The 2024 Black Friday and Cyber Monday (BFCM) shopping season was not merely a promotional event; it was the definitive test of omnichannel maturity in the modern retail era. Success was no longer measured by the depth of discounts alone but by a retailer’s ability to orchestrate a seamless, AI-driven, and hyper-convenient customer journey. This report deconstructs the playbooks of America’s leading retailers (Walmart, Target, Best Buy, The Home Depot, Macy’s, and Kohl’s) to reveal the new benchmarks for success.

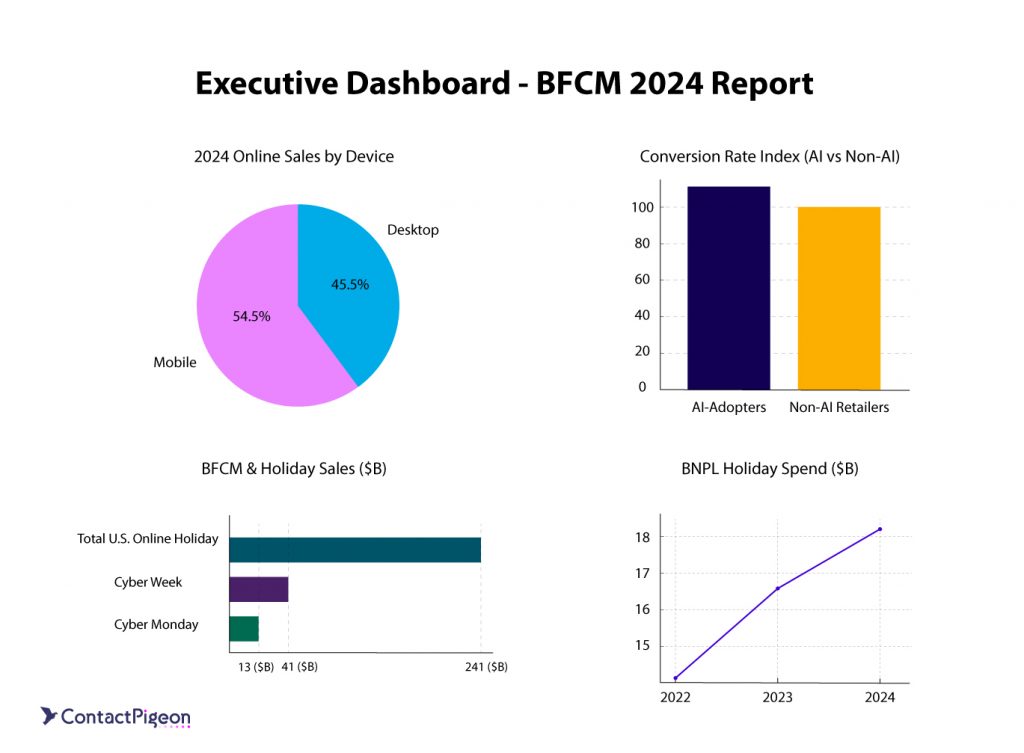

The season was defined by a striking paradox: despite consumer caution and rising debt (with shoppers carrying more credit card balances than ever)【1】, digital spending shattered all previous records. U.S. online holiday sales (Nov. 1–Dec. 31) surged to a historic $241.4 billion, an 8.7% year-over-year (YoY) increase【2】. This growth was overwhelmingly driven by mobile commerce, which for the first time accounted for the majority of all online transactions at 54.5%【2】【3】. The catalyst for this spending was a combination of aggressive discounting and the mainstreaming of flexible payment options like Buy Now, Pay Later (BNPL), which facilitated $18.2 billion in sales (+9.6% YoY)【2】. Consumers embraced these services on mobile as well – 79.1% of BNPL transactions during the season were made on smartphones【2】.

Critically, 2024 marked the commercial tipping point for Generative AI. Moving beyond experimentation, AI became a front-line sales tool, influencing an estimated $229 billion in global online sales during the holiday period and delivering a 9% higher conversion rate for retailers that deployed it effectively【3】【6】. Retailers using AI-powered chatbots and recommendation engines saw measurable gains in traffic and sales, validating AI’s role as a revenue driver rather than just a novelty.

The market’s most formidable operators distinguished themselves through three core competencies:

- AI-Driven Personalization: Walmart led the charge, leveraging a new suite of GenAI tools to create a personalized homepage, power a conversational shopping assistant, and streamline the path to purchase, all while gating its best deals behind its Walmart+ loyalty program.

- Loyalty-Gated Ecosystems: Best Buy and Walmart transformed their loyalty programs into “access” platforms, making paid membership a prerequisite for the most coveted deals. This strategy drove high-margin subscription revenue and locked in their most valuable customers. In contrast, Kohl’s amplified its proprietary “currency,” Kohl’s Cash, creating a powerful repeat-purchase loop that fueled its ecosystem.

- Hyper-Convenient Fulfillment: Target set a new standard for convenience with its Drive Up service, brilliantly integrating Starbucks orders and product returns into a single, frictionless curbside interaction. This transformed its physical stores into high-value service hubs, creating a significant competitive moat.

