The back-to-school (B2S) season is more than just a busy shopping period; it’s a pivotal time that significantly impacts annual sales for retailers. As students and parents gear up for a new academic year, retailers must strategically align their offerings to meet the evolving demands of this market. Understanding and analyzing the latest back-to-school retail trends is crucial for retailers who wish to stay competitive and maximize sales during this high-stakes period.

This blog post highlights the key back-to-school trends, providing actionable insights for retail executives looking to capitalize on the latest market dynamics. By understanding these trends, retailers can better prepare their strategies to meet consumer demands and maximize their sales potential during the back-to-school season.

Back-to-school retail trends #1: In 2023, the average household expenditure on back-to-school items surged by 41.5%, with families spending around $890 each

What is this about

The substantial increase in household spending on back-to-school items in 2023 reflects broader economic trends and shifts in consumer behavior. Factors contributing to this rise include inflation, increased costs of goods, and a growing emphasis on acquiring technology and educational tools necessary for modern learning environments. While these factors might intuitively suggest reduced spending, they have instead led to higher expenditures because families are allocating more funds to essential, albeit costly, items.

Relevance to retailers and strategic use

- Diversified inventory: Retailers should expand their product range, particularly in high-demand areas like technology, clothing, and school supplies.

- Targeted marketing: Utilizing data analytics to target promotions can help retailers attract customers planning significant back-to-school purchases.

- Customer engagement: Enhancing both online and in-store experiences can cater to diverse shopping preferences, ensuring customers feel valued and supported throughout their shopping journey.

Back-to-school retail trends #2: End-of-summer sales are prompting parents to start their back-to-school shopping earlier, with many beginning well before summer ends

What is this about

The trend of starting back-to-school shopping earlier is fueled by aggressive end-of-summer sales. Retailers, aiming to spread out demand and reduce the stress on their supply chains, have begun offering substantial discounts and promotions earlier in the season. This strategy also helps parents avoid the last-minute rush, ensuring they can secure all necessary items without facing stock shortages or long waits.

Relevance to retailers and strategic use

- Early promotions: Launching back-to-school campaigns at the beginning of summer can capture early shoppers looking for the best deals.

- Extended sales periods: Retailers can extend the duration of sales events to cater to early and late shoppers alike, ensuring a steady stream of customers.

- Exclusive offers: Providing exclusive early bird discounts and bundles can incentivize customers to shop sooner rather than later.

