The Marks & Spencer eCommerce case study serves as an inspiration to every eCommerce marketer. The old saying: “It’s better late than never,” comes to mind. It’s a tale of failures and comebacks. That’s what makes the Marks and Spencer eCommerce story so interesting.

- eCommerce 101: Why you need to create a seamless shopping journey

- The history of a retail giant

- The Marks and Spencer eCommerce strategy for scaling growth

- eCommerce growth lessons for every eCommerce Manager

- Marks and Spencer business stats you should know

- Breaking news about Marks and Spencer

- In Conclusion

eCommerce 101: Why you need to create a seamless shopping journey

The company arrived late and unprepared for the online scene. In fact, Marks and Spencer weren’t selling online until the mid-2000s. Consequently, lagging behind the competition, the company announced an 8.1% drop in sales and resulting share price dip in July 2014.

Following drastic drops in revenue, the CEO and other senior figureheads pointed the blame at Mark and Spencer’s eCommerce platform. The company’s website relaunch, two years in the making, was a bust.

Customers complained that Marks and Spencer’s relaunched website had dysfunctional and un-clickable checkout buttons (as the below video demonstrates), difficult-to-use search filters for size, limited product availability, items disappearing from shoppers’ baskets during checkout, delivery forms excluding major cities, and so on. In simple words, Marks and Spencer was far away from eCommerce checkout best practices.

https://youtu.be/zwsp6VhkFG8

As a result of poor eCommerce experience, by 2018, the retail giant was considerably behind its competition.

Only 18.5% of its clothing and home sales were online. With an annual growth of 5%, Marks and Spencer wasn’t going to come close to its 2022 growth target of 33%. Store closures were soon announced.

Marks and Spencer storefront in China. Source: Cyprus News

However, the losses resulted in designing and implementing a series of aggressive Marks and Spencer eCommerce growth strategies. Like a phoenix rising from the dust, Marks and Spencer eCommerce would soon become a model of how to scale online sales.

ECommerce managers can take away a lot from Marks and Spencer’s eCommerce bumpy road to (finally) succeeding in online retail.

In this post, we will go over a plethora of lessons on retail, website usability, and design. We will also explore how revamping the Marks and Spencer eCommerce strategy gave the company a second chance.

The history of a retail giant

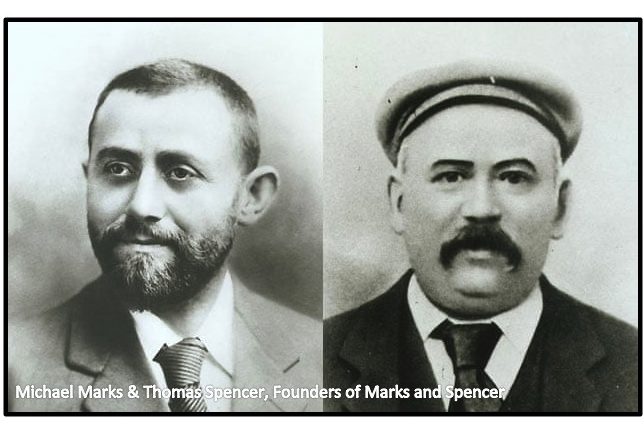

It all started in 1884, in Leeds, West Yorkshire, England. This is where the fate of two men collided: Michael Marks and Thomas Spencer.

The founders of Marks and Spencer

Michael Marks, a Polish-British businessman and entrepreneur, bought goods from Dewhirst and sold them in nearby villages. As his business grew, Marks became known for one of the stalls he established in Leeds that offered every product in it for a penny. There, he placed a poster next to the stall saying, “Don’t Ask the Price, It’s a Penny”

Marks and Spencer modern-day marketing campaign celebrating 125 years

Meanwhile, Thomas Spencer was an aspiring British businessman who was a cashier at I.J Dewhirst’s wholesale company.