Looking ahead, this analysis points to several strategic imperatives for 2025. Leadership will require a decisive investment in a unified commerce stack to break down data silos and create a single source of customer truth. Loyalty programs must evolve from transactional reward systems into experiential platforms that build emotional connection. Finally, retailers must embrace AI not as a cost-saving tool, but as a core driver of customer experience, personalization, and long-term growth.

BFCM 2024 by numbers

The 2024 BFCM period operated within a complex economic environment, rewarding retailers who understood the nuanced behavior of a consumer who was simultaneously cautious and more willing than ever to spend online. The season’s macro trends reveal a shopper who is digitally native, defaults to mobile, demands convenience, and responds decisively to clear Black Friday strategies for retailers.

The 2024 holiday shopping season set new benchmarks for e-commerce. Total U.S. online spending across November and December reached an unprecedented $241.4 billion, growing 8.7% YoY【2】. The critical “Cyber Week” period, spanning from Thanksgiving through Cyber Monday, was the engine of this growth – generating $41.1 billion in online sales, up 8.2% YoY【2】. Individually, the anchor days of the event posted formidable growth:

- Black Friday online sales achieved a record $10.8 billion, a significant 10.2% jump from 2023【5】. This marked the first time Black Friday e-commerce sales surpassed the $10 billion mark, illustrating the enduring appeal of the day’s deals in an omnichannel era.

- Cyber Monday maintained its status as the single largest online shopping day in history, with sales hitting $13.3 billion, a 7.3% YoY increase【5】. It edged out Adobe’s earlier prediction and reaffirmed Cyber Monday’s title as the “biggest online shopping day of all time” for a fourth consecutive year.

Discounts in key categories hit near-record highs. Electronics deals peaked at 30.1% off listed prices, toys at 28% off, and apparel at 23.2% off【2】. This created a “value paradox”: while consumers were highly price-sensitive, their propensity to spend increased dramatically when presented with compelling deals. Importantly, the growth in online sales was driven by net-new demand, not inflation – according to Adobe’s Digital Price Index, e-commerce prices had been falling for over two years leading into the holiday season【2】. Retailers who successfully communicated clear value were able to capture a larger share of this record-setting spend.

Build smarter customer journeys and activate AI-driven personalization for repeat purchases.

Key insights of BFCM 2024

The macro data paints a clear picture: the 2024 BFCM arena was defined by digital acceleration, behavioral agility, and a redefined notion of value. Consumers didn’t simply migrate online, they rebuilt their entire shopping journey around convenience, flexibility, and trust. Mobile became the primary storefront; payment flexibility turned into a purchase enabler; and AI quietly emerged as the invisible hand guiding discovery, decision-making, and fulfillment.

For retail executives, these shifts signal a decisive moment: the competitive advantage is no longer in who discounts deepest, but in who delivers the most frictionless, data-intelligent experience. The following four key insights unpack how these macro forces reshaped the 2024 BFCM landscape, and where the next wave of retail leadership will come from.

#1 Black Friday key insight: Mobile commerce becomes the default

For the first time, mobile commerce was the undisputed majority channel for the entire holiday season. Across November and December, smartphones drove 54.5% of all online sales, totaling $131.5 billion【2】. This represents a significant milestone, cementing the smartphone as the primary transaction device for the American consumer.

On peak shopping days, this trend was even more pronounced. On Cyber Monday, mobile devices accounted for 57% of total online sales (about $7.6 billion), while globally on Black Friday, mobile’s share of purchases reached 69%【2】. The share of digital traffic originating from mobile was higher still – hitting between 74% and 80% on key days, confirming its role as the primary touchpoint for discovery, browsing, and research. The strategic implication is clear: the customer journey no longer simply includes mobile; for the majority of consumers, it begins, proceeds, and ends there—making mobile-first retention tactics like BFCM push notification planning a direct lever for conversion during peak days.

#2 Black Friday key insight: The mainstreaming of financial flexibility: BNPL’s surge

The 2024 season solidified Buy Now, Pay Later (BNPL) as a critical component of the modern checkout process. Consumers actively sought ways to manage their budgets, driving BNPL usage to an all-time high. Across the holiday season, BNPL services contributed $18.2 billion in online spending, a robust 9.6% YoY increase【2】. Cyber Monday became the largest single day in BNPL history, driving $991.2 million in sales (5.5% higher than the same day in 2023)【2】. This rapid adoption, particularly among younger demographics, demonstrates that offering financial flexibility is no longer a niche feature but a core expectation. The link between mobile commerce and ecommerce checkout best practices is undeniable: an overwhelming 79.1% of all BNPL transactions during the season were initiated on a smartphone【2】, highlighting the seamless integration of these two trends.

#3 Black Friday key insight: The new commerce engine: Data, personalization, and Retail Media Networks

The standout BFCM campaigns of 2024 were not simply a collection of well-executed tactics; they were the visible output of a deeply integrated technological and data-driven engine. The ability to create a seamless journey, from a social media ad to a curbside pickup, relies on a sophisticated backend that unifies channels, personalizes communication, and leverages first-party data as a strategic asset. A critical component of this new engine is the maturation of Retail Media Networks (RMNs).