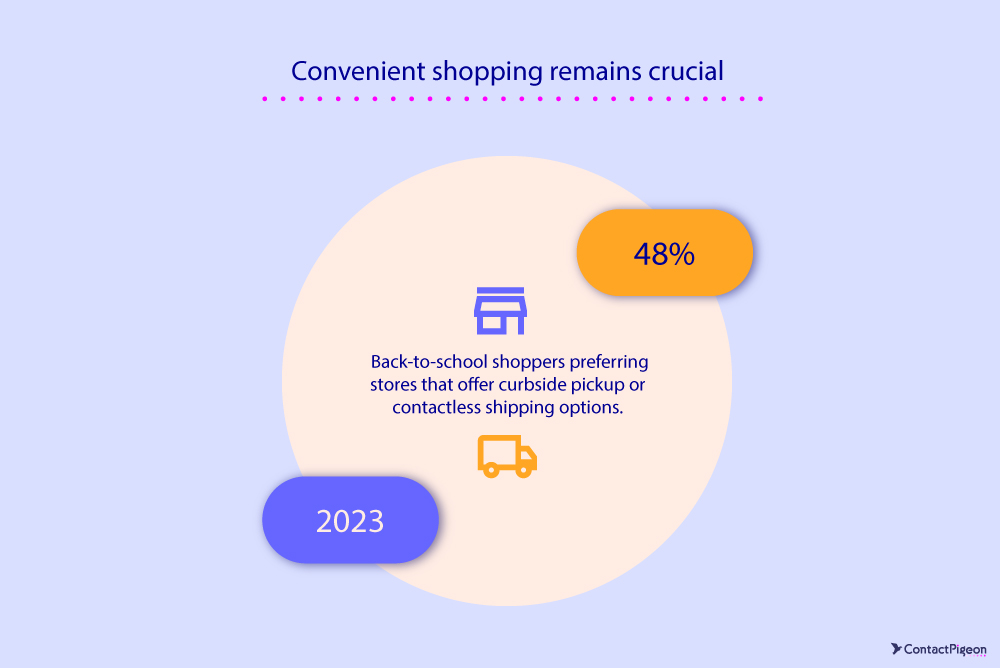

Back-to-school retail trends #3: 48% of back-to-school shoppers favor stores that provide curbside pickup or contactless shipping

What is this about

The preference for convenience-driven shopping methods, such as curbside pickup and contactless shipping, has become a significant trend. This shift is largely a response to the pandemic, which heightened consumer awareness and demand for safe, efficient shopping options. These methods offer the convenience of online shopping combined with the immediacy of in-store pickup, meeting a wide range of customer needs.

Relevance to retailers and strategic use

- Enhanced pickup services: Implementing efficient curbside pickup options can attract customers who prioritize convenience and safety.

- Optimized delivery: Streamlining contactless shipping processes ensures that customers receive their orders quickly and safely, enhancing overall satisfaction.

- Marketing focus: Highlighting these convenient shopping options in marketing materials can differentiate retailers from competitors and appeal to busy parents.

Back to school retail trends #4: 71% of U.S. shoppers are willing to wait over two weeks to benefit from sales or promotions

What is this about

A majority of U.S. shoppers demonstrate a strategic approach to spending by waiting over two weeks for sales or promotions. Due to economic pressures shoppers are willing to plan their purchases around significant discounts during specific promotional periods.

Relevance to retailers and strategic use

- Planned promotions: Scheduling well-timed sales and promotions can align with customer expectations and shopping habits.

- Loyalty programs: Creating loyalty programs that offer early access to sales or exclusive promotions can incentivize repeat purchases and build customer loyalty.

- Awareness campaigns: Informing customers about upcoming promotions through targeted email campaigns and social media can generate excitement and increase traffic.

Back-to-school retail trends #5: There is a growing trend in secondhand and thrift shopping, with 7% of shoppers choosing these options for back-to-school and 9% for back-to-college in 2023

What is this about

The popularity of secondhand and thrift shopping is increasing, driven by both economic considerations and sustainability efforts. More consumers are turning to resale shops and thrift stores for back-to-school and back-to-college needs to save money and reduce their environmental impact. This trend reflects a broader societal shift towards sustainable living and budget-conscious spending.

Relevance to retailers and strategic use

- Sustainable inventory: Retailers can introduce or expand their selection of secondhand and thrift items to attract eco-conscious shoppers.

- Marketing sustainability: Highlighting the environmental benefits of purchasing secondhand items can appeal to a growing demographic of environmentally aware consumers.

- Community engagement: Partnering with local thrift shops or organizing thrift events can enhance community ties and attract budget-conscious shoppers.

Back-to-school retail trends #6: There is an increasing demand for sustainable and eco-friendly products among back-to-school shoppers

What is this about

The demand for sustainable and eco-friendly products is rising as consumers become more environmentally conscious. This increase is driven by greater awareness of environmental issues and a preference for products that align with sustainable living. Back-to-school shoppers are increasingly looking for items made from recycled materials, biodegradable products, and those sourced sustainably.

Relevance to retailers and strategic use

- Eco-friendly products: Expanding the range of sustainable and eco-friendly products can attract a broader customer base.

- Green marketing: Utilizing marketing campaigns that emphasize the sustainability of products can enhance brand reputation and appeal to eco-conscious consumers.

- Educational content: Providing information on the environmental impact of different products can help consumers make informed purchasing decisions and build brand trust.