Marks originally asked I.J Dewhirst to go into business with him to open a store, to which Dewhirst declined and recommended Marks ask his cashier, Thomas Spencer. Spencer thought over Marks’ proposal and decided that investing £300 for half the share of the business was worth the gamble. Thus, the first Marks and Spencer store was born.

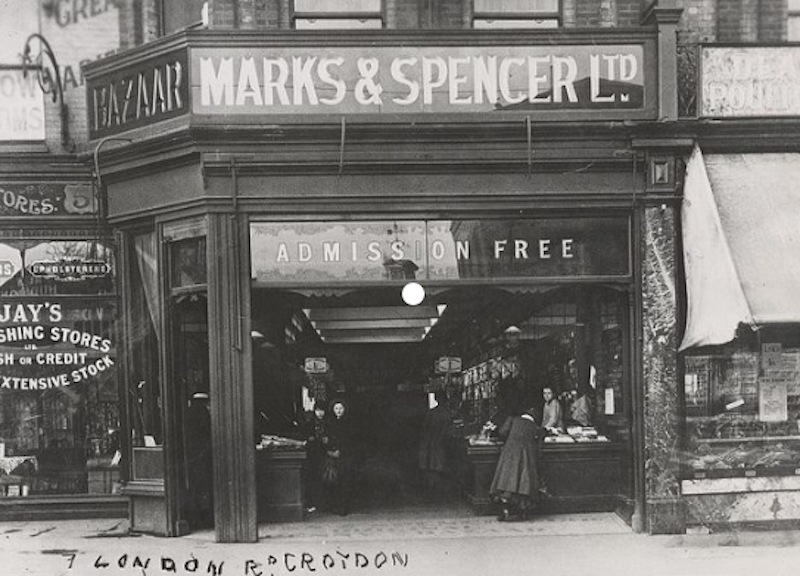

Screenshot of a vintage photograph of Marks and Spencer for sale on Etsy

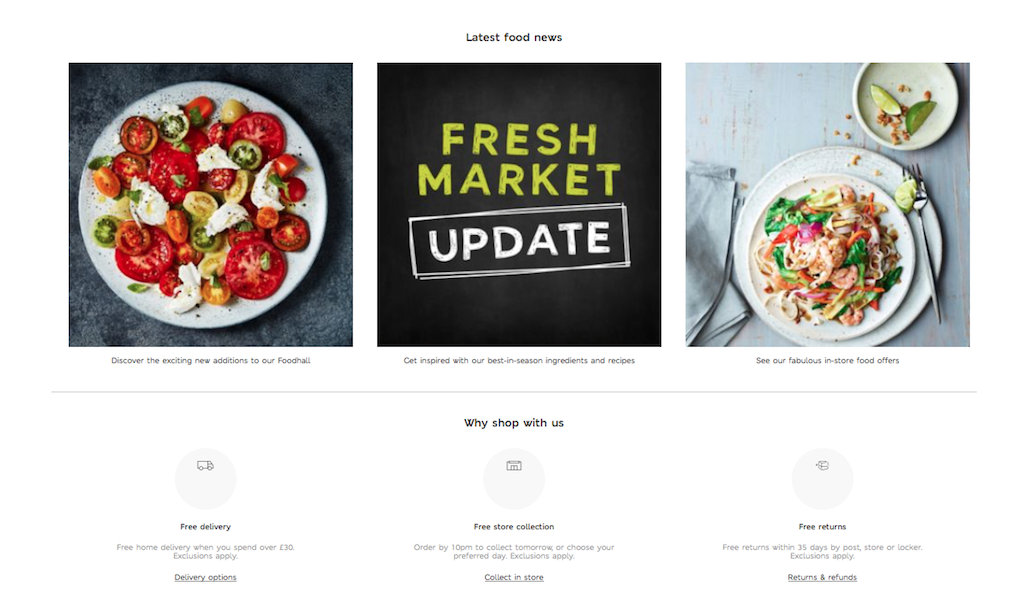

The store they opened in 1884 started off selling high-quality clothing and home products. In the last decade, food has also been added to the Marks and Spencer inventory.