#4 Black Friday key insight: Generative AI’s commercial debut

While prior years saw experimentation with AI, 2024 was its official commercial debut as a front-line sales and marketing tool. The impact was immediate and substantial. According to Salesforce, AI and AI agents directly influenced an astounding $229 billion in global online sales during the holiday period【3】. This was not merely a background influence. Retailers that integrated Generative AI into their operations saw a measurable 9% higher conversion rate compared to those that did not【6】. Consumer adoption of these tools for product discovery surged as well – traffic to retail websites originating from AI-powered chatbots skyrocketed by 1,950% on Cyber Monday YoY【6】. This signals a fundamental shift in how consumers research products, moving from traditional keyword search to conversational discovery, a trend that market leaders are already capitalizing on.

Omnichannel BFCM strategy in action: How leading retailers dominated Black Friday 2024

From strategy to execution, the 2024 Black Friday and Cyber Monday (BFCM) season proved that winning in retail no longer hinges on the depth of discounts, but on the orchestration of an intelligent, unified commerce ecosystem. Walmart, Target, Best Buy, The Home Depot, Macy’s, and Kohl’s each translated broad market forces, AI adoption, mobile dominance, and value-driven consumer behavior, into differentiated playbooks that blended technology, data, and loyalty into competitive advantage.

The following synthesis highlights the macro patterns that separated the leaders from the rest, followed by retailer-specific strategies that defined omnichannel excellence in 2024. In total, six strategic dimensions emerged as the defining traits of leadership across America’s top omnichannel retailers.

The 6 strategic dimensions of the 2024 BFCM US retail leaders

#1 Early activation & membership advantage: Walmart and Best Buy began promotions in early November, leveraging paid memberships (Walmart+, My Best Buy Plus/Total) for early deal access. This marked a strategic shift toward subscription-based loyalty ecosystems that not only rewarded exclusivity but also drove recurring, high-margin revenue.

#2 Value at scale: Target and Kohl’s focused on high-frequency, value-led engagement, extending rolling deals throughout the season. Their free loyalty programs — Target Circle and Kohl’s Rewards — were instrumental in granting exclusive savings and sustaining retention through accessible personalization.

#3 Traditional strengths,modern execution: Macy’s and The Home Depot maintained longer, multi-phase campaigns, balancing brand heritage with operational excellence. Macy’s leaned on its “Parade of Deals” and iconic holiday branding, while Home Depot focused on month-long savings in tools, appliances, and décor supported by precise fulfillment.

#4 AI & personalization as competitive leverage: 2024 marked the commercial tipping point for retail AI. Walmart led the field with its Generative AI shopping assistant, AI-enhanced search, and predictive homepage personalization, driving measurable conversion uplift. Target, Best Buy, and Macy’s embedded AI within product recommendations and customer service. Home Depot’s AI-powered search and localized data personalization further refined its project-driven shopping model. Kohl’s leveraged dynamic coupons and personalized digital gifting experiences to enhance loyalty engagement. Retailers who deployed AI effectively saw, on average, 9% higher conversion rates than their peers, confirming personalization as a primary growth driver rather than a supporting feature【6】.

#5 Retail Media Networks as growth engines: Another defining 2024 shift was the monetization of audience data through Retail Media Networks. Walmart Connect led the pack with $4.4B in revenue (+27% YoY), while Target’s Roundel reached ~$2B, leveraging its premium “guest” data. Best Buy Ads differentiated via its Meta partnership (introducing a Social+ ad solution), and Home Depot’s rebranded Orange Apron Media expanded into non-endemic categories like insurance and finance. Macy’s Media Network capitalized on post-purchase “transaction moments,” while Kohl’s Media Network used its 65 million loyalty base for on-site targeting. Collectively, RMNs became the new profit center of omnichannel commerce – turning retailers from merchants into media powerhouses. Notably, Walmart’s global advertising business grew 27% in fiscal 2024 to reach $4.4 billion, and Target’s Roundel delivered approximately $2 billion in value in 2024 (with executives projecting it could double within five years)【4】.

Each major retailer has developed a distinct RMN strategy:

| 1) Retailer / RMN Name | 2) Stated Audience Size (or Shopper Reach) | 3) Key Ad Formats | 4) Core Differentiator or Strategy | 5) Openness to Non-Endemic Advertisers |

|---|---|---|---|---|

| Walmart / Walmart Connect | ~145M weekly U.S. shoppers | On-site sponsored search & display; off-site media; in-store screens/digital TV walls | Scale + full-funnel activation with closed-loop attribution across grocery & GM | Yes (select categories) |

| Target / Roundel | Not formally disclosed; tens of millions of “guest” profiles | Sponsored product ads; on-site display; off-site/paid social; CTV pilots | Premium first-party “guest” data; AI buying (e.g., Precision Plus); Target Product Ads +35% sales in 2024 | Limited (brand- & guest-aligned) |

| Best Buy / Best Buy Ads | Not disclosed; high-intent consumer electronics shoppers | On-site search/display; off-site media; in-store screens; live/social commerce | Category authority in CE; Social+ (Meta partnership) uses BBY 1P data for FB/IG targeting | Limited (CE-adjacent focus) |

| The Home Depot / Orange Apron Media | Not disclosed; DIYers, homeowners & Pro segments | On-site search/display; off-site; in-store screens; email | Pro/Project focus; 2024 rebrand; expanding to non-endemic (insurance, finance, auto) | Yes |

| Macy’s / Macy’s Media Network | Not disclosed; Macy’s + Bloomingdale’s shoppers | On-site search/display; off-site; email; post-purchase offers (Rokt) | Monetizes the “Transaction Moment” after checkout without disrupting core CX | Yes (via Rokt offers) |

| Kohl’s / Kohl’s Media Network | ~65M loyalty shoppers (Kohl’s Rewards) | Sponsored products; on-site display; email; in-app push | Value-led loyalty scale; middle-market families; tie-ins with Kohl’s Cash | Limited (primarily endemic) |

Note: Financial benchmarks include Walmart’s global advertising business at $4.4B (+27% YoY) and Target’s Roundel at ~$2B with a multi-year doubling outlook【4】.

