnerships: From Olympic sponsorships to in-game presence in EA Sports, Intersport amplifies visibility around cultural moments that matter to its audience.

Lesson: Tie marketing efforts to major sports events and partnerships to boost relevance, visibility, and sales when consumer enthusiasm peaks.

3. Omnichannel isn’t optional: By linking physical and digital retail through click-and-collect, ship-from-store, and unified inventory, Intersport delivers a seamless shopping experience. These initiatives have directly driven incremental sales and customer retention.

Lesson: Eliminate silos between online and offline. Customers see one brand, make sure they experience one unified journey.

4. Personalization elevates performance: Using weather-based triggers, segmented email journeys, and loyalty insights, Intersport tailors its messaging for each shopper. This approach increased engagement and average order value across markets. In practice, this level of retail personalization transforms generic campaigns into meaningful, high-performing customer experiences

Lesson: Invest in data and personalization. Relevance builds loyalty and keeps customers returning across all touchpoints.

5. Refresh the brand experience: Once viewed as “old-fashioned” in some markets, Intersport redefined its image through modern campaigns, experiential stores, and digital upgrades.

Lesson: Long-standing retailers must periodically evolve. A refreshed brand story and customer experience keep the business aligned with new generations.

6. Empower and align teams globally: Intersport’s success depends on coordinated execution across 42 markets. Global marketing councils and shared KPIs align local teams and suppliers toward common brand goals.

Lesson: Alignment is strategy. Unified teams and partners deliver consistent brand experiences and stronger long-term growth.

Interesting statistics about Intersport (2024–2025)

- France: Market leader with €3.88 billion in revenue, strengthened by the 2023 Go Sport acquisition (adding 72 stores). (Fashion Network)

- Germany & Austria: Remain core markets, ranking among Intersport’s top three for sales performance. (Marketing Week)

- Pandemic-driven digital pivot tripled online sales in several markets. (Fashion Network)

- Over 10,000 employees in France alone actively engage with local sports communities, strengthening brand trust and loyalty. (Fashion Network)

- Proprietary brands like McKinley (outdoor) and Energetics (fitness) play a growing role in revenue and differentiation. (Retail Times)

- Private labels remain a strategic priority for higher margins and customer retention.

- INTERSPORT reported that its private-label segment brought in approximately €1.4 billion in revenue last year, with plans to increase the category’s contribution to around 20% of total annual sales over the next five years. (Financial Times)

Replicate Intersport’s Omnichannel Performance System

Intersport scales a global brand while staying local, using connected channels, data-driven personalization, and coordinated execution across markets. Select a pillar to see how similar capabilities are operationalized with ContactPigeon.

Latest news about Intersport

- New CEO (2025): Tom Foley appointed as CEO of Intersport International, succeeding Steven Evers after six years of growth.His focus areas are operational efficiency, global partnerships, and continued digital expansion. (Fashion Network)

- Go Sport Acquisition (2023): €35 million deal secured ~90% of Go Sport’s workforce and expanded Intersport’s French network to over 750 stores. (Fashion Network)

- Planned €150 million investment to rebrand and modernize acquired locations.

- 10–20 more specialty stores planned across Europe by 2026. (Internet Retailing)

- Boosted by major sports events, new partnerships (EA Sports FC 25), and sponsorship of the 2025 Handball World Championship. (Retail Times)

- Intersport Greece launched an immersive 1,200 m² concept featuring an indoor pitch, gaming zone, and digital experiences and a new mobile app, enhancing omnichannel convenience. (Internet Retailing)

Further reading on Intersport

- Intersport International – Press Center: Latest news, financial reports, and strategy updates.

- Marketing Week: “Intersport’s Mission to Become a Global Destination for Local Sport.”

Final thoughts about the Intersport marketing strategy

The Intersport marketing strategy proves that legacy retailers can stay ahead by combining agility, community focus, and data-driven innovation. From its cooperative roots to a modern omnichannel powerhouse, the brand continues to thrive by uniting local relevance with global vision. For retail leaders, the takeaway is clear: success comes from understanding your customers and meeting them with the right message, channel, and experience every time.

Ready to bring the same level of personalization and intelligence to your retail strategy?

Book a demo and explore how ContactPigeon’s Customer Data Platform and Menura AI can help you deliver smarter, more human retail experiences.