Nowadays, there are 950+ Marks and Spencer stores across the UK alone. You will find the British multinational retailer headquartered in Westminster, London. The retail chain is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index.

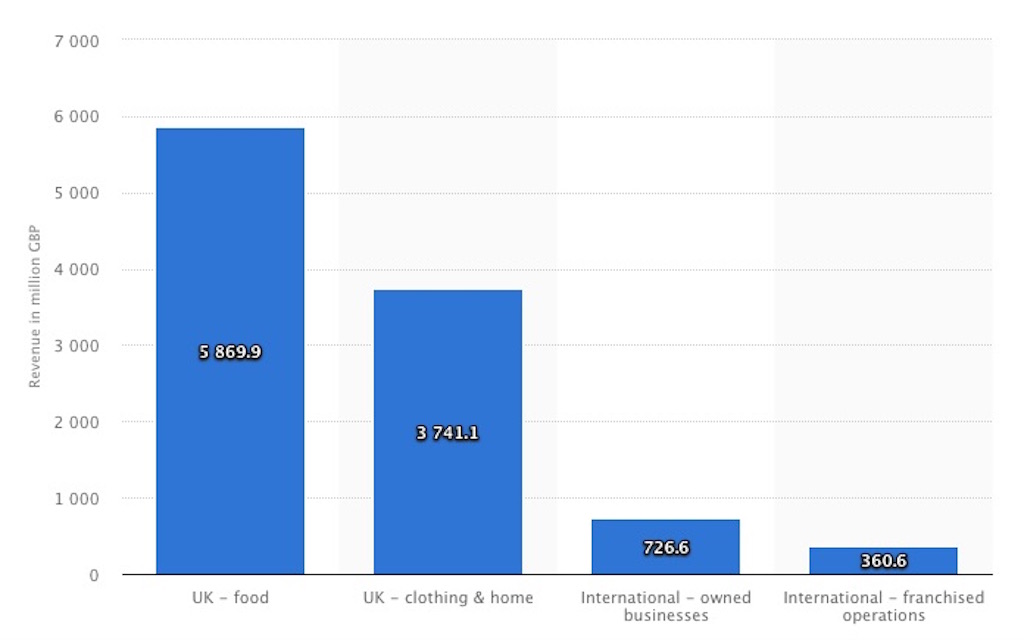

Nowadays, Marks and Spencer sees much of its revenue from food sales

How the Marks & Spencer empire almost collapsed

Although Marks & Spencer’s profits peaked in the late 1990s, by the 2000s the company was in crisis. Several factors contributed to the decline of its profits.

First, the company’s supply chain strategy was in need of an overhaul. Marks & Spencer won the hearts of Brits by using local suppliers. However, as the UK suppliers’ costs continued to rise, the company’s profit margin suffered while the competition turned to importing from low-cost countries.

Marks and Spencer storefront in London

By the time the business decided to start importing, the switch came too late.

The holdout had been for nothing. Marks and Spencer would lose a core part of its appeal to the British public, and it already had paid the high price of staying with British suppliers too long.

Another factor that contributed to the decline of the brand is that Marks and Spencer was late to the game of accepting different forms of payment. Up until 2001, the company refused to accept any other credit card besides its own Chargecard.

Soon after, the brand started closing unprofitable stores. As recently as May 2018, Marks and Spencer confirmed that over 100 stores will close by 2022.

The path to international expansion

The Marks & Spencer company values incorporate a policy dating back to the early 20th century of only selling British-made goods creating loyal customers. However, the brand recognized the need to grow domestically as well as internationally.

Marks and Spencer storefront in France

For this reason, in 1960, Marks and Spencer opened its first Asian store in Kabul, Afghanistan, followed by multiple cities in Europe. The international growth lasted through the 1980s.

While the stores in Paris remained profitable, many other international cities were not a complete success story. A total of eighteen non-profitable shops in Europe were sold in 2001. In Canada, the brand was viewed as a stodgy retailer catering to seniors and expatriate Brits. Efforts to modernize the brand came too late, and store closures soon followed.