- Walmart Connect: Leverages its unparalleled scale of nearly 145 million weekly U.S. shoppers to offer a full-funnel advertising solution, including sponsored search, on-site display, off-site media, and in-store digital screens.

- Target Roundel: Differentiates on the perceived quality of its “guest” data, positioning its audience as more trend-conscious and affluent. Its sponsored product ads (Target Product Ads) saw over 35% sales growth in 2024, and it is innovating with new AI-powered buying solutions like Precision Plus.

- Best Buy Ads: Focuses on the high-intent consumer electronics shopper. A key 2024 innovation was the launch of Social+, an automated solution in partnership with Meta that allows brand partners to use Best Buy’s first-party data to target shoppers on Facebook and Instagram.

- The Home Depot (Orange Apron Media): Rebranded from Retail Media+ in 2024, Orange Apron Media is built to serve brands targeting the high-value Home Improvement and Professional customer segments. It is strategically expanding to non-endemic advertisers (e.g., automotive, insurance, financial services) who want to reach homeowners and small business owners.

- Macy’s Media Network: Offers a full suite of media products across both Macy’s and Bloomingdale’s properties. In a unique strategic move, it partnered with Rokt to use AI to serve relevant, non-endemic offers to customers after they complete a purchase, monetizing the “Transaction Moment” without disrupting the core shopping journey.

- Kohl’s Media Network: Leverages its highly loyal customer base of over 65 million shoppers to offer brand partners a range of advertising options, including sponsored products, on-site display, email marketing, and in-app push notifications.

#6 Omnichannel fulfillment as the baseline: By 2024, omnichannel convenience (BOPIS, curbside pickup, same-day delivery, and extended returns) became table stakes across the industry. Target’s Drive Up and Starbucks integration redefined in-store convenience, while Walmart expanded 30-minute express delivery. Home Depot and Best Buy continued to excel with lockers, flexible pickup, and ship-from-store operations.

Additional insights from the BFCM competitive landscape in the USA in 2024

#1 Mobile commerce became the default: Over 55% of U.S. online sales on Black Friday 2024 came via smartphones — cementing mobile as the primary storefront. Retailers’ mobile-first UX investments (app-exclusive deals, digital wallets, personalized push campaigns) directly drove higher conversion.

#2 Digital sales outpaced physical growth: Online revenue rose 10–15% YoY, while in-store sales were flat (+0.7%). Brick-and-mortar became a fulfillment and experience layer rather than the sales anchor.

#3 AI and financial flexibility converged: Chatbot-driven retail traffic surged +1,950% YoY on Cyber Monday. Retailers employing AI achieved 9% higher conversion. Meanwhile, Buy Now Pay Later (BNPL) hit a record $18.2 billion, illustrating the intersection of convenience and credit flexibility.

#4 Value-centric behavior drove consolidated spend: Inflation-sensitive shoppers bought more strategically: larger baskets, fewer retailers, deeper engagement in discount categories like electronics and toys. Retailers that balanced aggressive pricing with trust-based value messaging captured outsized share.

Analysis of the BFCM strategy per leading US retailer

Walmart: “Black Friday Deals” all month with membership & AI

| Key Area | Highlights |

|---|---|

| Campaign Format | Multi-event campaign titled “Dial Up the Thrill of the Deal”【7】, spanning three shopping waves — Event 1 (Nov 11), Event 2 (Nov 25), and Cyber Monday (Dec 1)【7】【54】. Each event launched online before in-store rollout, with Walmart+ members gaining early access. This “rolling sale” model kept Walmart top-of-mind throughout November while reducing peak-day congestion. |

| Promotions & Marketing | Introduced “surprise deal drops” — unadvertised flash sales during each event to sustain engagement【54】. Launched the 10-episode “Deals of Desire” advertainment web series【44】, parodying telenovela-style drama around deal-hunting. Featuring influencers and actors, it aimed to “take culture commerce to the next level”【44】 and kept audiences both entertained and shopping. |

| Loyalty Activation | Walmart made Walmart+ a central pillar of BFCM. Members shopped 5 hours earlier for Black Friday and 3 hours earlier for Cyber Monday【54】. In 2024, Walmart extended early access by 2 additional hours to meet demand【54】. Roughly 80% of members planned to use this perk【54】. A major incentive: 50% off Walmart+ annual memberships ($49/year)【54】, positioned as “the season’s biggest Black Friday deal.” This approach deepened short-term conversions while expanding long-term loyalty. |

| Fulfillment & Omnichannel | Focused on “effortless convenience”【54】. Expanded Early Morning Delivery (starting at 6 a.m.) and Express Delivery (30-minute window) for last-minute needs【54】. AI-powered route optimization extended Walmart’s reach to 12 million more households in 2024【44】. Promoted Walmart+ InHome for in-fridge delivery【44】 and maintained robust curbside and in-store pickup — key omnichannel pillars. Stores closed on Thanksgiving, but the app and website remained active 24/7. |

| Personalization & Technology | Walmart expanded the beta of its Generative AI Shopping Assistant【44】, allowing natural-language product discovery. AI-driven algorithms improved search relevance and personalized site content (e.g., gift ideas, category-based deals)【44】. A GenAI Customer Support Assistant automated order tracking and returns【44】. This “tech-powered omnichannel” strategy【46】 positioned Walmart as a leader in AI-enhanced personalization and CX automation — contributing to higher conversion rates【6】. |