Back-to-school retail trends #7: Shoppers are adopting a hybrid approach for back-to-school supplies, with 63% preferring in-store and 37% opting for online shopping

What is this about

The adoption of a hybrid shopping approach, blending in-store and online experiences, has become more prevalent. Omnichannel shopping is a response to the convenience of online shopping combined with the tactile benefits of in-store purchases. Technological advancements and the pandemic have accelerated this shift, making it essential for retailers to integrate their sales channels.

Relevance to retailers and strategic use

- Omnichannel experience: Retailers should create a seamless shopping experience across physical and digital channels.

- Inventory synchronization: Ensuring real-time inventory updates across all platforms can enhance customer satisfaction and prevent stockouts.

- Cross-channel promotions: Implementing cross-channel promotions that can be redeemed both online and in-store can encourage customers to shop through multiple channels.

Back-to-school retail trends #8: Schools are prioritizing mental health services more than ever, with a notable increase in students seeking help post-pandemic

What is this about

The psychological impact of the pandemic has heightened awareness of mental health issues among students, prompting schools to enhance their support systems. However, many schools still struggle to meet the growing demand effectively.

Since the onset of the coronavirus pandemic, 69% of public schools have observed an increase in the number of students seeking mental health services. Additionally, 13% of public schools strongly agreed and 43% moderately agreed that they were effectively providing mental health services to all students in need.

Relevance to retailers and strategic use

- Mental health products: Retailers can expand their offerings to include products that support mental wellness, such as stress-relief tools, planners, and wellness apps.

- Collaborative programs: Partnering with schools and mental health organizations to provide resources and support can enhance community engagement.

- Educational campaigns: Developing campaigns that raise awareness about mental health and the available supportive products can attract concerned parents and educators.

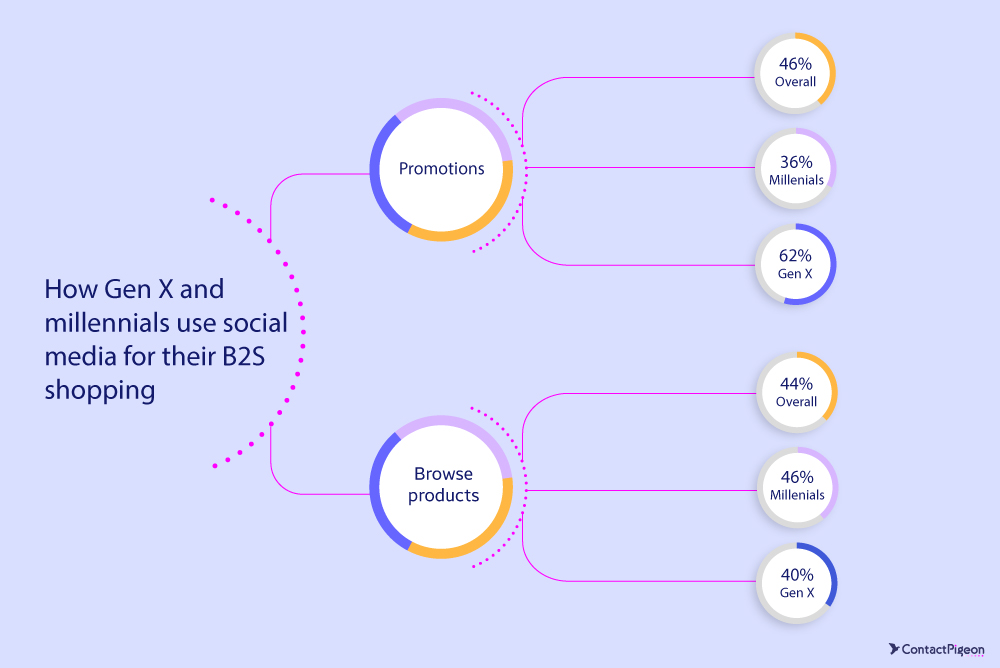

Back-to-school retail trends #9: Social media plays a crucial role in shaping B2S shopping behaviors, with 62% of Gen X and 39% of Millennials scanning social media for promotions in 2023

What is this about

Social media’s influence on back-to-school shopping behaviors is substantial, with a significant portion of Gen X and Millennials using these platforms for promotions and product browsing. The widespread use of social media for information gathering and retailers’ effectiveness of targeted marketing campaigns have significantly influenced shopping patterns.