In China, after Marks and Spencer once again failed to win over the local consumers, it hired Maria Roday, a former alumnus of Inditex with a reputation for nailing the latest consumer trends, as the new general manager for the Chinese market.

Marks and Spencer learned a valuable lesson from their international expansion: When expanding your brand, adapt your marketing strategies to appeal to local consumers.

Marks and Spencer Storefront in China

The Marks and Spencer eCommerce Strategy for scaling growth

By 2009, pressures from profits and sales loss led Marks & Spencer to initiate a restructuring plan.

They took measures such as closures of low-profit stores to cut costs, along with discontinuing several of the brand’s low-profit lines. CEO Marc Bolland rolled out a new strategy aimed to strengthen brand image and increase profits. The brand would modernize its physical stores and focus on revamping its eCommerce platform.

Facing challenges with changes

If there is one thing Marks & Spencer took away from their international expansion failures, it is that you must appeal to your local consumers’ preferences. Bolland called for major change starting with the rollout of a new design for physical stores in May 2011 that would be based on demographics such as affluence and age of the stores’ locations.

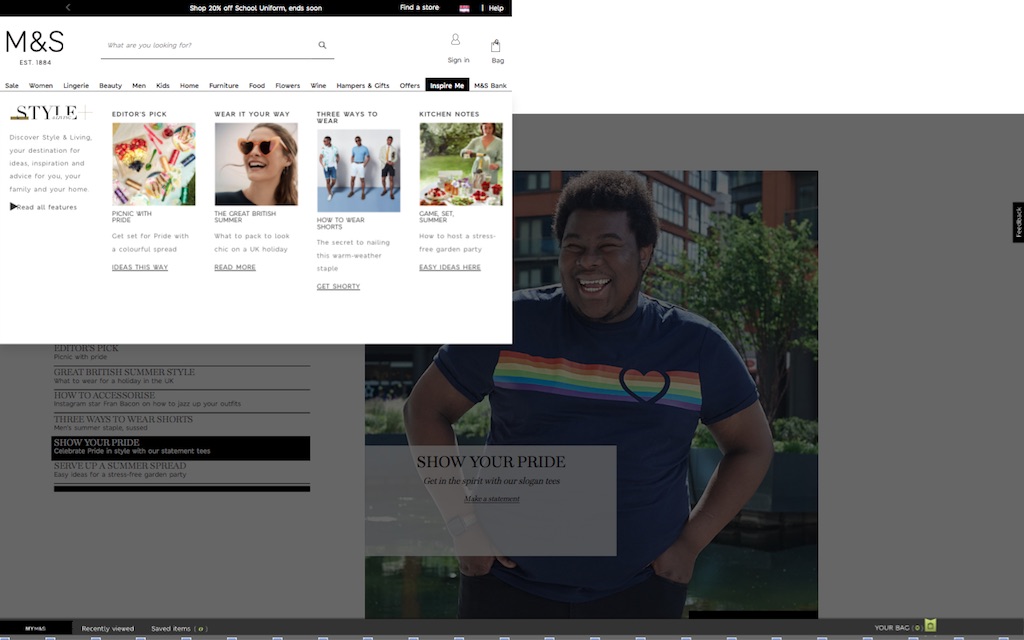

In response to shopper surveys on the difficulty of in-store navigation, Bolland implemented a new store “navigation scheme”. Easier shopping means happier customers. Happier customers spend more money. The brand’s clothing division had an 11% market share in the UK by 2013. In 2018, following the retail innovation trends, M&S tested in its Amsterdam store a real-life clothing rail which was a success because it added an online feature to an in-store experience. Providing a seamless user experience, both online and in-store has now become a top priority for M&S.