Target: Early deals, exclusive loyalty offers & seamless fulfillment

| Key Area | Highlights |

|---|---|

| Campaign & Timeline | Holiday deals kicked off Nov. 1 and ran through Cyber Week, starting earlier than Thanksgiving to “make shopping easy and fun”【31】. Weekly themed promos and a 3-day Early Black Friday Sale (Nov 7–9) delivered “thousands of hot deals” up to 50% off【31】. |

| Promotions & Price Promise | Relaunched daily flash deals via Deal of the Day (up to 50% off) from Nov. 1–Dec. 24, creating daily reasons to check the app【31】. Weekly category events (e.g., 50% off floorcare, BOGO 50% toys) refreshed offers every Sunday【31】. Kept the Holiday Price Match Guarantee active Nov. 7–Dec. 24 to remove timing risk for early buyers【31】. |

| Loyalty Integration | Put Target Circle at the center of savings: Deal of the Day and many promos were Circle-exclusive【31】. Highlighted personalized offers and the updated Target Circle Card (5% everyday savings)【31】. Introduced Target Circle 360 for unlimited same-day delivery (free on $35+) to elevate convenience during BFCM【31】. |

| Omnichannel Fulfillment | All deals available in-store, on Target.com, and in the app simultaneously【31】. Pushed Order Pickup and Drive Up (no minimum) plus same-day delivery via Shipt — aligning with “shop whenever/however you want”【31】. Offered extended returns and seasonal shipping promos to reduce friction【31】. |

| Personalization & CX | Used Circle data to tailor savings and deliver personalized coupons in-app【31】. Featured curated gift finders, exclusive Only-at-Target brands, and store experiences (Disney, Ulta shop-in-shops) to differentiate holiday discovery — “amazing deals all season” in a way “only Target can”【31】. |

Best Buy: Tech-focused doorbusters & membership early access

| Key Area | Highlights |

|---|---|

| Campaign & Timeline | Best Buy launched its “Holiday Calendar” in October【33】 — a week-by-week roadmap of deals leading up to Black Friday. Early access began Nov. 8 with Black Friday Deals released three weeks ahead of the actual day【33】. New “doorbusters” dropped every Friday through Dec. 20, while members got Thursday early access to each week’s batch【33】. The main sale officially began Nov. 21, continuing through Cyber Monday with rolling flash sales on top tech categories. |

| Promotions & Events | Weekly doorbuster cycles kept customers engaged across November【33】. Top categories included 4K TVs, gaming consoles, laptops, and smartphones. Members of My Best Buy Plus™ and Total™ received exclusive Thursday previews and VIP-style access to limited deals【33】, reinforcing a sense of exclusivity. |

| Membership & Loyalty | The My Best Buy Plus™ and My Best Buy Total™ paid tiers were central to BFCM 2024【33】【48】. Members received early access, free 2-day shipping, and extended return windows through Jan. 14, 2025【48】. Best Buy’s Holiday Price Match Guarantee also extended to Jan. 14【48】, ensuring customers could buy early with confidence. The company positioned membership as both a deal unlocker and a trust anchor — strengthening customer retention and lifetime value. |

| Omnichannel Experience | Focused on speed, convenience, and assurance. Best Buy leveraged 1-hour in-store pickup, curbside service, and self-service lockers for quick retrieval. Extended store hours (as early as 5 a.m.) and real-time online inventory visibility minimized friction. The Best Buy app offered a Deal of the Day feed and AI-driven product recommendations, merging digital personalization with in-store reliability【48】. |

| Innovation & Media | Experimented with live shopping events on TikTok and YouTube, featuring influencer-led unboxings and buying tips linked directly to products. Through Best Buy Ads, the retailer launched a “Social+” retail media program that allowed partner brands to synchronize Best Buy placements with social ads【44】. This innovation expanded reach across multiple channels while monetizing Best Buy’s engaged tech audience. |