Relevance to retailers and strategic use

- Social media campaigns: Launching targeted social media campaigns can capture the attention of both parents and students.

- Influencer collaborations: Partnering with influencers to showcase products can create authentic endorsements and drive sales.

- User-generated content: Encouraging customers to share their back-to-school purchases and experiences on social media can build community and trust.

Back-to-school retail trends #10: Electronics and computer-related equipment dominated back-to-school and back-to-college spending in 2023, accounting for 69% and 68% of total expenditures

What is this about

The integration of technology into education is more prevalent than ever. The rise of e-learning and digital classrooms has expanded the list of essentials beyond traditional school supplies, emphasizing the importance of tablets, laptops, and educational software. This shift reflects the increasing need for students to access modern technology for effective learning.

Relevance to retailers and strategic use

- Tech bundles: Offering bundled deals on popular electronics and accessories can provide value and attract tech-savvy shoppers.

- In-store demonstrations: Providing hands-on demonstrations and workshops can help customers understand and use new technology.

- Extended warranties: Offering extended warranties and tech support services can add value and build customer trust.

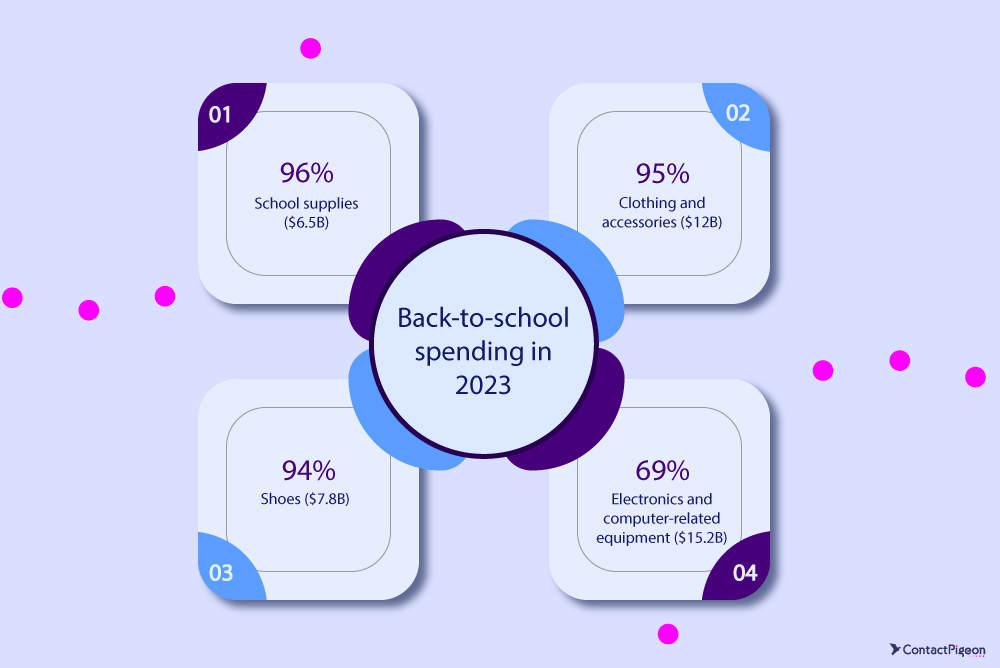

Back-to-school retail trends: Spending per category

- School supplies: A significant majority of families, 96%, spent a total of $6.5 billion on school supplies in 2023, highlighting the essential nature of back-to-school classroom necessities.