Breaking ties with Amazon

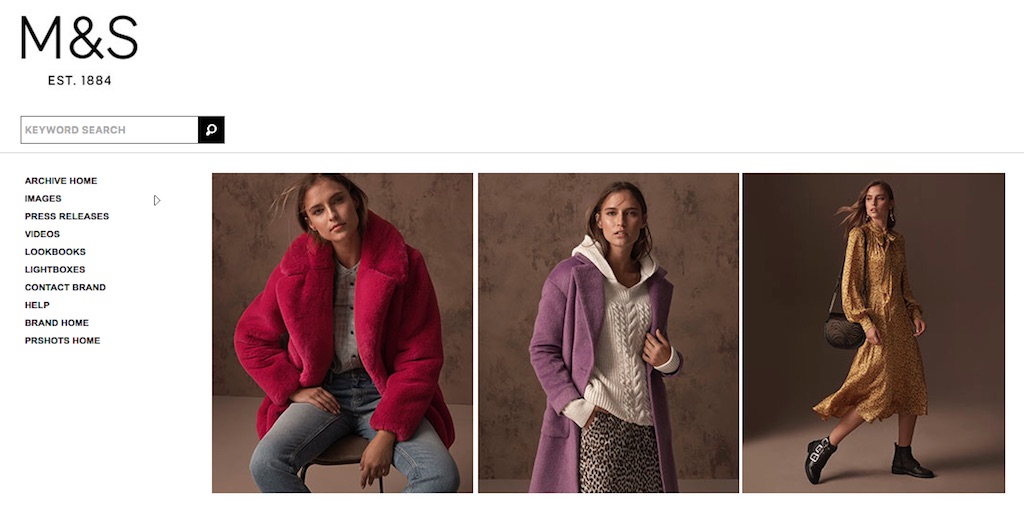

Marks & Spencer’s eCommerce platform was also due for a major overhaul. Until 2011, online operations for Marks & Spencer were conducted solely via a partnership with Amazon. As the brand set a goal to revamp its image and increase multichannel sales by 2014, it also took the initiative to build and manage its own eCommerce platform.

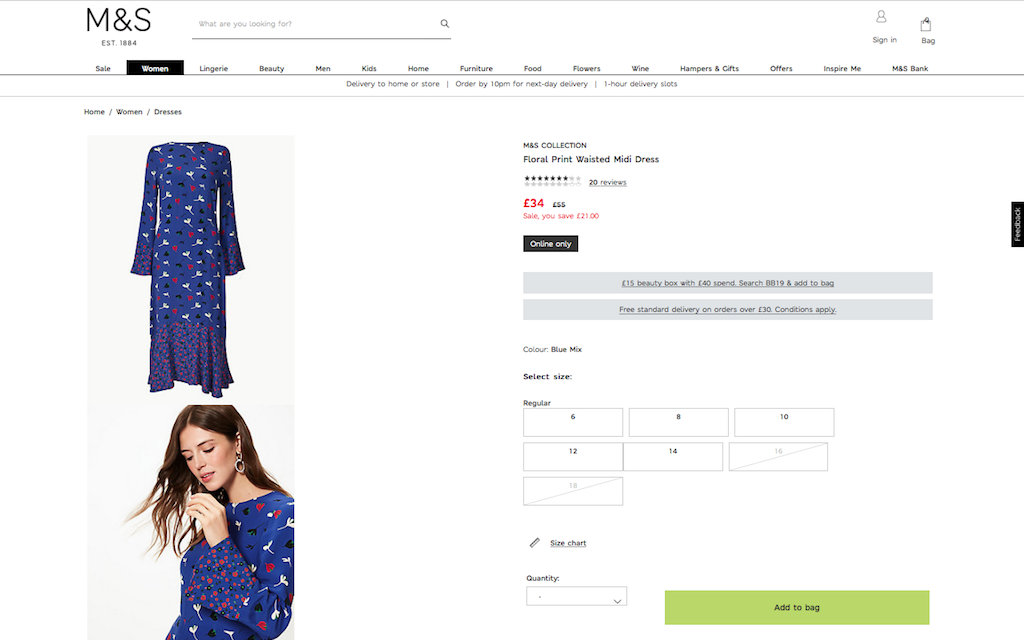

Their newly redesigned website cost around £150m, however, despite such a costly price tag, it proved to be a disaster. For all of the attention to detail in making the shoppers’ journey seamless and hassle-free in brick-and-mortar stores, the brand totally neglected to apply the same strategy to its eCommerce platform.