The Home Depot: Month-long deals & proficient omnichannel services

| Key Area | Highlights |

|---|---|

| Promotions & Timing | Branded as “Black Friday Savings”, Home Depot’s deals ran the entire month of November through Dec. 4【35】. The official circular covered promotions through Nov. 27【36】, giving shoppers early access to plan big-ticket purchases. Offers typically included up to 40% off appliances, BOGO tool deals, and heavy discounts on décor, lighting, and home essentials. By spreading promotions, Home Depot smoothed delivery volumes and reduced peak-day strain, especially for bulky, installable products. |

| Loyalty & Financing | Focused on Pro Xtra (for contractors) and its Home Depot credit programs rather than traditional retail loyalty. Pro members benefited from tool bundle discounts and exclusive coupons, while cardholders received special financing (12 months on $299+) and select-day extra 5% savings【35】. Though subtle, these perks fostered loyalty via financial incentives and bulk-purchase value rather than exclusivity access. |

| Omnichannel Fulfillment | Over 50% of online orders fulfilled from stores continued through Holiday 2024【43】. Promoted Free Store Pickup (under 2 hours)【37】 and Curbside Pickup (9 a.m.–6 p.m.)【38】【39】 as core services. Expanded use of pickup lockers for contactless collection of online orders, crucial for heavy items. Extended free shipping thresholds and scheduled appliance deliveries improved flexibility, while real-time inventory visibility helped shoppers locate stock in local stores — a key personalization layer. |

| Personalization & Technology | Leveraged data-driven recommendations and AI-based search to surface related items (e.g., “customers also bought” bundles). The site and app featured localized promotions and real-time inventory data by ZIP code. Push notifications highlighted nearby store deals, while browsing behavior (e.g., “kitchen appliances”) informed personalized deal displays. This “solution-selling” approach tied directly into project-driven customer needs, from DIY shoppers to contractors. |

| Customer Experience & Marketing | Promoted “Black Friday Savings – All Month Long” via national ads and digital channels【35】【43】. Focused messaging around home transformation and gifting rather than hype, showing festive décor, power tools, and kitchen makeovers. The online Black Friday Hub organized deals by category and offered how-to content (e.g., decorating guides, DIY tips). Stores opened early on Black Friday (typically 6 a.m.) with doorbusters, while closing on Thanksgiving to align with brand values. Campaign tone: helpful, practical, family-first retail. |

Macy’s: Multi-phase “Black Friday Now” and omnichannel personal touches

| Key Area | Highlights |

|---|---|

| Promotions & Phased Deals |

Macy’s ran a month-long program under banners like “Black Friday Now/Starts Now,” “Parade of Deals,” and “Cyber Monday”, blending classic holiday branding with extended savings【47】.

• “Parade of Deals”: daily reveals Nov 11–28 tied to the Thanksgiving Parade theme to drive app/social check-ins【47】. • Black Friday specials: available Nov 14–30 online & in-store【47】【48】 with deep discounts (e.g., 50–70% fashion, up to 75% fine jewelry, 60–65% bedding, 50% appliances)【47】【48】. • Cyber Monday: follow-on deals Dec 1–3【47】. |

| Timeline, Hours & Cutoffs | Stores closed on Thanksgiving; reopened early (typically 6 a.m.) on Black Friday with extended hours to 11 p.m.【47】. Clear shipping guidance: standard by Dec 21, express by Dec 22, and same-day delivery available through Dec 24 morning【60】. Week-long in-store specials (Nov 24–30) spread traffic beyond a single peak day【47】【48】. |

| Omnichannel & Fulfillment | Emphasized BOPIS, curbside pickup, and ship-to-store to meet shoppers “on or off-mall.” Digital hub and app supported inventory lookup, coupon wallet, and barcode scan in-store【47】. Same-day delivery offered for last-minute gifts, aligning online discovery with rapid fulfillment【60】. Holiday Gift Finder curated ideas by recipient/category; featured exclusive brands and Toys“R”Us tie-ins (Geoffrey’s Hot Toy List) to guide discovery【47】. |

| Loyalty & Personalization | Star Rewards active across BFCM: members earn on every purchase (tiered Bronze/Silver/Gold/Platinum with ~1–5% back in Star Money)【50】【51】. Bronze is free to join, enabling rapid data capture during peak season; higher tiers/cardholders receive extra savings passes and surprise perks【53】. Personalization via site/email recommendations and Macy’s Media Network placements; personal stylist booking offered for high-touch gifting support【47】【53】. |

| Brand & Experience | Leveraged iconic Macy’s Thanksgiving Day Parade as a cultural anchor; “Parade of Deals” gamified daily shopping leading into the holiday【47】. Holiday windows, pop-ups/Story boutiques, and influencer-led gift guides blended nostalgia with modern social commerce to drive footfall and digital buzz【47】. |

Kohl’s: Early access sales, Kohl’s cash & enhanced convenience

| Key Area | Highlights |

|---|---|

| Promotions & Kohl’s Cash |

Centered around “stackable value” — combining deep discounts, coupons, and Kohl’s Cash.

• Three-Day Early Access Sale (Nov 8–10) offered up to 70% off fine jewelry, 50% off toys, 40–60% off apparel/home décor【9】【54】. • Earned $15 Kohl’s Cash per $50 spent on Nov 8 (and $10 per $50 on Nov 9–10)【9】 — effectively up to 30% back for shoppers. • Official Black Friday Week (Nov 24–29) extended the $15 Kohl’s Cash promo across six days【55】【56】. • On Black Friday (Nov 29), Kohl’s hosted its nostalgic “TGIBF” Sweepstakes with over $1M in prizes【9】【56】. |

| Loyalty & Credit Activation |

Integrated Kohl’s Rewards and Kohl’s Cash for a layered loyalty ecosystem.

Members earn 5% back year-round in Kohl’s Cash【57】【58】, stacked on promotional earnings.