- Shoes: In 2023, 94% of families allocated $7.8 billion to purchasing shoes for the back-to-school season. Students of all ages, require durable and comfortable footwear for daily wear and specialized shoes for sports and physical activities.

- Clothing and accessories: Families driven by fashion trends, growth spurts, and the need for weather-appropriate attire spent $12 billion on clothing and accessories in 2023, with 95% of households participating in this category.

- Electronics and computer-related equipment: Electronics and computer-related equipment accounted for $15.2 billion in back-to-school spending in 2023. Technology integration in education, including the need for laptops, tablets, and other digital devices essential for modern learning has affected 69% of families investing in this category.

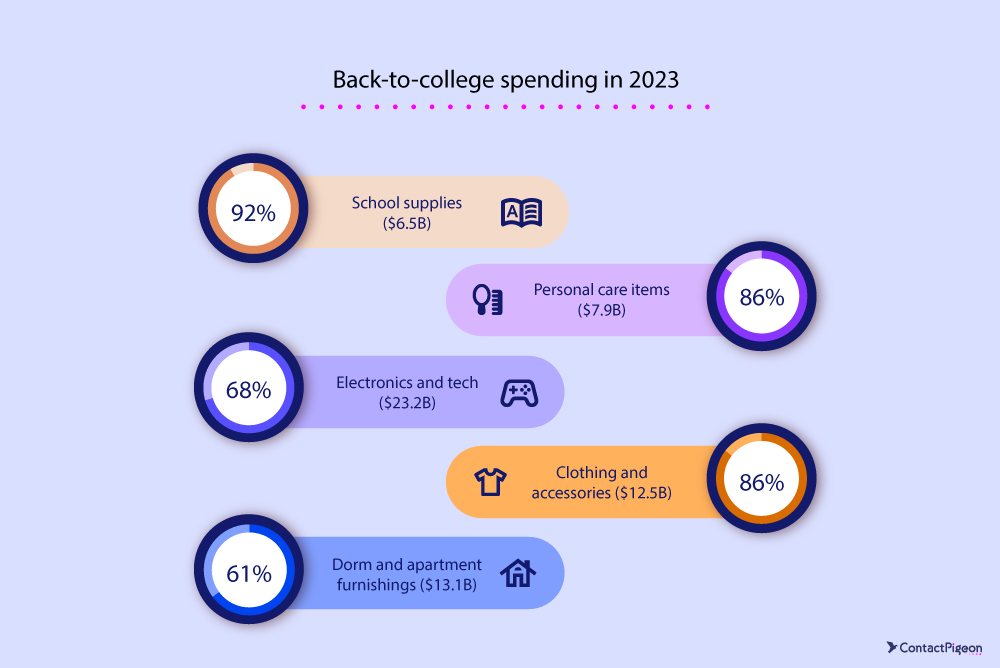

Back-to-college retail trends: Spending per category

- School supplies: A majority of college students and their families spent $6.5 billion on school supplies, including textbooks, notebooks, and writing instruments. The high costs of textbooks and the necessity for updated educational materials significantly contribute to this spending.

- Personal care items: Spending on personal care items reached $7.9 billion, highlighting their importance among college students. This includes toiletries, grooming products, and health-related items, driven by a growing awareness of health and wellness. The demand for quality personal care products to maintain hygiene and self-care is a key factor.

- Electronics and tech: Electronics and tech accounted for a substantial $23.2 billion in spending. This includes devices like laptops, tablets, and smartphones, necessary for modern education and connectivity.

- Clothing and accessories: Clothing and accessories saw $12.5 billion in spending, with 86% of students purchasing new attire for the school year. This includes everyday wear and fashion accessories, influenced by seasonal changes and fashion trends. The need for durable, versatile clothing suitable for various activities also drives this expenditure.

- Dorm and apartment furnishings: Spending on dorm and apartment furnishings reached $13.1 billion, with 61% of students investing in furniture, bedding, and kitchen supplies. Creating a comfortable and functional living environment, coupled with the trend of personalizing living spaces to suit individual tastes is critical for college students.