An example is that Marks and Spencer forced existing customers to re-register on the new site. This major misstep confused and annoyed customers. Also, simple changes such as replacing the ‘add to basket’ option with ‘Your bag’ left Marks and Spencer shoppers confused. Further impacting online conversions was the site’s non-clickable and malfunctioning path to checkout.

If at first, you do not succeed, try, try again…

Marks and Spencer saw online sales drop 8% in the first quarter of 2014 following the re-launch of their website. At first, Bolland refused to acknowledge the shortcomings of the website and their impact on online conversions. He said that the new website is “a journey, not something customers recognize in a morning”.

However, by 2015, Bolland admitted the flawed eCommerce design, leading Marks and Spencers to make “thousands of changes” in the first year following its launch.

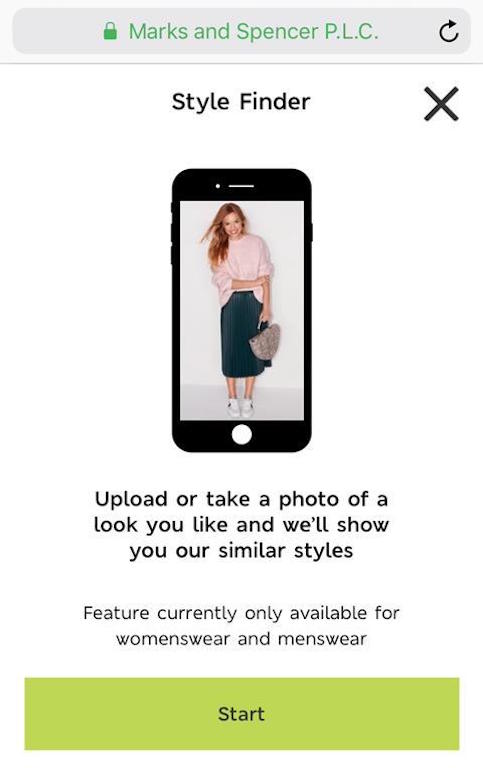

Following all of the tweaks and turnarounds, the brand’s ultimate eCommerce goal and strategy shifted. Marks and Spencer aimed to better understand its customers’ needs and deliver a more personalized shopping experience both online and in-store.

The result was Marks and Spencer developing an online platform that combines key capabilities of eCommerce, content management, search, and analytics to create a customized multichannel customer experience.

It had some teething problems from the start. Yet, by acknowledging mistakes and learning from them, Marks and Spencer was able to grow and put the company on the path toward eCommerce success.

The Retail Tech Transformation

Marks and Spencer eCommerce continues to grow and set trends. In 2018, the brand became a digital-first chain, aiming to improve customer experience in their stores and to create the basis for more growth using commercial technology.