• Kohl’s Card holders earn 7.5% back and receive extra discounts/early access【57】【58】. • Introduced the new Kohl’s Rewards Visa (usable outside Kohl’s) in Oct 2024 to expand earning potential across everyday spending. • During BFCM, these combined benefits “paid shoppers to shop,” reinforcing loyalty and repeat visits during redemption windows. |

| Omnichannel Convenience |

All 1,100+ stores offered self-pickup for online orders via lockers or QR-code scanning【57】.

Partnered with Instacart for same-day delivery in select markets — a first for Kohl’s, enhancing competitiveness in speed【57】.

Also featured Amazon returns drop-off in-store, driving incidental traffic during holiday returns. Stores closed on Thanksgiving but opened early (5 a.m.) on Black Friday【9】, with extended December hours to capture late-night shoppers. |

| Merchandising & Value Experience |

Expanded assortment for holiday gifting with new “Value Gift Shops” (hundreds of $3–$8 gifts) and curated gifting zones across categories.

Beauty remained a traffic driver through expanded Sephora at Kohl’s shop-in-shops. In-store experiential gifting displays highlighted ease and affordability, positioning Kohl’s as a true holiday gifting destination【54】【55】. |

| Personalization & Engagement |

Personalized offers via email, app push, and Rewards profiles — e.g., one-day extra 10% coupons or Kohl’s Cash reminders.

In-store associates used customer data to flag unused rewards or relevant promos, creating personal, value-driven service. Result: a fully integrated, data-informed ecosystem blending savings, convenience, and engagement across channels. |

The top 10 BFCM & omnichannel trends for 2025

The trends that accelerated in 2024 provide a clear roadmap for the future of retail. For C-level executives, anticipating these shifts is critical for maintaining a competitive edge. The following trends are projected to define the 2025 BFCM season and the broader omnichannel landscape.

BFCM top trend #1: The rise of AI shopping agents and “agentic commerce”

The next evolution of Generative AI will move beyond conversational chatbots to proactive AI agents that execute complex tasks on behalf of the consumer. In 2025, the first generation of these agents will become more widespread, capable of comparing prices across retailers, automatically applying the best coupons, and completing purchases within user-defined budgets or preferences. This paradigm shift, termed Agentic Commerce, means marketing success will depend less on persuading humans with creative campaigns, and more on optimizing product data, pricing, and availability for discovery by AI shopping assistants that now act on behalf of consumers [58].

BFCM top trend #2: AI-powered personalization at scale

If 2024 was the breakthrough year for AI chatbots and generative recommendations, 2025 will see full-scale adoption of AI-powered personalization. Retailers will deploy smarter “virtual shopping companions” across websites, apps, and messaging platforms to guide customers in real time toward the right product and the right offer. With chat-driven traffic already converting at +1,800% higher rates in 2024, these AI assistants are set to become a standard feature of BFCM sites, enhancing conversion rates, customer satisfaction, and long-term loyalty [59].

BFCM top trend #3: The transition from omnichannel to unified commerce

While omnichannel retail strategy focused on consistent experiences, Unified Commerce will dominate in 2025. This represents the full back-end integration of core systems, sales, inventory, fulfillment, and customer data, into a single platform. True real-time inventory visibility will eliminate pain points like canceled BOPIS orders and enable sophisticated fulfillment strategies across stores, warehouses, and last-mile partners. For customers, this means fewer disappointments and faster, frictionless service; for retailers, it ensures operational efficiency and margin protection [60].

BFCM top trend #4: Phygitalization: The smart, experiential store

Physical stores will continue to evolve from transactional spaces to immersive brand hubs. This “phygitalization” blends physical and digital experiences, think smart mirrors in fitting rooms, AR-powered product visualization, and interactive digital displays tied to Retail Media Networks. At the same time, stores will function as strategic fulfillment hubs, with expanded curbside lanes, automated pickup lockers, and even curbside returns to streamline omnichannel flow. Expect retailers to layer in festive in-store events, product demos, and family activations to drive traffic and create memorable, shareable experiences during BFCM [61].

BFCM top trend #5: Membership-exclusive events & loyalty differentiation

Building on Walmart’s and Best Buy’s 2024 success, 2025 will see an expansion of tiered BFCM events for loyalty members. Target Circle flash sales, Macy’s Star Rewards VIP days, or Kohl’s Cash super-earn events may precede the broader Black Friday promotions. Paid memberships like Prime, Walmart+, and Best Buy Total will unlock exclusive bundles, early access days, or members-only pricing. For retailers, this trend reduces reliance on blanket discounts while growing recurring membership revenue and deeper customer stickiness [62].

BFCM top trend #6: The earlier and longer holiday season

The creep into October will intensify. Retailers will roll out “Black Friday in October” events — like Amazon’s Prime Early Access or Target’s October Deal Days, conditioning shoppers to start lists sooner. By 2025, holiday campaigns may launch immediately after back-to-school, creating an 8+ week rolling season of promotions. While Black Friday weekend will remain the peak, it will increasingly act as the finale of a much longer sales marathon. This helps consumers budget across multiple pay cycles while allowing retailers to smooth supply chain and staffing demands [63].