Additional key back-to-school statistics for your strategy

- 34% of U.S. adults say they expect to shop for back-to-school/college this year.

- One in five (22%) had already started shopping for the ‘24/’25 school year from early June.

- 68% of shoppers say they typically plan their back-to-school and college shopping around retailer events like Prime Day, 4th of July, or Labor Day sales.

- 21% of shoppers used social media for BTS shopping in 2023

- 58% of parents purchase clothing and accessories in-store, while 42% prefer online shopping.

- In 2023, 3 in 10 parents were in a worse financial situation compared to 2022.

- In fall 2022, about 54% of college students enrolled in distance education courses. The e-learning market is expected to expand by 20.5% between 2022 and 2030.

- The global back-to-school market reached $195.14 billion in 2023.

- Over 90% of schools in the UK mandate uniforms.

- During the 2023 back-to-school shopping season, typically occurring in summer and early autumn, American families were expected to spend around $41.5 billion.

Reports about the latest back-to-school trends for executives

- Εarly back-to-class shopping in 2024 – NRF

- Back-to-Class Data Center – NRF

- 2023 Deloitte back-to-school survey – A season of economizing

- Data Drop: 5 Charts on 2024 Back-to-School Shopping – eMarketer

- Back-to-school Statistics & Facts – Statista

- 2024 Online Learning Statistics – Forbes

Detecting trends using ContactPigeon’s retail CDP

Retailers are constantly seeking ways to stay ahead of trends, especially during crucial periods like the Back-to-school season. ContactPigeon’s Customer Data Platform (CDP) offers a powerful solution by providing in-depth insights and data-driven strategies to help retailers capitalize on emerging trends.

Unifying customer data for better insights

ContactPigeon’s CDP centralizes customer data from various touchpoints, creating a comprehensive 360-degree view of each customer. This unification allows retailers to track behavior, preferences, and interactions in real-time, facilitating more accurate trend detection and personalized marketing.

Real-time analytics and segmentation

With built-in BI analytics and dynamic segmentation, retailers can analyze customer segments, channel performance, and retail trends effortlessly. This real-time capability ensures that retailers can quickly adapt to changes in customer behavior and emerging back-to-school trends.

Enhancing omnichannel strategies

The platform supports omnichannel orchestration, allowing retailers to deliver a consistent customer experience across all channels. By leveraging ContactPigeon’s insights, retailers can tailor their marketing efforts to meet the needs of their audience, whether online or in-store.

Predictive analytics for future trends

ContactPigeon’s CDP includes predictive analytics, enabling retailers to foresee future trends and customer behaviors. This foresight is crucial for planning effective back-to-school campaigns and ensuring that inventory and marketing strategies align with anticipated demands.

Personalized customer engagement

Retailers can boost engagement through personalized recommendations and optimized delivery times. By using data-driven insights, ContactPigeon helps retailers create more relevant and timely marketing messages, increasing the likelihood of conversion and customer satisfaction.

Getting from back-to-school trends to back-to-school revenue

The back-to-school season presents a prime opportunity for retailers to boost their sales and solidify their market position. By understanding and leveraging key back-to-school retail trends, retailers can make informed decisions that align with consumer preferences and market demands. Staying ahead of these trends not only ensures a successful BTS season but also lays the groundwork for sustained growth and customer loyalty throughout the year. As we move into 2024, staying informed and adaptable will be crucial for retailers aiming to thrive in the competitive BTS landscape.

Other Insightful Summer Marketing Resources for Retailers

- 90+ Summer Marketing Ideas to Heat Up Your Sales

- The best summer marketing campaigns for eCommerce

- Best 26 Back to School Campaigns That Made the Grade

- 23 Back-to-School Marketing Ideas for Retailers

- Retail best practices: Nailing your Summer Marketing

Let’s Help You Scale Up