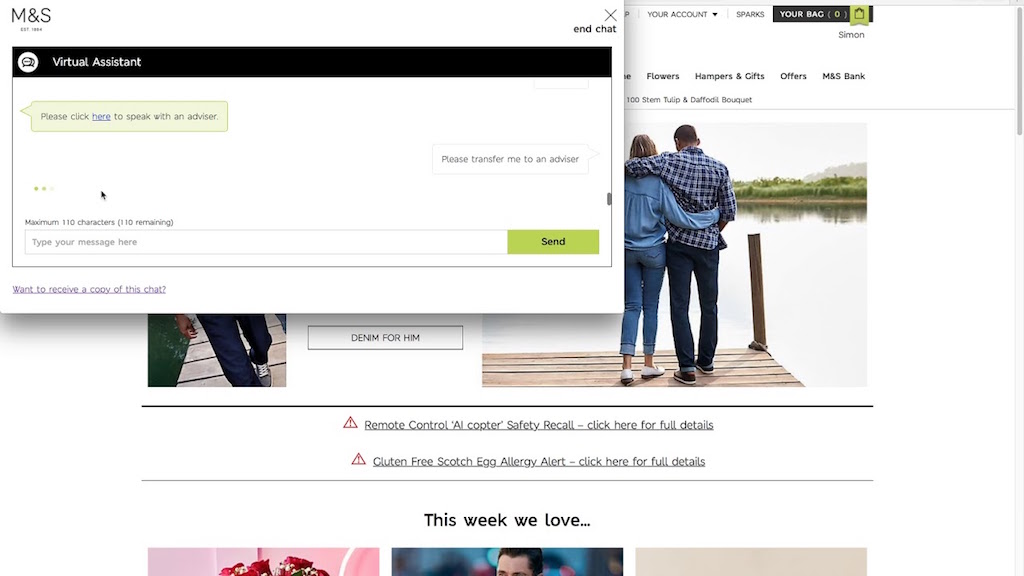

The Marks & Spencer plan to increase sales by more than £1bn by offering shoppers an intelligent virtual assistant. To achieve that, the brand expects to invest £25m to implement this new technology.

An intelligent virtual assistant offers online customers a personal shopping assistant that uniquely interacts with them throughout their online shopping journey.

Marks &^ Spencer is the first retailer to offer this feature. Since its launch in March 2018, over a quarter of a million customers have reaped the benefits of a customer-centric and smooth shopping journey on Marks and Spencer eCommerce platform.

Marks & Spencer: Plan A

Another way that Marks & Spencer is ramping up their brand’s image is with Plan A. Launched in 2007, this eco and ethical program focuses on sustainable retail challenges.

By using business practices such as being the world’s first and only carbon-neutral major retailer, Marks and Spencer wins the hearts of its customers.

The company also holds its suppliers to the same expectations: meeting high quality, safety, environmental and social standards. Furthermore, it signed off on a business-wide Human Rights Policy in 2016 and became a signatory of the UN Global Compact.

As Marks and Spencer continues to expand internationally, Plan A has helped the brand redeem its image with local suppliers and shoppers alike by communicating its commitment to consciously sourced products and fair trade.

eCommerce growth lessons for every eCommerce Manager

Lesson #1: Better late than never

Similarly to Zara, Marks and Spencer is a great example of this. They successfully “migrated” or embedded their logistics strategy and Supplier Management to their success online. It’s important to realize your core competitive advantage early on, invest in them, and leverage them across all sales channels.

Lesson #2: Stick to your core mission

Similar to Zara, Marks and Spencer is a great example of this. They successfully “migrated” or embedded their logistics strategy and Supplier Management to their success online. It’s important to realize your core competitive advantage early on, invest on them, and leverage them across all sales channels.

Lesson #3: Build on your offline competitive advantage

Similar to Zara, Marks and Spencer is a great example of this. They successfully “migrated” or embedded their logistics strategy and Supplier Management to their success online. It’s important to realize your core competitive advantage early on, invest on them, and leverage them across all sales channels.