BFCM top trend #7: The re-emergence of high-touch physical marketing

In a digitally saturated environment, tactile marketing channels are re-emerging as premium engagement tools. Retailers will increasingly deploy personalized direct mail, such as handwritten-style postcards triggered by online behavior, and integrate QR codes or NFC tags into packaging and store signage to link offline interactions to digital journeys. These high-touch tactics provide a sense of exclusivity and delight that purely digital channels struggle to replicate, particularly for high-value customers [64].

BFCM top trend #8: Sustainability and social values as differentiators

Gen Z and millennial shoppers are increasingly mindful of sustainability and ethics in their purchase decisions. In 2025, expect a rise in eco-friendly BFCM campaigns: “Green Friday” promotions highlighting refurbished tech, carbon-neutral delivery options, or donations tied to purchases. Department stores like Macy’s and Kohl’s already integrate community giving into holiday marketing; in 2025, others will follow, positioning sustainability not only as compliance but as a competitive brand advantage [65].

BFCM top trend #9: Hyper-personalization becomes table stakes

With the maturation of customer data platforms (CDPs) and AI, personalization will move beyond product recommendations into fully individualized customer journeys. In 2025, this means dynamically generated marketing copy, customized landing pages, and loyalty offers tailored to each customer’s behavior, preferences, and predicted lifetime value. Generic, segment-based marketing will be increasingly ineffective as consumers expect every touchpoint to feel curated “for me” [66]. Hyper-personalization in retail is the new trend!

BFCM top trend #10: Competitive logistics – fast, free, and flexible

Finally, logistics will remain a battlefield. By 2025, same-day delivery in major metros may be table stakes, with cut-off times extending later (e.g. order by 2 p.m. Christmas Eve for guaranteed delivery). Partnerships (e.g. Kohl’s with Instacart) will expand coverage and speed. Returns will also be critical: expect free, frictionless returns via mail or drop-off networks (UPS Access Point, Amazon Counter, etc.) to become standard. In this environment, execution precision is as important as price, retailers that fail to deliver on convenience risk immediate abandonment [67][68].

Strategic imperatives for omnichannel BFCM leadership

The 2024 BFCM season was not an anomaly but an acceleration of trends that are fundamentally reshaping retail. For C-level executives, navigating this new landscape requires a decisive shift in strategy, investment, and organizational mindset. The following imperatives provide a roadmap for building a resilient and profitable omnichannel business capable of winning not just during the holidays, but year-round—and for measurement, use our BFCM ROI benchmark calculator to sanity-check channel performance and investment levels.

#1 Invest in a unified commerce & data infrastructure

The most significant gap between market leaders and laggards is the ability to understand and act on customer data across all touchpoints. A customer journey that starts with a social media ad, moves to a mobile app, and culminates in a curbside pickup generates data in multiple siloed systems. Without a central platform to unify this information, the experience remains fragmented and personalization is superficial. Investment in a Customer Data Platform (CDP) is the foundational requirement for true omnichannel leadership. A CDP ingests data from all sources — e-commerce platforms, POS systems, mobile apps, loyalty programs, to create a persistent, unified profile for each customer. This single source of truth is what enables the advanced capabilities seen from market leaders and is the core engine of a modern omnichannel engagement platform [69]. If you’re pressure-testing your readiness, a BFCM page audit can help identify conversion leaks before the peak week hits.

#2 Evolve your loyalty program into an experiential platform

In a sea of discounts, points-for-purchase programs are no longer a sufficient differentiator. The most effective loyalty strategies are shifting the value proposition from purely transactional benefits to experiential ones. The objective should be to cultivate a sense of membership and exclusivity. This involves leveraging rich first-party data to offer non-monetary perks, such as exclusive early access to deals, hyper-personalized offers, or unparalleled convenience, that build an emotional connection and drive long-term retention, a far more profitable strategy than constantly competing on price [70].

#3 Treat your stores as strategic fulfillment and service hubs

The sustained high usage of BOPIS and curbside pickup confirms that a physical store network is one of the most significant competitive advantages an omnichannel retailer possesses. Retailers must treat their stores as critical last-mile fulfillment hubs and invest in the technology required to optimize their operations. This includes robust, real-time inventory management systems, mobile tools for store associates to efficiently pick orders, and customer-facing technologies to create a frictionless pickup experience. The physical store is a strategic asset that, when digitally integrated, provides a level of speed and convenience that online-only players cannot match [71].

#4 Develop a proactive AI strategy

The 2024 season proved that AI is no longer a futuristic concept but a present-day commercial driver. Organizations must move beyond experimentation and strategically deploy AI across the business. This includes customer-facing roles, such as leveraging GenAI-powered chatbots for discovery and support, and back-end operations, like using predictive analytics for inventory forecasting and supply chain optimization. Furthermore, leadership must begin preparing for the emergence of AI shopping agents by ensuring all product data is structured, accurate, and optimized for machine readability to win in the next era of commerce [72].

#5 Define your Retail Media Network strategy

RMNs have matured into billion-dollar, high-margin business units that are fundamentally altering the retail P&L and the relationship with suppliers. A clear, executive-level strategy for this space is now essential. For retailers operating an RMN, this means continued investment in the technology, data science, and sales talent required to scale the business and expand into new areas like off-site and non-endemic advertising. For brands, it requires a sophisticated approach to budget allocation, cross-network performance measurement, and deep partnerships to maximize ROI in this complex and rapidly growing landscape [73].