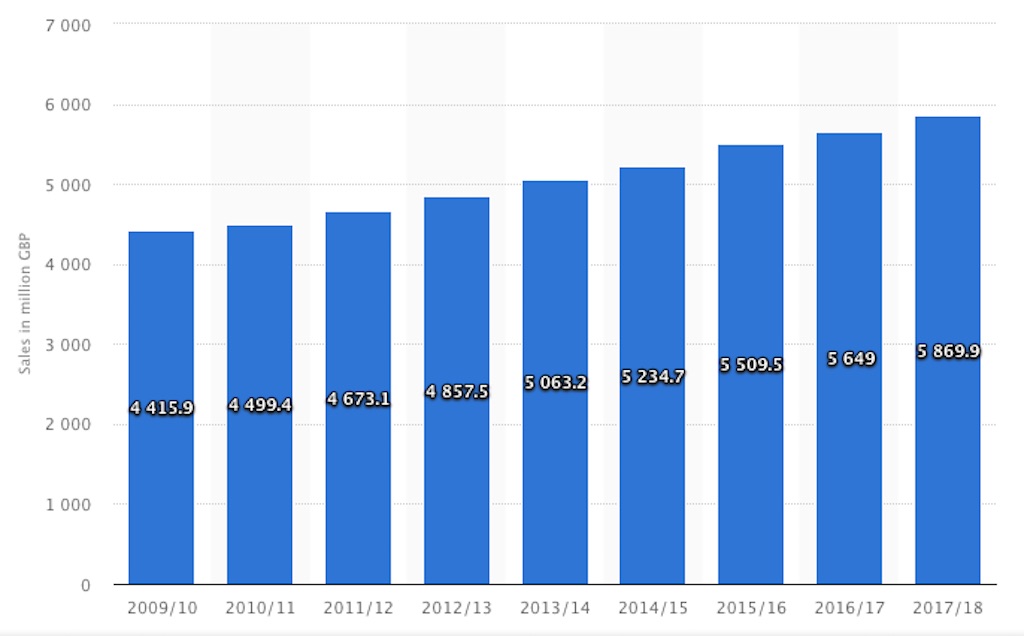

Marks & Spencer business stats you should know

- There are a total of 1,463 M&S stores worldwide

- M&S currently has 979 stores across the U.K. including 615 that only sell food products

- Estimated M&S profits for 2019 are approximately £10.4 billion, of which 89% came from the British market

- Marks and Spencer food is its biggest selling category. Sales reached £6 billion in 2018

- Marks and Spencer eCommerce revenue hit £836 million for 2016/17

- M&S brands include Limited collection, Per Una, North Coast, Portfolio, Indigo Collection, Autograph, Marks and Spencer, Classic Collection, and more

Breaking news about Marks & Spencer

- November 2020 – M&S posts first loss in 94 years – Read more here

- May 2020 – Marks & Spencer reopens 49 branches in UK – full list of stores now open – Read more here

- May 2020 – Marks and Spencer extends 30-minute home delivery service – Read more here

- April 2020 – M&S shopping rules: Retailer clarifies lockdown changes to stores and refund policy – Read more here

Discover more resources about FMCG retailers

- Sainsbury’s Marketing Strategy: Becoming the Second-Largest Supermarket Chain in the UK

- ASDA’s marketing strategy: How the British supermarket chain reached the top

- Tesco Case Study: How an Online Grocery Goliath Was Born

- The Ocado marketing strategy: How it reached the UK TOP50 retailers list

- ALDI’s marketing strategy: The key growth ingredients of the FMCG titan

- Walmart Marketing Strategy: Decoding the Success of the US Multinational Retailer

- Analyzing Lidl’s Marketing Strategy: How the Discount Supermarket Leader Scaled

- FMCG Marketing Strategies to Increase YOY Revenue

Resources about other renowned fashion retailers

- How ZARA Dominates the Ecommerce Fashion Industry

- Why ASOS is the Absolute UK Ecommerce Success Story

- New Look: The Marketing Strategy Behind the UK Fast-Fashion Retailer

- Farfetch Case Study: Analyzing The Strategy of the UK Fashion Unicorn

- SUPERDRY case study: The marketing strategy behind one of the top UK clothing retailers

In Conclusion

The Marks & Spencer eCommerce case study has many layers. All the layers demonstrate various tactics every eCommerce retailer can “borrow” to replicate its success and growth rates.

Let your takeaway from this post be the core lesson learned from Marks and Spencer: It’s never too late to join and conquer the online market. Know that, in eCommerce, there really is no such thing as “too late” as long as you are willing to grow from your mistakes and move forward.

Let’s Help You Scale Up

Spending time on Linkedin? Follow us and get notified of our thought-leadership content:

![Benchmarking Growth Strategies of Top Fashion Retailers [Study]](https://blog.contactpigeon.com/wp-content/uploads/2025/11/top-fashion-retailers.jpg)